Options Market Statistics: Broadcom Beats Targets, Disappoints on Sales Outlook; Shares Drop and Options Pop

News Highlights

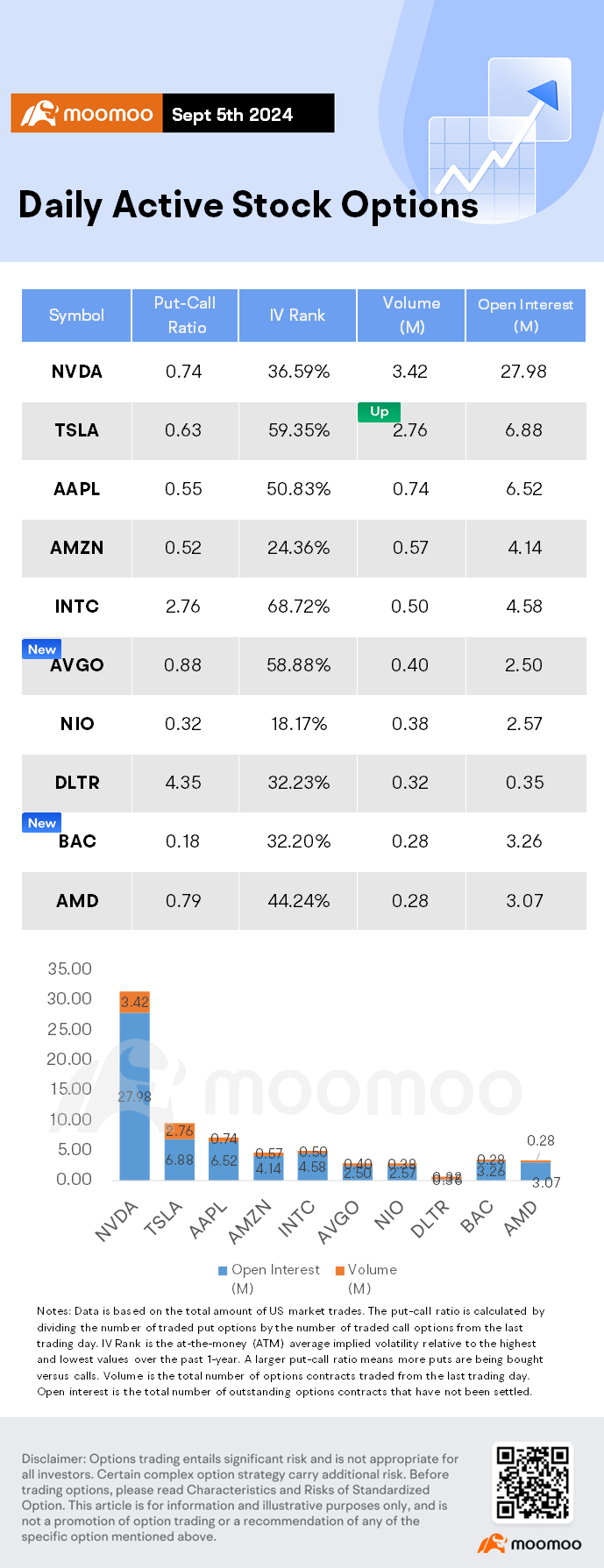

$Tesla (TSLA.US)$ shares climbed 4.9% Thursday to close at $230.17. Its options trading volume was 2.76 million. Call contracts account for 61.3% of the total trading volume.The $220 calls expiring September 6 were traded most actively.

Tesla shares rose on Thursday after the company reaffirmed plans to launch its Full Self-Driving (FSD) software in China and Europe, pending regulatory approval. This comes ahead of the unveiling of its robotaxi, "Cybercab," which uses FSD technology. CEO Elon Musk expects regulatory approval in both regions by year-end, with launches in right-hand drive markets in early 2024. Despite skepticism over self-driving tech due to regulatory challenges, investors are hopeful about expedited approval under a potential Trump administration. In China, Tesla has partnered with Baidu for navigation, while Europe may face a longer approval process. Shanghai has already allowed FSD testing, setting the stage for its rollout amid local competition. Tesla also announced new features like Actually Smart Summon and FSD for the Cybertruck.

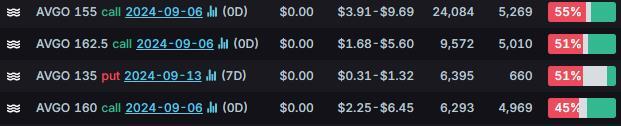

$Broadcom (AVGO.US)$ shares fell 0.84% Thursday to close at $152.82. Its options trading volume was 0.40 million. Call contracts account for 53.3% of the total trading volume.The $155 calls expiring September 6 were traded most actively.

Broadcom narrowly beat Wall Street targets for its fiscal third quarter, reporting adjusted earnings of $1.24 per share on $13.07 billion in sales, both slightly above expectations. However, it guided slightly below analyst forecasts for the current quarter, expecting $14 billion in sales versus the $14.11 billion anticipated. Despite strong year-over-year growth, benefiting from its VMware acquisition, AVGO stock fell 4.8% in after-hours trading. CEO Hock Tan highlighted continued strength in AI semiconductor solutions, projecting $12 billion in AI chip revenue for fiscal 2024, up from a previous target of $11 billion.

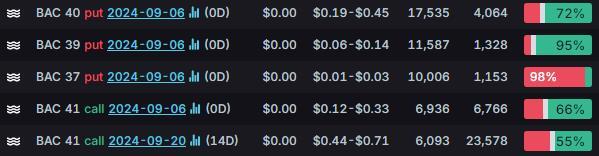

$Bank of America (BAC.US)$ shares fell 0.89% Thursday to close at $40.14. Its options trading volume was 0.28 million. Call contracts account for 84.4% of the total trading volume.The $40 puts expiring September 6 were traded most actively.

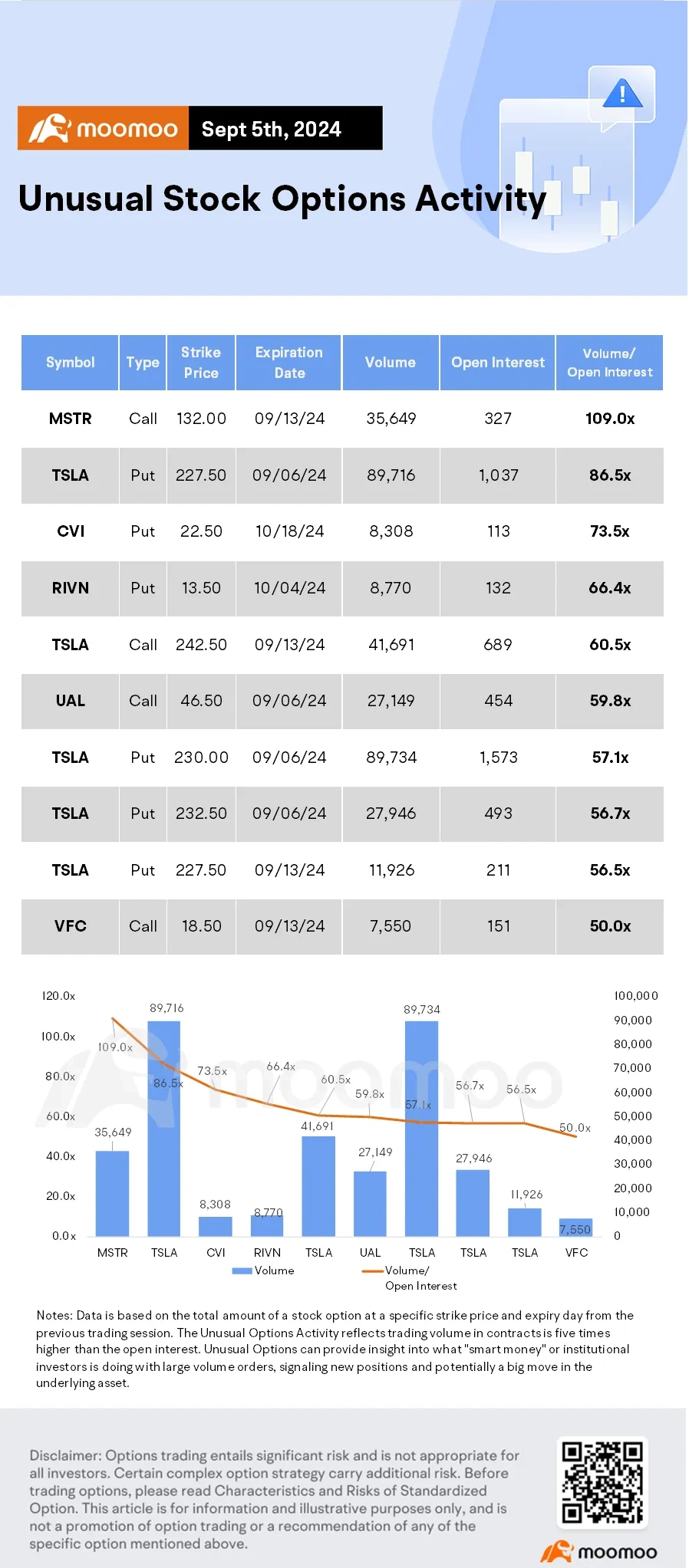

Unusual Stock Options Activity

There was a noteworthy activity in $MicroStrategy (MSTR.US)$ , where $132 CALLs have topped volume to open interest ranking. The highestvolume over open interest ratio reaches 109x with 35,649 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Cypher : “CEO Elon Musk expects regulatory approval in both regions by year-end, with launches in right-hand drive markets in early 2024.” Did you mean early 2025?

@Options Newsman