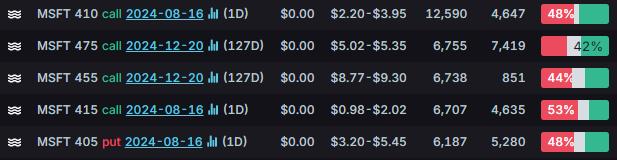

Google's parent company, Alphabet, saw its stock fall over 2% following news that the Justice Department might force the company to split due to its illegal search monopoly. This decision stems from a ruling by Judge Amit Mehta, who agreed with the government that Google's dominance in search stifles competition. The potential breakup could involve separating Chrome or the Android operating system from Google. Other remedies might include making Google open its user data to competitors or ending deals that make it the default search engine on devices like the iPhone. This antitrust case, which mirrors a historic case against Microsoft, could have significant implications for other tech giants like Apple, Amazon, and Meta, who are also facing antitrust scrutiny. Despite launching new AI-powered smartphones to boost sales, Google's stock initially rose but then dropped following the antitrust news.

lambnguyen : good time to buy in case you missed the 8/4 fire sale

山芭佬 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)