【Options ABC】How Does Implied Volatility Affect Your Options Price?

Hello everyone and welcome back to moomoo. I am options explorer![]() . In today's [Options ABC], we'll be taking a look at Implied Volatility, explore option prices and implied volatility in the most straightforward way possible to help demystify this complex topic together.

. In today's [Options ABC], we'll be taking a look at Implied Volatility, explore option prices and implied volatility in the most straightforward way possible to help demystify this complex topic together.

Wordcount: 1500

Target Audience: Options Trading Novices

Main Content: Option price, basic concepts of implied volatility (IV) and IV crush.

1.Option Price

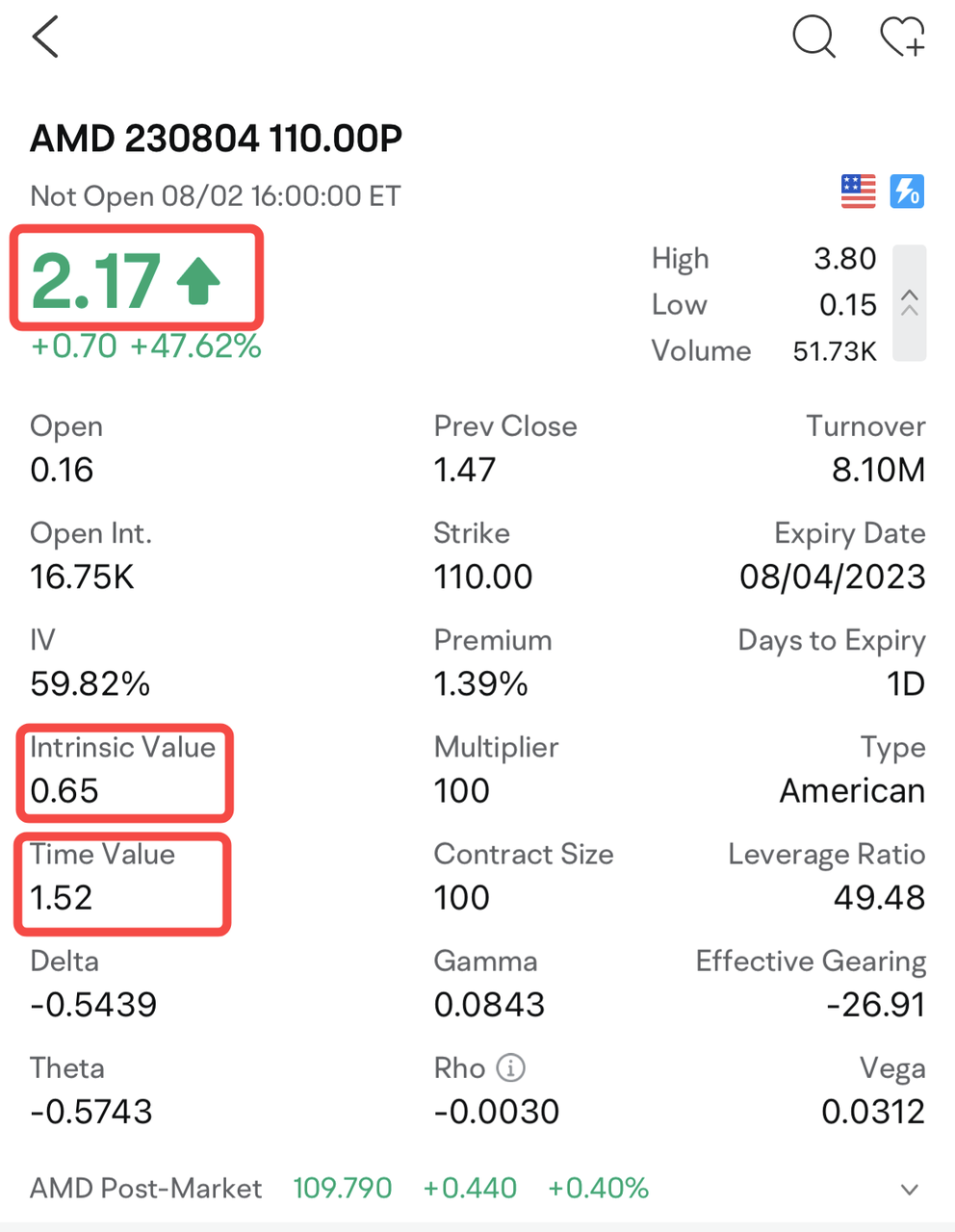

Options are different from stocks in that their price consists of two parts: intrinsic value and extrinsic value.

Option Price (Premium) = Intrinsic Value + Extrinsic Value (Time Value)

Option Price (Premium) = Intrinsic Value + Extrinsic Value (Time Value)

(Any app images provided are not current and any securities shown are for illustrative purposes only and is not a recommendation.)

Let's break it down and start with intrinsic value first.

1.1 Intrinsic value

Before we dive into intrinsic value, let's take a minute to refresh our memory of what "in-the-money," "out-of-the-money," and "at-the-money" mean. If you need a quick refresher, simply go back to EP. 1 of Options ABC.

Intrinsic value is solely determined by the price of the underlying asset. Specifically, it is determined by the difference between the option's strike price and the current market price of the underlying asset, which shows the value one would gain from exercising the option immediately.

In other words, when the intrinsic value is greater than zero, exercising the option will be profitable. When the intrinsic value is zero, exercising the option will either result in a break-even or a loss-making situation.

To help you understand this concept better, let's say Alice purchased a call option of AMD with a strike price of US$115. In this case, the intrinsic value of the option is determined by the current market price of AMD stock.

Now, think about this: If Alice buys a put option of AMD with a strike price of US$110, when will the intrinsic value of the put option be greater than zero?

The short answer is when the market price of AMD stock is less than US$110, this put option will have intrinsic value.

1.2 Extrinsic Value (Time Value)

Now that we understand intrinsic value, let's take a look at extrinsic value. Extrinsic value, also known as time value, measures the amount of time remaining till expiration.

Why is time value vital for options trading?

Remember, options are contracts that have an expiration date. If the market price of the underlying asset is below (for call options) or above (for put options) the strike price by the expiration date of the option, the option will expire out-of-the-money and become worthless. Hence, in the options market, time is money.

Many factors will affect the time value of options, such as expiration date, strike price, and risk-free interest rates. However, implied volatility has the most significant impact on it.

Implied volatility (IV) is a crucial parameter in the option pricing model used to obtain theoretical option prices that seek to match market prices. If you find this concept overwhelming, don't worry. Let me explain it to you step by step.

To start with, the option pricing module estimates the theoretical price of an option, which is constantly changing before its expiration date. To do so, it needs inputs, including the strike price, current market price, time to expiration, interest rate, and IV.

To understand how IV fits into this formula, let's take a closer look at the Black-Scholes model, one of the most widely used models for pricing options:

This formula calculates the theoretical option price C using six variables:

S: current market price of the underlying asset

L: option strike price

d: cash dividend rate

T: option time to expiration

y: risk-free interest rate

σ: implied volatility

With this formula, you can get a good sense of how those six variables influence the option's price.

L: option strike price

d: cash dividend rate

T: option time to expiration

y: risk-free interest rate

σ: implied volatility

With this formula, you can get a good sense of how those six variables influence the option's price.

Some of you may be overwhelmed by the complexity of the formula and the need for extensive calculations.

But don't worry - I've got your back!

But don't worry - I've got your back!

Moomoo provides a handy option pricing calculator that performs these calculations. By inputting data such as the underlying asset price, IV, risk-free interest rate, and expiration date, you can quickly compute the theoretical price of an option. This tool makes it easier to determine whether an option may be expensive or not, saving you time and effort in your trading.

(Any app images provided are not current and any securities shown are for illustrative purposes only and is not a recommendation.)

2. Implied Volatility: expectations for future market volatility

2.1 What is implied volatility(IV)?

Now that we've covered the option pricing module, understanding implied volatility will be much easier. As previously mentioned, implied volatility (IV) is the volatility parameter that must be entered into the option pricing model to obtain theoretical option prices that attempt to match market prices. In simpler terms, IV represents the market's expectation for future volatility.

If implied volatility is high, it suggests that most traders believe the underlying stock will experience significant fluctuations in the future. Some option traders may see these fluctuations as potential opportunities to earn a profit. As a result, options with high levels of implied volatility tend to have higher-priced premiums and are also typically associated with greater trading risks.

2.2 When to sell and when to buy?

One of the most important questions for options traders is when to sell and when to buy. Generally speaking, option traders are more likely to sell options when implied volatility is high and buy options when implied volatility is low.

Why is this the case? As we discussed earlier, implied volatility presents potential opportunities for options trading. Being an option buyer is equivalent to taking a long position on implied volatility, while being an option seller is equivalent to taking a short position on implied volatility.

Buying options when the option price is relatively low, i.e., when implied volatility is low, may offer more profit potential. On the other hand, selling options when the option price is relatively high, i.e., when implied volatility is high, increases the probability of volatility decreasing which can lead to lower option prices, all other things being equal.

There is also an apparent mean-reversion effect on the implied volatility of the options market, which means that if implied volatility rises too high, it tends to fall back down, and if it falls too sharply, it tends to rise again. In this case, shorting implied volatility at high levels generally aligns well with the mean-reversion effect of implied volatility.

Let's do a quick recap: options with low IV may signal a potential buying opportunity, and options with high IV may signal a potential selling opportunity.

On moomoo, you can easily find an option's volatility analysis by going to the Analysis tab, where both the implied volatility and historical volatility are presented in detail. It's convenient, easy-to-use, and definitely worth a try!

(Any app images provided are not current and any securities shown are for illustrative purposes only and is not a recommendation.)

However, implied volatility should not be the only criterion for options trading since it is based on expectations about the future, which may not necessarily come true.

Therefore, it is not wise for traders to simply sell when volatility is high or buy when it is low. Other factors affecting the option's price should also be considered, such as the underlying asset's price and its expected future movement, the strike price, and the expiration date.

3.IV Crush: Why Your Calls Can Lose Money Even When the Stock Goes Up

Now that we understand how implied volatility (IV) works, let's take a closer look at IV crush.

As we mentioned earlier, traders can buy calls if they expect the stock to rise or sell them if they don't.

However, sometimes even when the stock price goes up, the call option we buy can still lose money, and this is due to IV crush.

As we mentioned earlier, traders can buy calls if they expect the stock to rise or sell them if they don't.

However, sometimes even when the stock price goes up, the call option we buy can still lose money, and this is due to IV crush.

IV crush occurs when an option's premium drops because of a decrease in its implied volatility, often after corporate earnings reports. This can be frustrating for traders who are not aware of the impact of IV on options trading.

But why does IV crush happen?

But why does IV crush happen?

Implied volatility represents traders' expectations for future market volatility. Before an uncertain event occurs, expectations are particularly high. Some traders speculate on price increases, while others speculate on decreases, resulting in a lively and volatile market. But once everything is settled, implied volatility declines as uncertainty decreases, leading to an IV crush.

If you want to trade options during earnings season, it's important not to overlook implied volatility. Traders who want to buy a call before earnings should identify whether the option's implied volatility is currently at a high level. If it is, traders need to be cautious.

That's all for today. Please leave a comment if you have any questions or thoughts about it![]() . Don't forget to follow us to stay up-to-date on all things related to options trading. For more information of options learning, you can click on the image below to follow me immediately!

. Don't forget to follow us to stay up-to-date on all things related to options trading. For more information of options learning, you can click on the image below to follow me immediately!

Risk Statement

The Options Price Calculator: IMPORTANT- The tool performs calculations based on model assumptions and other inputs and variables that you select. The projections or other information generated by the Options Price Calculator regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time.The Option Profit and Loss Diagram (the “P/L Analysis”): The P/L analysis assumes postions will be held until expiration. Your actual losses may exceed calculated theoretical values due to changes in implied volatility, early assignment and ex-dividend dates, among other factors.The P/L Analysis is for informational purposes only and should not be considered a personalized recommendation or investment advice. The P/L Analysis performs hypothetical calculations based on model assumptions and other inputs you select, which may not reflect actual market conditions and do not guarantee future results. The maximum loss on a spread position remains limited only as long as the integrity of the spread is maintained.

The examples provided herein are for illustrative and educational purposes only and not intended to be reflective of results any investor can expect to achieve. The figures shown in the examples are not guarantees or projections, and no taxes or fees/expenses are included in the calculations which would reduce the figures shown. Actual results will vary.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

This article is for educational use only and is not a recommendation of any particular investment strategy. Content is general in nature, strictly for educational purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. All investing involves risks. Any examples are provided herein are for illustrative purposes only and not intended to be reflective of results any investor can expect to achieve.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options (https://j.us.moomoo.com/00xBBz) before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

The Options Price Calculator: IMPORTANT- The tool performs calculations based on model assumptions and other inputs and variables that you select. The projections or other information generated by the Options Price Calculator regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Results may vary with each use and over time.The Option Profit and Loss Diagram (the “P/L Analysis”): The P/L analysis assumes postions will be held until expiration. Your actual losses may exceed calculated theoretical values due to changes in implied volatility, early assignment and ex-dividend dates, among other factors.The P/L Analysis is for informational purposes only and should not be considered a personalized recommendation or investment advice. The P/L Analysis performs hypothetical calculations based on model assumptions and other inputs you select, which may not reflect actual market conditions and do not guarantee future results. The maximum loss on a spread position remains limited only as long as the integrity of the spread is maintained.

The examples provided herein are for illustrative and educational purposes only and not intended to be reflective of results any investor can expect to achieve. The figures shown in the examples are not guarantees or projections, and no taxes or fees/expenses are included in the calculations which would reduce the figures shown. Actual results will vary.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

This article is for educational use only and is not a recommendation of any particular investment strategy. Content is general in nature, strictly for educational purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. All investing involves risks. Any examples are provided herein are for illustrative purposes only and not intended to be reflective of results any investor can expect to achieve.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options (https://j.us.moomoo.com/00xBBz) before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

SpyderCall : Good stuff. I could always use a little brushing up on my options knowledge.