Options Market Statistics: Apple Shares Rise as New iPhone Speculation Ramps Up, Options Pop

News Highlights

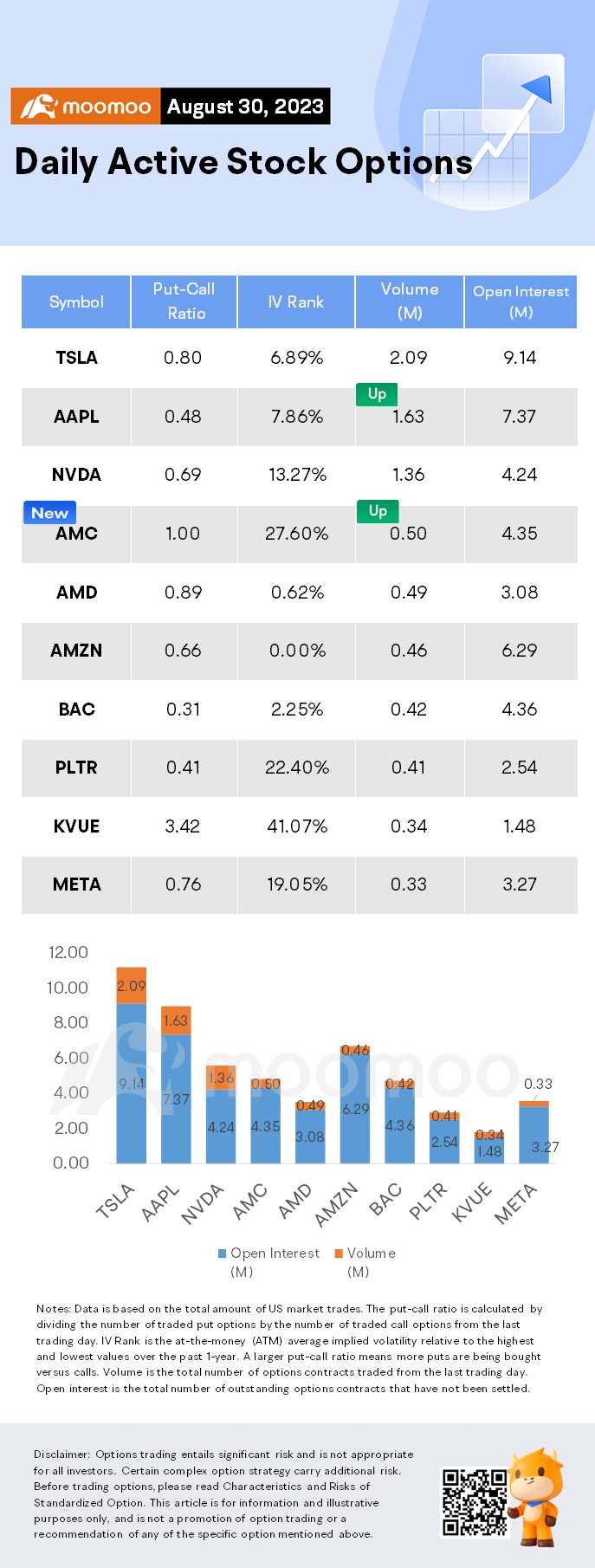

$Apple (AAPL.US)$ shares rose by 1.92%, closing at $187.65. Its options trading volume is 1.63 million. Call contracts account for 67.5% of the whole trading volume.

The consumer-electronics giant has scheduled its fall product event for Sept. 12, and it's expected to debut its latest smartphone lineup then. Apple is likely to debut four iPhone models at the fall event, including two Pro versions and two regular devices. The company is expected to keep screen sizes the same, with 6.1-inch and 6.7-inch options in each category, according to MacRumors.

One big question concerns pricing for the iPhone 15 line. Apple declined to raise prices on its new phones last year, which came as a surprising move and one that likely reflected pressure on consumer budgets. While wallet pressures remain, Bloomberg News and others have suggested Apple may be more keen to hike prices this year.

$NVIDIA (NVDA.US)$ shares rose by 0.98%, closing at $492.64. Its options trading volume is 1.36 million. Call contracts account for 59.0% of the whole trading volume.

Kress Colette, Executive Vice President and Chief Financial Officer, on August 28, 2023, sold 4,980 shares in Nvidia for $2,294,476. Following the Form 4 filing with the SEC, Kress Colette has control over a total of 576,996 shares of the company, with 499,428 shares held directly and 77,568 controlled indirectly.

$AMC Entertainment (AMC.US)$ shares rose by 16.68%, closing at $12.73. Its options trading volume is 0.5 million. Call contracts account for 50.0% of the whole trading volume.

AMC Entertainment shares were trading higher on continued volatility after the company's reverse stock split took effect last week and amid last Friday's APE conversion.

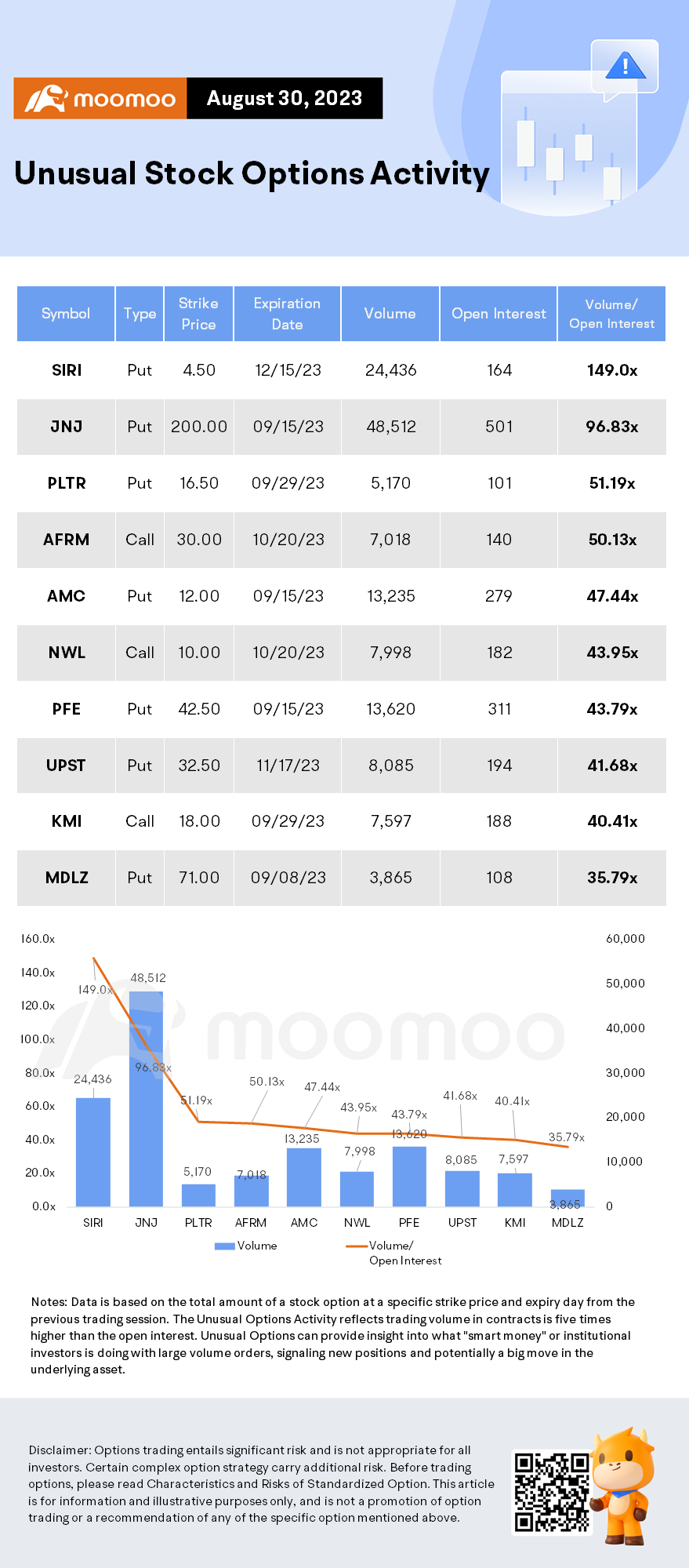

Unusual Stock Options Activity

Some notable put activity is being seen in $Johnson & Johnson (JNJ.US)$ ,which is primarily being driven by activity on the September 15th 200.00 put. Volume on this contract is 48,512 versus open interest of 501, so it's likely that nearly all of the volume represents fresh positioning.

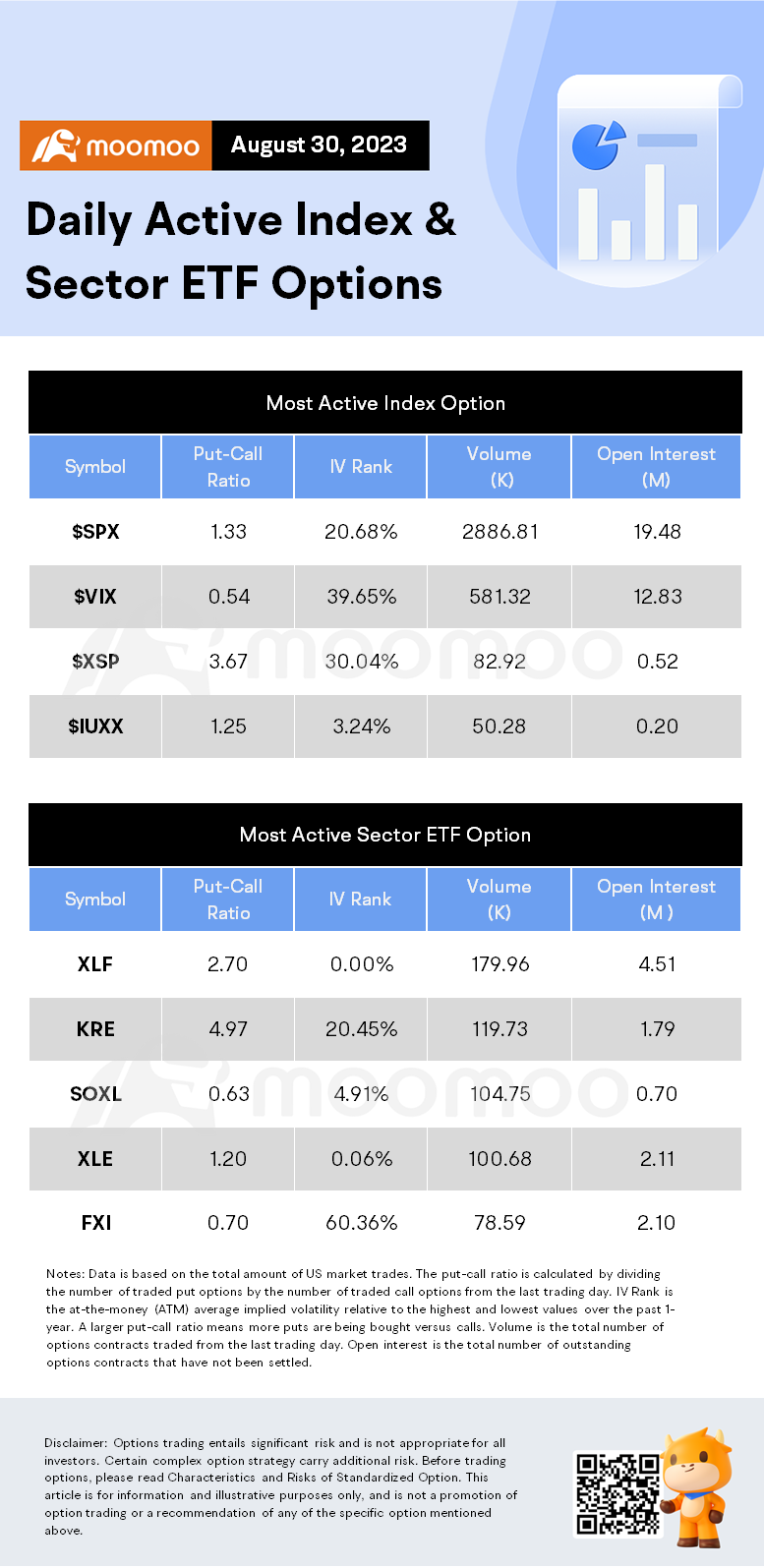

Daily Active Index & Sector ETF Options

Source: Benzinga, Dow Jones, CNBC

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please readCharacteristics and Risks of Standardized Option.This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Source: Benzinga, WSJ

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

73724046 : great