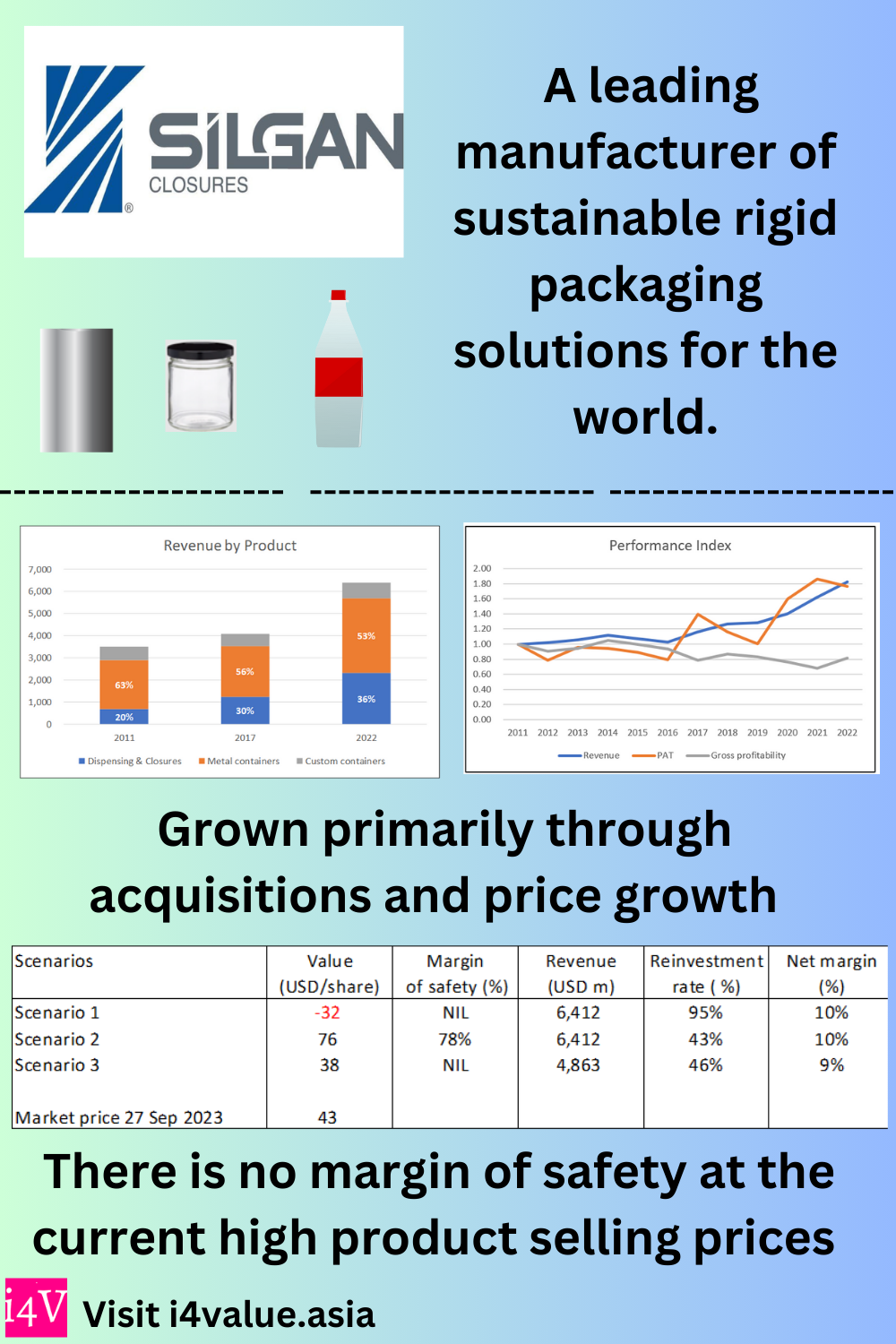

It has a high debt-equity ratio and no signs of strong fundamentals as there were no uptrends in ROE and operating parameters. There is no margin of safety at the current high product selling prices. With an unsustainable Reinvestment rate, it is not an investment opportunity.