Options Market Statistics: Big Tech Stocks Surge on Monday, Boosting S&P 500 and Nasdaq Gains

News Highlights

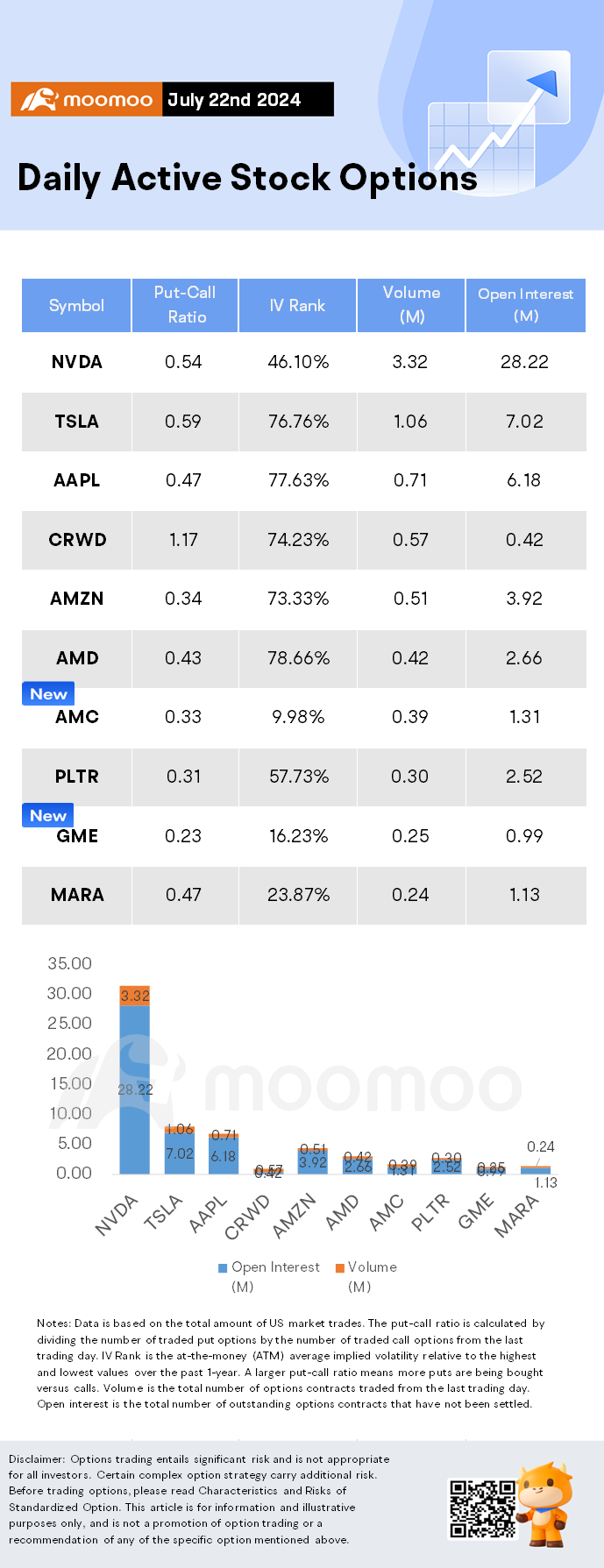

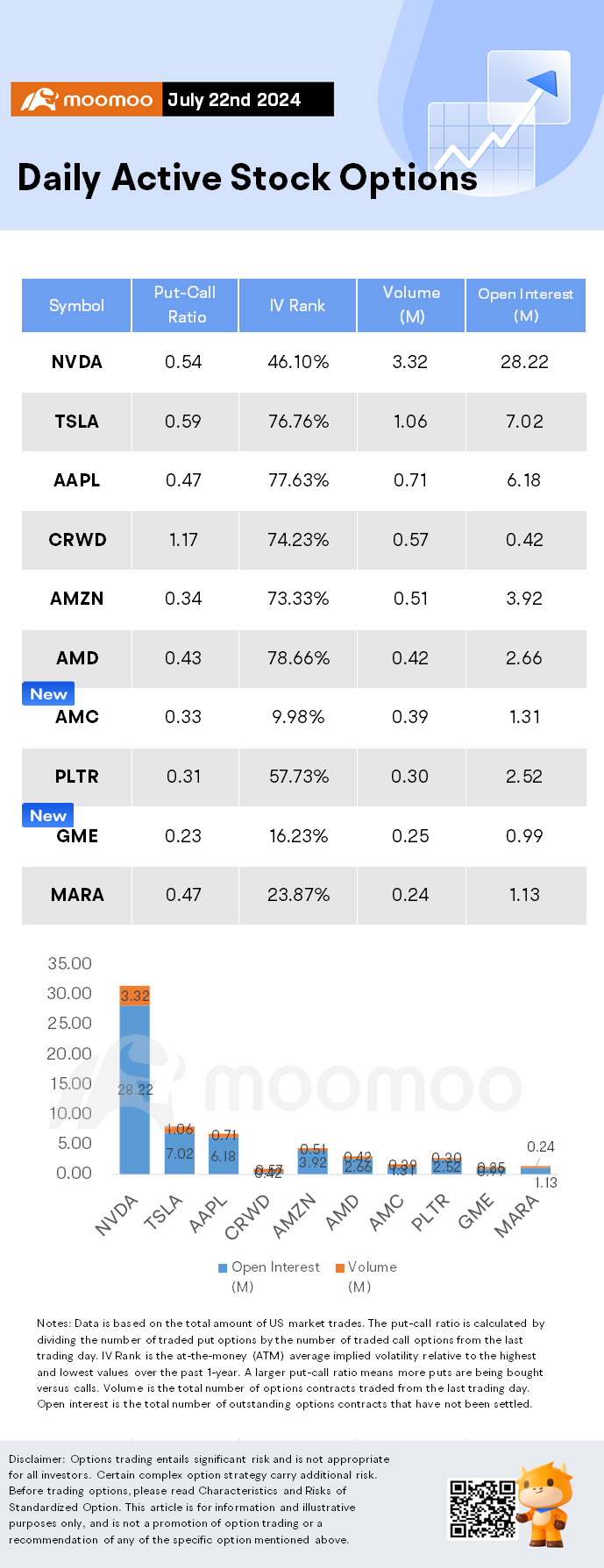

$NVIDIA (NVDA.US)$ rose 4.76%. Its options trading volume was 3.32 million. Call contracts account for 64.8% of the total trading volume.

Nvidia is reportedly designing a new variant of its most powerful GPU specifically for the Chinese market, with shipments expected to begin in the second quarter of 2025. This move comes despite concerns over restrictions from the U.S. and allies on selling advanced processors to China, which have negatively impacted Nvidia's stock. The strategy indicates Nvidia's continued commitment to China, a major market for its products, and could generate significant short-term revenue.

Wall Street analysts are optimistic about Nvidia's prospects. Piper Sandler's Harsh Kumar raised his one-year price target for Nvidia from $120 to $140 per share, citing positive business trends and the upcoming launch of Nvidia's new Blackwell chip platform, which promises substantial performance improvements. Similarly, Loop Capital's Ananda Baruah reiterated a buy rating and increased the price target to $175 per share, predicting that Nvidia's data center revenue for 2025 could far exceed Wall Street expectations, potentially reaching between $215 billion and $240 billion, compared to the average estimate of $145 billion. Sales for the compute segment could also surpass expectations, potentially hitting between $200 billion and $225 billion, against Wall Street's target of $132 billion.

$Tesla (TSLA.US)$ rose 5.15%. Its options trading volume was 1.06 million. Call contracts account for 62.8% of the total trading volume.

Tesla shares rose over 5% on Monday, ahead of the company's earnings report, following CEO Elon Musk's announcement that Tesla will start low production of humanoid robots for internal use in 2025, with hopes for high production for other companies by 2026. Previously, Musk had stated that these robots were expected to be in the factory by the end of 2024.

$CrowdStrike (CRWD.US)$ declined 13.46%. Its options trading volume was 0.57 million. Call contracts account for 46% of the total trading volume.

Shares of cybersecurity company CrowdStrike dropped over 13% after a recent technology outage caused by a security update led to global disruptions, affecting 8.5 million Windows devices. The incident, which resulted in system crashes and impacted critical infrastructure like hospitals, banks, and airports, has led to significant investor uncertainty.

Although CrowdStrike has deployed a fix, the company's stock has fallen over 20% since the incident, reflecting concerns about potential damage to its brand and the costs associated with compensating affected parties. Several Wall Street analysts have downgraded the stock; for instance, Guggenheim's John DiFucci and a BTIG analyst both moved their ratings from Buy to Neutral, citing potential resistance to new deals and more negative feedback than expected. The market remains unsure about the long-term impact, suggesting that CrowdStrike faces a significant challenge in regaining trust and stabilizing its business.

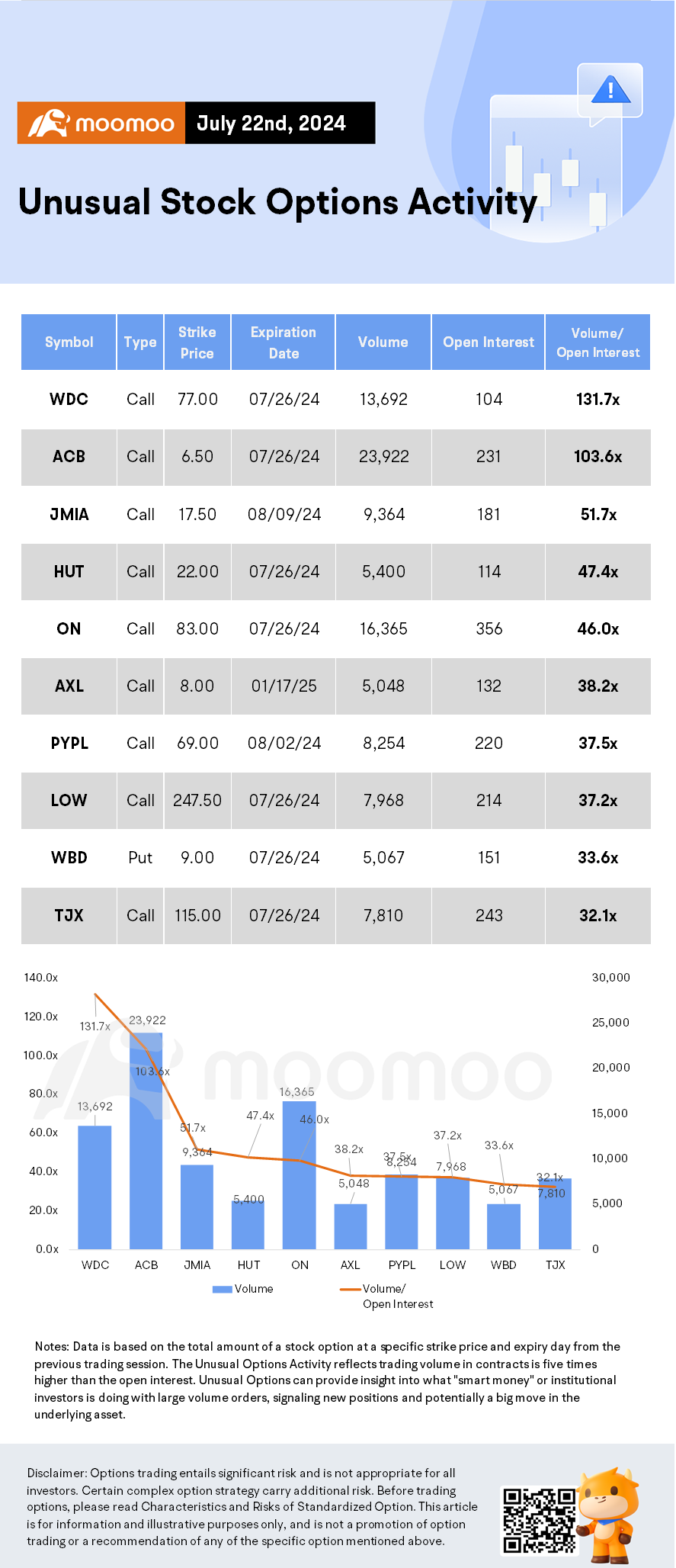

Unusual Stock Options Activity

There was a noteworthy activity in $Western Digital (WDC.US)$, where multiple calls have topped volume to open interest ranking. The highest volume over open interest ratio reaches 131.7x with 13,692 contracts.

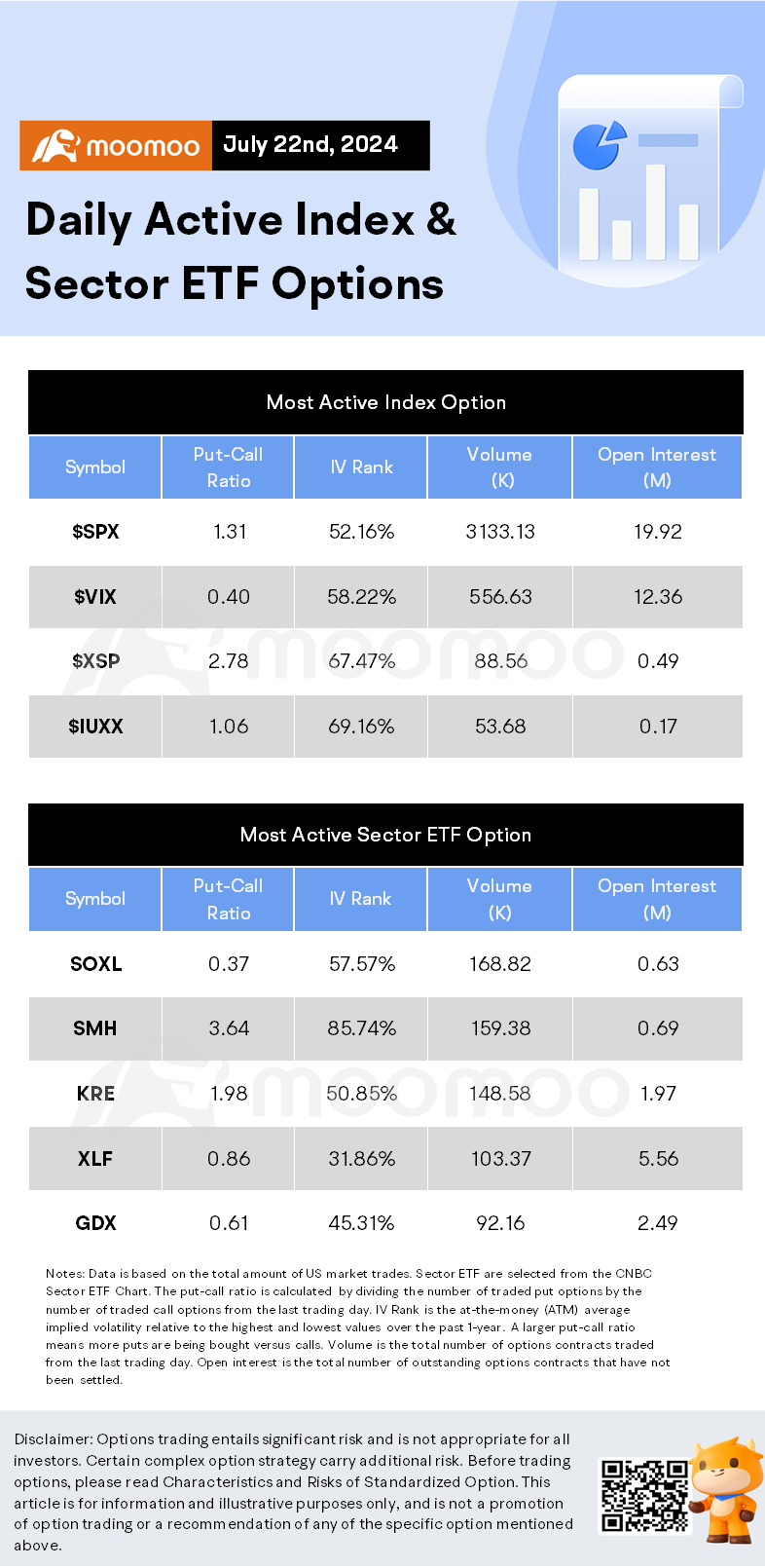

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer:Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment