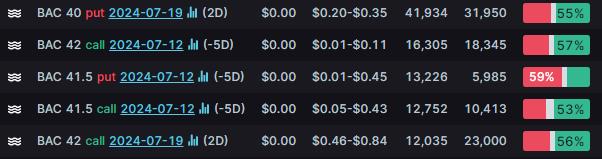

Bank of America reported better-than-expected second-quarter revenue and profit, driven by rising investment banking and asset management fees. The bank's earnings were 83 cents per share, beating the 80 cents per share estimate, and revenue was $25.54 billion, surpassing the $25.22 billion estimate. Although profit dropped 6.9% to $6.9 billion due to decreased net interest income (NII), revenue saw a slight increase.

JASONPUEBLA-SALINAS : thank you for the information on my assests

muhamad Hazairudin s : Muhammad Hazairudin Shadan