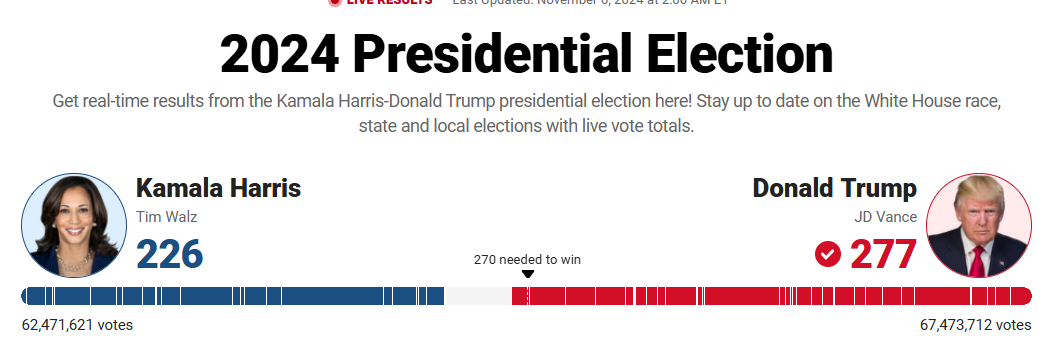

Given Trump's victory, the potential outcome I had envisioned aligns closely with:

Scenario: Republican Sweep, with the hierarchy being U.S. Stocks> USD> Gold > Treasuries. In this scenario, Trump can be expected to smoothly implement and enforce his policies, such as significant tax cuts and deregulation for domestic businesses. The "America First" policies are likely to boost U.S. stocks. Additionally, policy synergies (increased tariffs + tightened immigration) may elevate re-inflationary pressures in the U.S., benefiting the USD. Meanwhile, the long end of the Treasury market may face selling pressure.

With a Republican sweep now seemingly in place, a strategy aligned with U.S. Stocks > USD > Gold > Treasuries appears prudent. However, it's important to note that market dynamics can be unpredictable, and we should remain vigilant and adaptable to any changes. Let's continue to monitor the situation closely! 👀

每天都在學習中 : He is already 70%.

Forever Learning : the result is getting near

FumooFu : I wonder if Democrats gonna repeat the tricks like last election. Same like this election… Trump’s electoral votes has been leading big then stays 230 … then Democrats is following.

Jeff_very_handsome : Better 4000

Sung Jun Lee : 100

Ttowbin23 : Caution

warmhearted Puppy_93 : Happy earnings. Keep it All up.

Middleman_chen : No follow-up.

AL MALIK PAIZA : are trading an Rock stars are Keller broghorth and positive response income cost profits closing delicate balance

103827296 : what do you problem I don't know quantity I understand I don't know run you very problem I know sleeping I found off you you know understand I only found off no it no sleeping you problem you know content finish

View more comments...