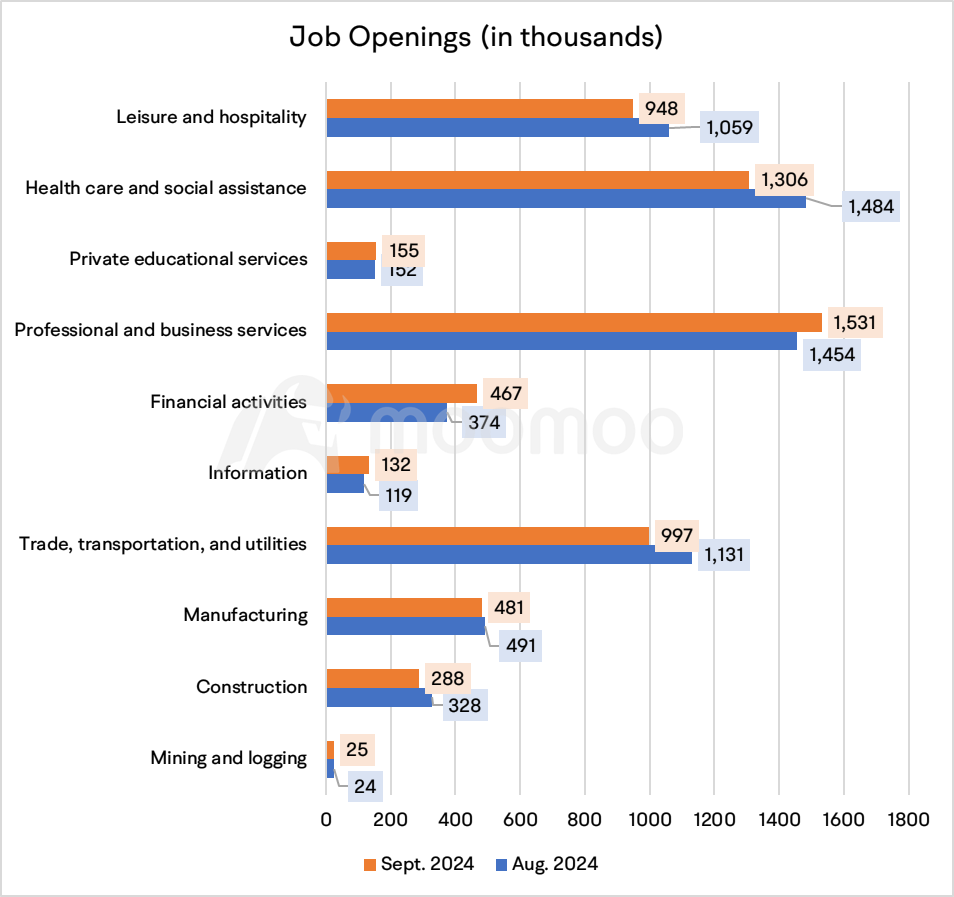

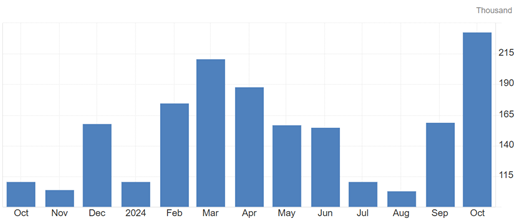

According to the latest data released on Wednesday, in October 2024, private companies in the US saw an addition of 233,000 workers to their payrolls, unexpectedly marking the largest increase since July 2023. This figure came after September's totals were revised upwards to 159,000. The service-producing sector was responsible for 211,000 of these new jobs, with the largest gains seen in education and health services (53,000), trade, transportation, and utilities (51,000), and leisure and hospitality (37,000). The goods-producing sector contributed an additional 22,000 jobs, including 37,000 in construction and 4,000 in natural resources and mining, although manufacturing experienced a decline, losing 19,000 jobs.

103053578 : k

103827803 : good

Laine Ford : can say don't know

104088143 : whatto