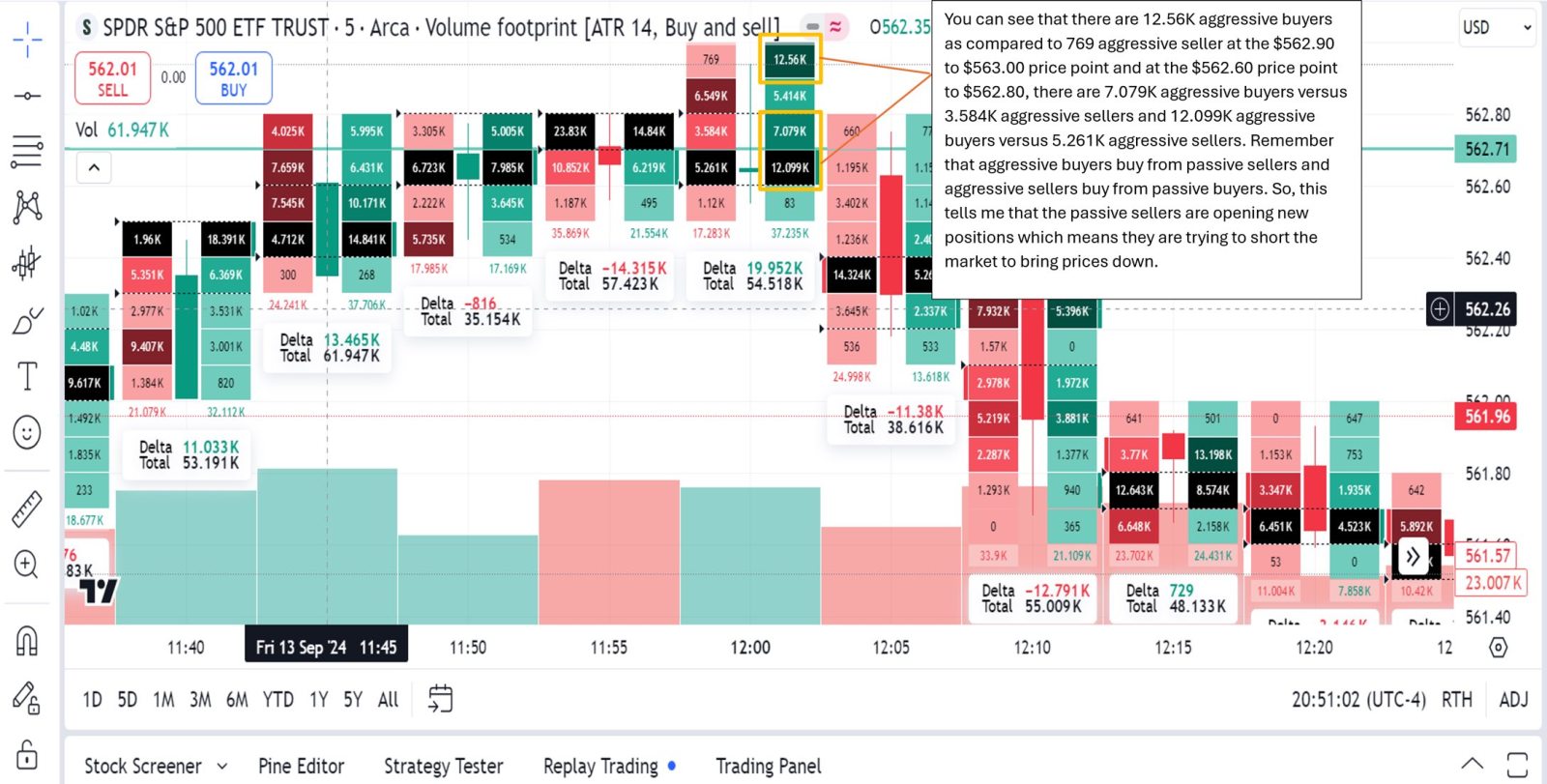

So how do you spot passive participants from aggressive participants? I used a tool called volume footprint that shows me the orderflow for a certain pricepoint. But you can observe the price action from the chart itself. When the market cannot get through a certain point with a relatively high volume, it is usually the passive participant at play. Let me give you an example so that you can better understand the concept. For example, looking at the 5 minute chart on 13 Sep for the SPY, from 12pm to 12.04pm, you can see that there is a relative high volume as compared to the previous two candles, but a small body is being formed, followed by a short sell off, before testing the level again but each time it tests that same level, SPY sell off again. This is usually because the big players are at play. It is telling me that at $562.65 to $562.94, 1 or several big institutional player is trying to short the market. The problem with this method is that I do not know if the big players are pumping in money to open new positions or they are closing old positions but with a volume footprint chart I might have a good idea (please see below to reference what im talking about)