Options Market Statistics: AI Stocks Surge as Evidence of Widespread AI Adoption Emerges

News Highlights

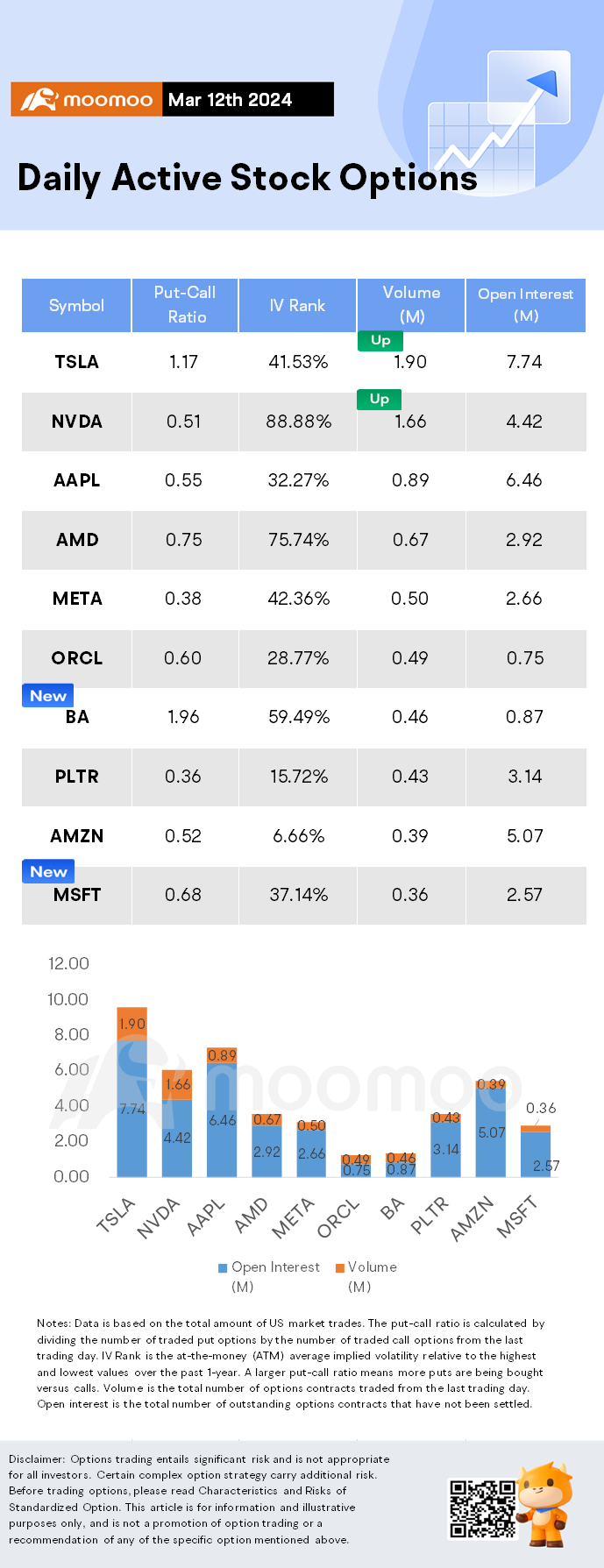

$Tesla (TSLA.US)$ shares lowered by 0.13%, closing at $177.54. Its options trading volume was 0.40 million. Call contracts account for 46.1% of the total trading volume. The most traded calls are contracts of $180 strike price that expire on Mar 15th. The total volume reaches 144,356 with an open interest of 31,609. The most traded puts are contracts of a $170 strike price that expires on Mar 15th; the volume is 116,583,195 contracts with an open interest of 38,093.

$NVIDIA (NVDA.US)$ shares rose by 7.16%, closing at $919.13. Its options trading volume was 0.40 million. Call contracts account for 66.0% of the total trading volume. The most traded calls are contracts of $900 strike price that expire on Mar 15th. The total volume reaches 87,556 with an open interest of 19,730. The most traded puts are contracts of a $850 strike price that expires on Mar 15th; the volume is 32,651 contracts with an open interest of 13,216.

There's little question that the catalyst that sparked the current bull market rally is artificial intelligence (AI). The AI gold rush that kicked off last year is gathering steam, but market watchers continue to question the resilience of this upward momentum. However, robust results from one company provided a lift for a number of AI stocks.

With that as a backdrop, audio AI specialist $SoundHound AI (SOUN.US)$ surged 15.9%, chipmaker Nvidia climbed 7%, and social media maven $Meta Platforms (META.US)$ climbed 3.34%.

A check of all the usual suspects -- financial reports, regulatory filings, and changes to analysts' price targets -- turned up nothing in the way of catalysts to explain the move higher. This seems to suggest that it was the results of another company that drove AI stocks upward.

The catalyst that seems to have sparked a rally among AI stocks was a surprisingly strong earnings report from database specialist $Oracle (ORCL.US)$ (ORCL 11.75%). The results provided evidence that demand for AI is spreading.

Oracle's cloud revenue was the headliner, growing 25% year over year to $5.1 billion. Even more impressive was the company's cloud infrastructure results, which climbed 52% year over year. This outpaced the growth of Amazon Web Services, Alphabet's Google Cloud, and Microsoft Azure -- also known as the "Big Three" cloud providers -- which grew 13%, 26%, and 30%, respectively. This suggests that either Oracle took market share from its closest cloud competitors, or that demand for cloud services is growing -- though both could be true.

$Boeing (BA.US)$ shares lowered by 4.29%, closing at $184.24. Its options trading volume was 0.40 million. Call contracts account for 33.8% of the total trading volume. The most traded calls are contracts of $190 strike price that expire on Mar 15th. The total volume reaches 14,568 with an open interest of 752. The most traded puts are contracts of a $180 strike price that expires on Mar 15th; the volume is 28,913 contracts with an open interest of 6,217.

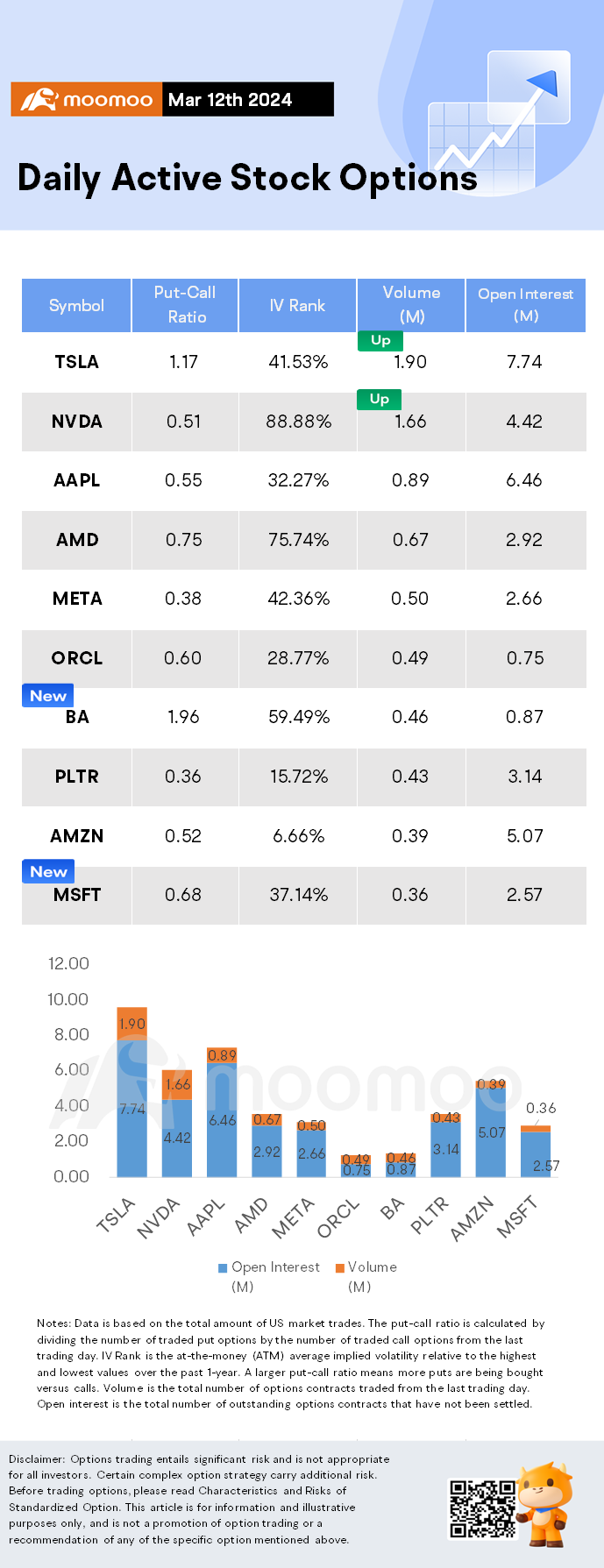

Unusual Stock Options Activity

Some notable put activity is being seen in $Warner Bros Discovery (WBD.US)$, which is primarily being driven by activity on the Apr. 12th put. Volume on this contract is 35,295 versus open interest of 238.

For all the mooers in Singapore, you can now lower your options commssions with our new campaign. Come check the link: US Stock Option.

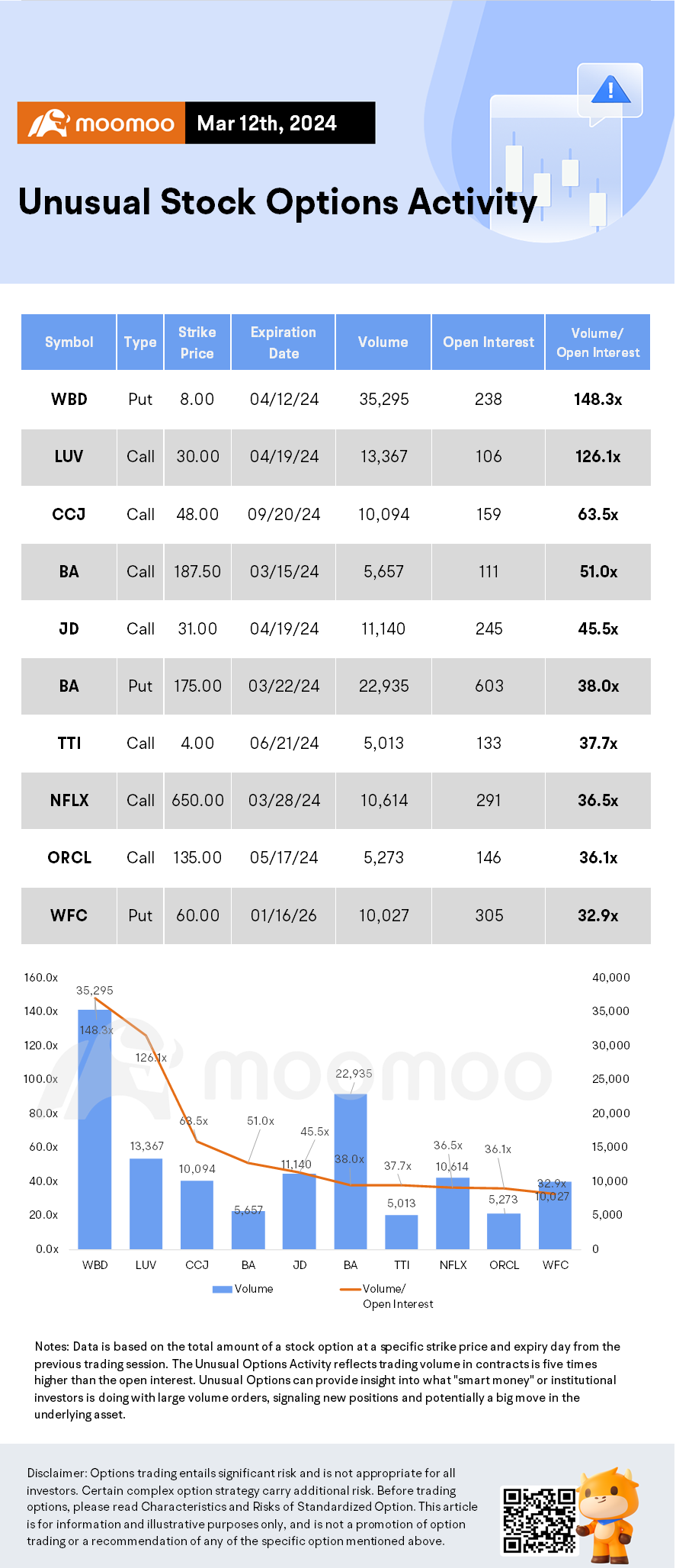

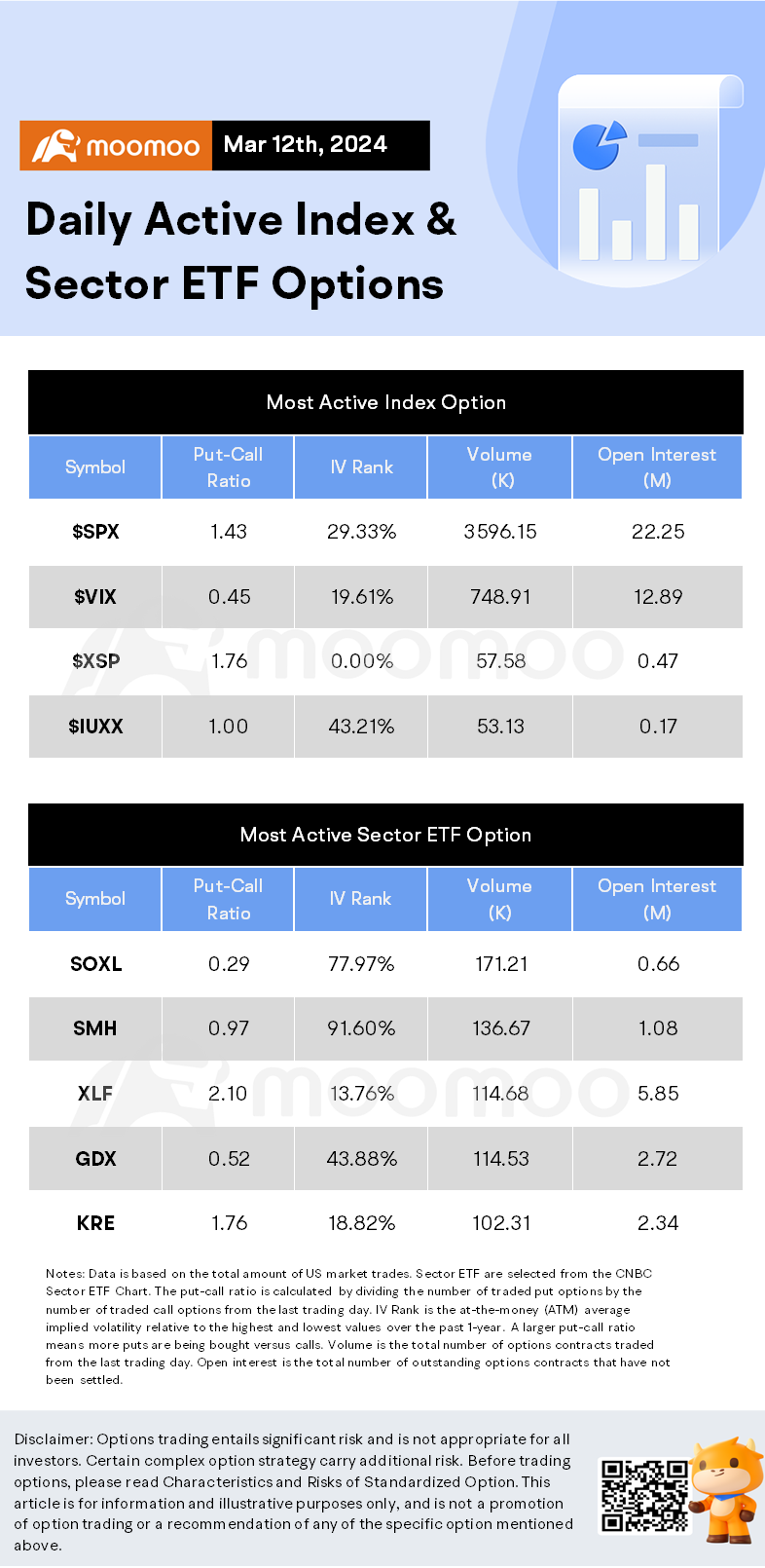

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, Barron's, The Motley Fool

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment