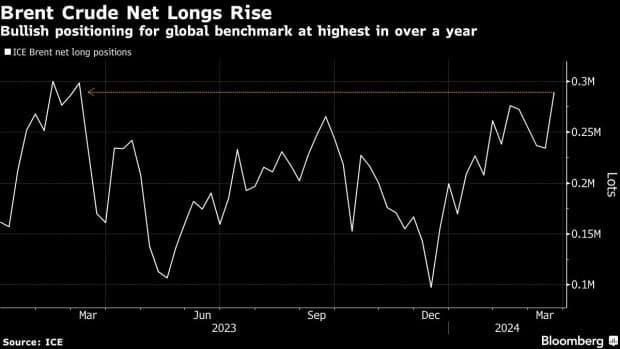

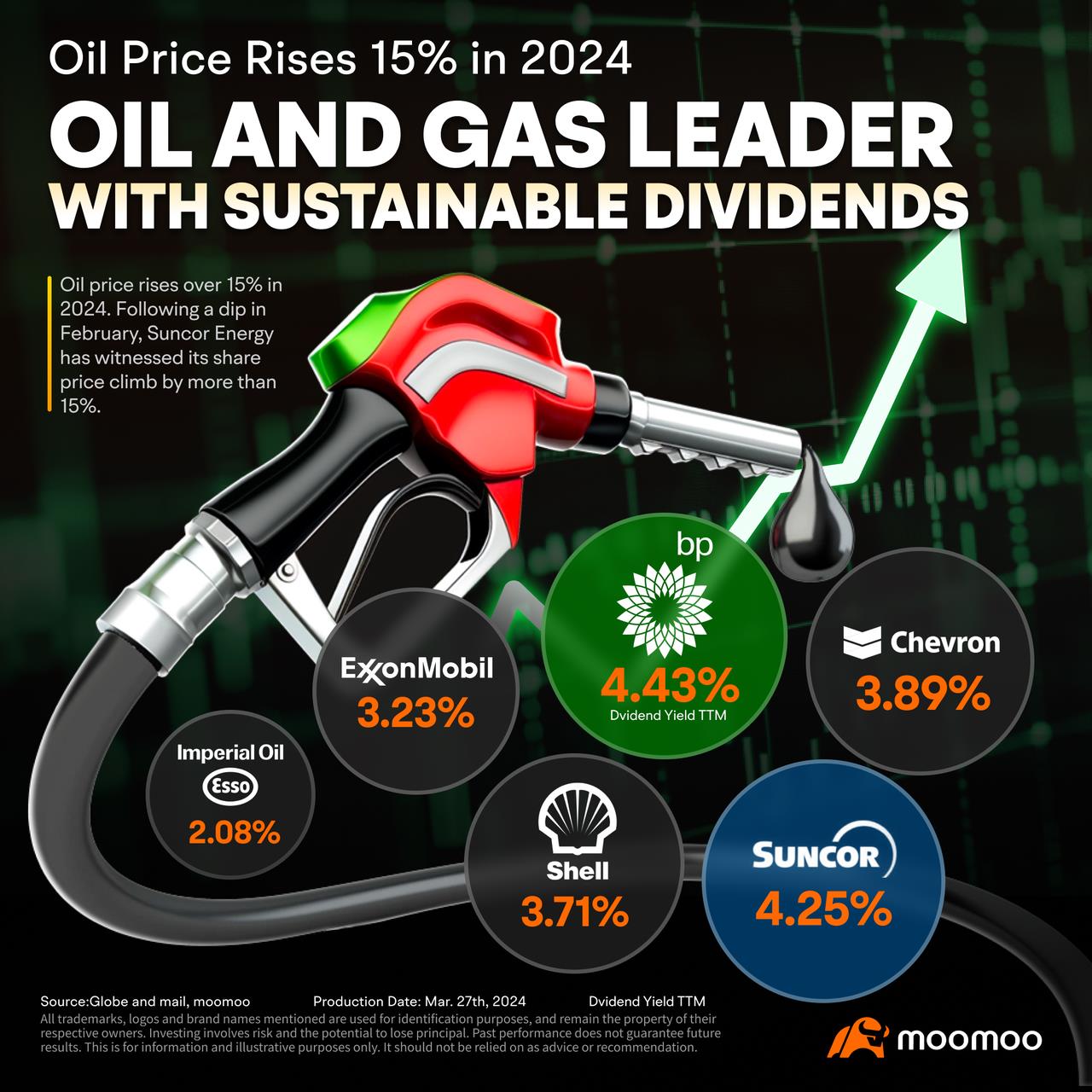

Crude oil prices have risen 15% since the beginning of the year, propelling energy stocks to new heights. Suncor hit an all-time high of $49.99 on Tuesday. Meanwhile, Imperial Oil reached a milestone, with shares climbing to an all-time high of $94.25 on Monday. Since a notable dip in February, both companies have witnessed a rebound of over 15%.

FARAMARZ AKBARY :