The old NISA is dangerous. If it only forcibly moves to a ta...

The old NISA is dangerous.

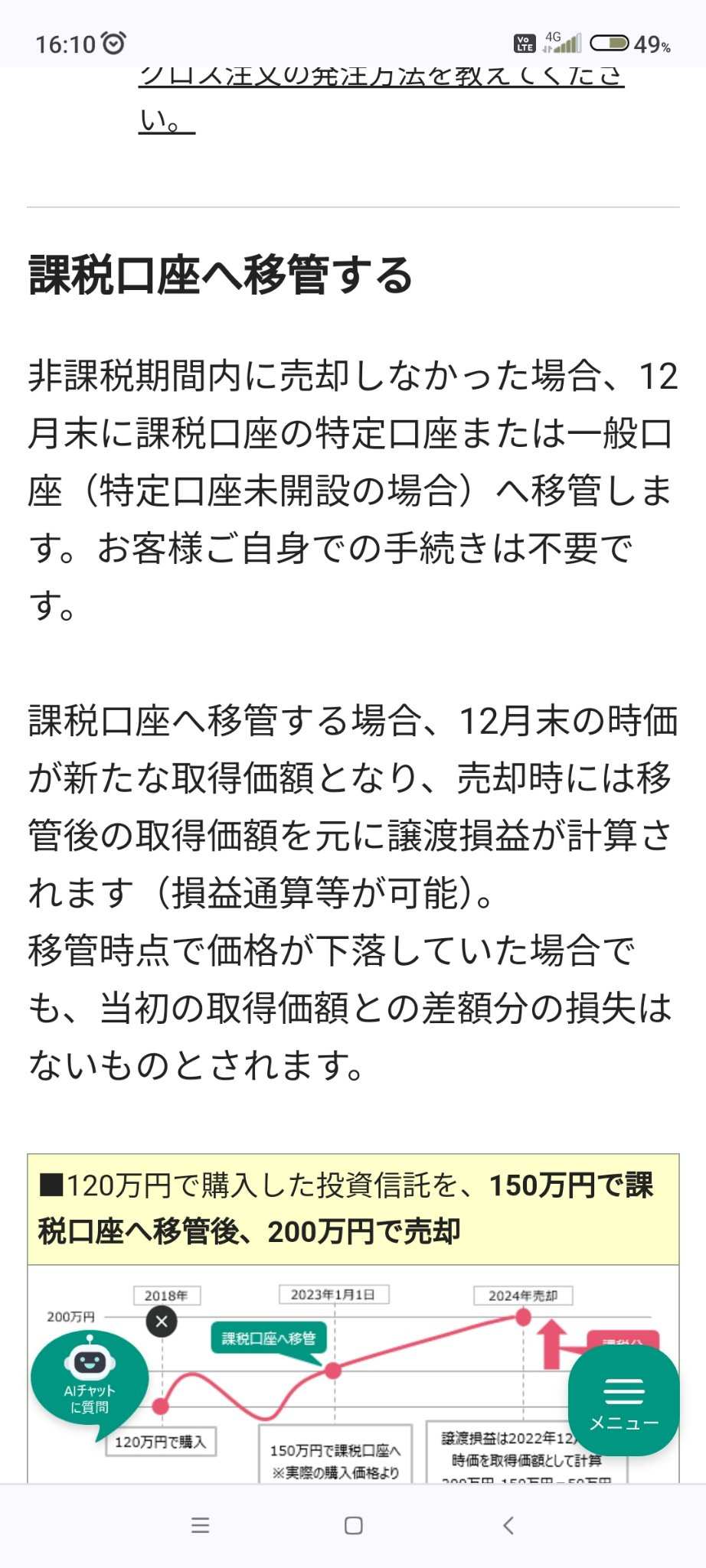

If it only forcibly moves to a taxable account when the 5-year deadline expires, that's one thing.

The acquisition cost is the market value at the time of transfer.![]()

If people who bought high transfer after the transfer and the value went up.

Even if it is sold for less than the acquisition price, it is subject to taxation.

It is the same as being taxed twice.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

kazuyukisan : NISA is consistent because there is no total profit or loss, and I don't think there is a problem with simply re-evaluation or restart when the application of the system is completed. In the first place, after understanding the differences in handling account types and tax systems, I think they invest by selecting NISA, whether general or specific. Look not only at capital gains, but also at income gains over the long term and comprehensively.

kenau OP kazuyukisan : At least I want the acquisition price to stay the same.

I think it was decided when NISA started, but I think very few people have watched it up to that point