TSLA

Tesla

-- 431.660 RGTI

Rigetti Computing

-- 17.0800 NVDA

NVIDIA

-- 137.010 PLTR

Palantir

-- 79.080 LAES

SEALSQ Corp

-- 9.080 JPMorgan will be watched closely for clues on how the industry fared amid surging interest rates and rising loan losses. While the biggest U.S. bank by assets has navigated volatile rates adeptly so far this year, the situation has caught several peers off guard, including a trio of midsized lenders that collapsed after deposit runs.

Bank stocks plunged last month after the Federal Reserve signaled it would keep interest rates higher for longer than expected to fight inflation amid unexpectedly robust economic growth. The 10-year Treasury yield, a key figure for long-term rates, jumped 74 basis points in the third quarter. One basis point equals one-hundredth of a percentage point.

Tesla's U.S. EV demand decline has Wall Street concerned. Question is if this is a blip or signs of a bigger change among consumers as rising interest rates and a weaker economic backdrop discourage consumers from making big-ticket purchases. The entire auto industry for the past 15 years has been built on 0-3% interest rates. No one is going to be buying $70k trucks at 8%. EVs or otherwise. Unfortunately, Tesla is the real winner here because they’re the only EV manufacturer with any margin, no dealerships, and flexibility to cut prices.

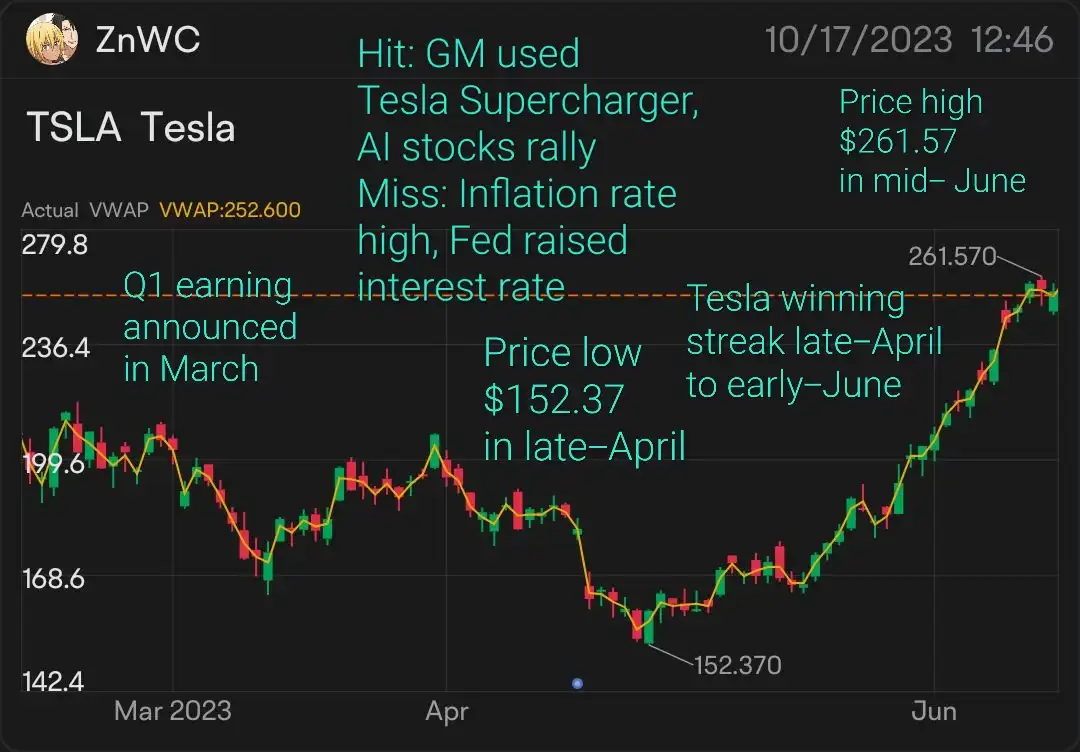

There are many similarities between Tesla earnings Q3 2023 and Q1 2023. Here's what happened just before Q1 2023 earnings announcement:

1) Production and delivery were down compared to previous quarter and below market expectation. In Q1 2023, the reason for the drop was more worse because it was due to China Shanghai Gigafactory shutdown due to COVID-19. China economy was still in a state of lock down which affected demand of almost everything including EV. In Q3 2023, Tesla production was slowed down by factory upgrade in almost all factories. Demand was hit due to China economy slowdown and increase in competition.

2) Market expectation for earnings such as earnings per share or EPS was downgraded prior announcement. This was expected because of the fall in Q1 production and delivery.

3) Market sentiment was against Tesla's share price. Analysts started to downgrade the rating to hold or sell and the target price was adjusted down. Tesla bears were quick to report that the EV company is losing market share and p/e ratio is high as compared to the rivals.

Netflix's financial performance plays a vital role in its stock price movements. Netflix's revenue and profitability have been steadily increasing over the past several years, making it an attractive investment opportunity for many investors. Additionally, Netflix's free cash flow continues to be strong, enabling the company to invest more in original content and other strategic initiatives. If Netflix's financial performance continues to grow, its stock price is likely to rise further.

Added 9 million paid subscribers, bringing total membership to 247 million- Operating margin increased to 22.4%- Free cash flow of $6.5 billion, beating forecast of $5 billion- Increased share buyback by $10 billion (6% of market cap)- Ads plan membership up 70% vs. previous quarter, now accounts for 30% of all new sign-ups- Average revenue per membership (ARM) decreased 1% year-over-year due to higher percentage of membership growth from lower ARM countries- Operating income of $1.9 billion, up 25% year-over-year- 70% of members are now outside the US, growing due to numerous successful local original series and movies- 60% of revenue is non-USD, so a foreign exchange risk management program is being started for 2024- Beat competition with the most watched original series for 37 out of 38 weeks of 2023, according to Nielsen.

As we are nearing end of 2023, the global chip shortage that was sparked in early 2020 due to the COVID-19 pandemic has still not fully recovered, and there is no clear indication on when it will end. Besides the hard-hit automotive industry, the consumer electronics, industrial, smartphone, wired communications, and server and PC sectors have been impacted by the shortage of chips.

Intel has recently reported in its earnings that they have done pretty well in the PC sectors, so it could be a signal that consumer electronics benefitted when the automotive industry began slashing vehicle production early in the pandemic.

Amazon remains the most dominant cloud player. Last year, the company captured 40% of the cloud services market, which compares with 21.5% by Microsoft and 7.5% by Google, according to estimates by Gartner. Longer term, analysts are watching how Amazon matches up with Microsoft on the AI front. Microsoft is seen as having a head start. At the start of the year, Microsoft invested $10 billion in OpenAI, the creator of the ChatGPT chatbot that set off the AI frenzy late last year.

Advertising revenue grew YoY by 24%, exceeding expectations, doubling the growth rate from the previous quarter. Revenue from Meta's metaverse-related Reality Labs, which includes AR (augmented reality) and VR (virtual reality) hardware, software, and content, fell dramatically by 26%. Meta's active user base for the application family and Facebook continued to grow YoY in Q3, securing the social ecosystem's barriers. Next year's expenses are expected to increase by more than 10%, partly due to significant losses in the metaverse business.

In summary, this quarter's financial report driven by advertising revenue was very impressive, but future guidance is cautious, indicating concerns about uncertain macroeconomic growth risks, causing the market to lose some confidence.

While the cloud business has been critical to tech titans, not all saw the same levels of success in the last quarter. This is evident from the sharp pullback in the shares of Google parent Alphabet following the release of its earnings, as investors fretted over softer third-quarter cloud revenue.

1) Amazon sounded more upbeat about the prospects of its cloud business. 2) Microsoft sparkles with strong growth. 3)Google cloud undershoots target.

金融弟弟 : https://youtu.be/nHvRGjUddxY?si=AySsGfzCxU7WRGYR

Asphen : yes. but signs are also clear.

Maggle Chen Asphen : Haha, comfort your heart