Options Market Statistics: Alibaba Plans Stake Sale in XPeng Motors as Part of Its Capital Management Targets, Options Pop

$Alibaba (BABA.US)$ shares rose by 2.76%, closing at $74.51. Its options trading volume is 0.57 million. Call contracts account for 85.5% of the whole trading volume. On Friday, Taobao China Holding Ltd., a subsidiary of

$Alibaba (BABA.US)$, revealed in an SEC filing that it intends to sell 25 million of

$XPeng (XPEV.US)$'s ADRs worth approximately $391 million, based on XPeng's closing share price on Thursday. According to a previous filing, Taobao China held approximately 10.2% of XPeng's outstanding shares as of December 6. As of the end of March, the Alibaba unit was the second-largest shareholder in XPeng, after founder He Xiaopeng, according to the EV maker's latest annual report.

While the two companies have partnered in other areas - including XPeng's autonomous driving capabilities backed by a computing center set up with Alibaba Cloud and the development of in-car payment features with Alibaba affiliate Alipay - Taobao China's plan to sell the stake is seen as part of Alibaba's broader efforts to manage its capital more efficiently.

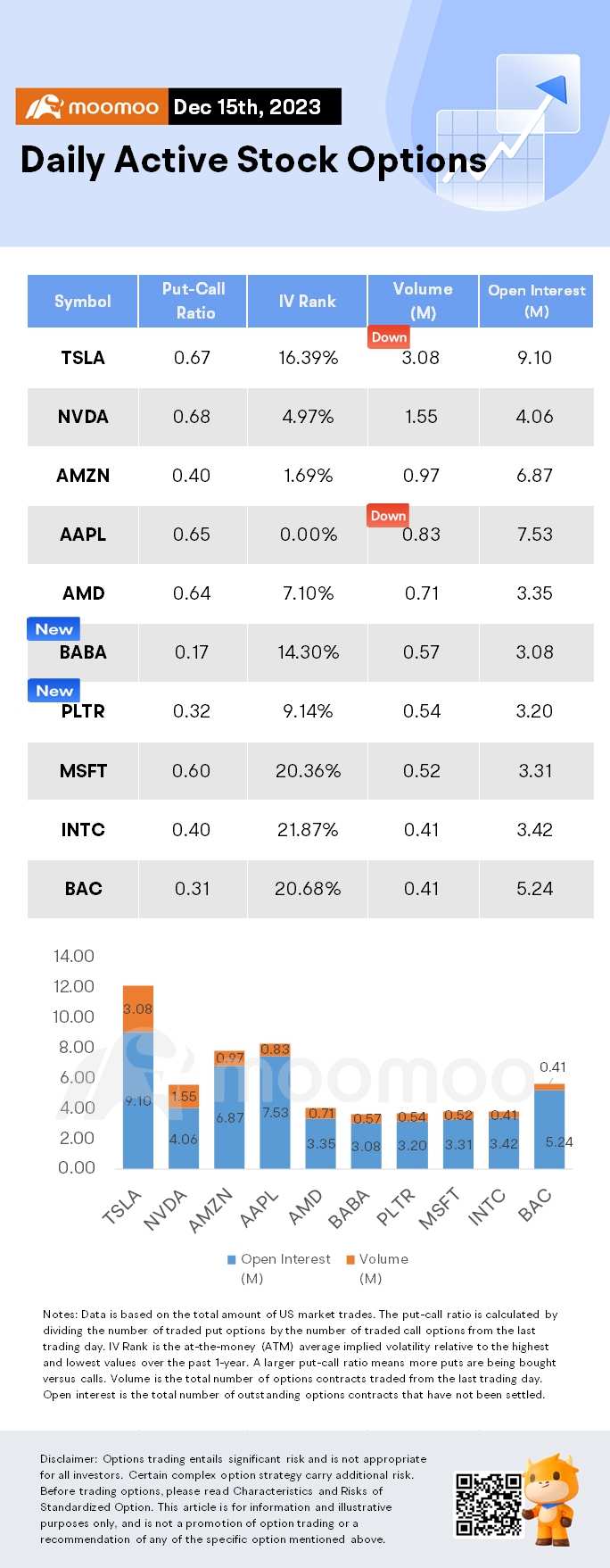

$Tesla (TSLA.US)$ shares rose by 0.98%, closing at $253.50. Its options trading volume is 3.08 million. Call contracts account for 59.8% of the whole trading volume. $Palantir (PLTR.US)$ shares fell by 0.05%, closing at $18.20. Its options trading volume is 0.54 million. Call contracts account for 71.3% of the whole trading volume. Unusual Stock Options Activity

Some notable call activity is being seen in

$U.S. Bancorp (USB.US)$, which is primarily being driven by activity on the 19-Apr-2024 call. Volume on this contract is 21,082 versus open interest of 433.

Daily Active Index & Sector ETF Options

Source: Benzinga, Dow Jones, CNBC, Reuters

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

frank Buffalo_8169 : good job

102359231 : With baba outta Xpeng, Xpeng will tank?

Nur Hidayat1 : Awesome

MonkeyGee 102359231 : I don't think so. Everything is very strange. just last week, they announced Alibaba as a big shareholder in Xpeng. People got nervous that BABA bad lucky with the government might spill over. I think this is a forced sell.

102359231 : Hi monkeygee. Many investors were initially split btw Xpeng n NIO. While NIO has provincial govt (think Guangzhou?) backing, many invested in Xpeng bcos of BABA backing. Now without baba, I have reservations. But u r right. Baba is both an asset as well as liability to Xpeng due govt intervention. I really dunno but I don’t feel good with her withdrawal. Unless a big institution or conglomerate takes over?

ZnWC : According to this article, XPeng’s share count increased by more than 50% since its initial public offering (IPO), reducing investors’ ownership stakes in the company. Xpeng tries to raise fund (like Nio) by stock dilution to cover losses in the cash burning projects. Alibaba reducing stake is just the beginning.

Share price dropped 5% after Alibaba sell Xpeng share reducing stake from 19% to 12.5...

https://www.moomoo.com/community/feed/111584936525834?global_content=%7B%22invite%22%3A%22101709443%22%2C%22promote_content%22%3A%22mm%3Afeed%3A111584936525834%22%7D&data_ticket=212ca245a589f1e400fb2e247953bc77

safri_moomoor : yup