Options Market Statistics: China-focused ETFs and Stocks Surge, Options Pop on Beijing's Stimulus Measures

News Highlights

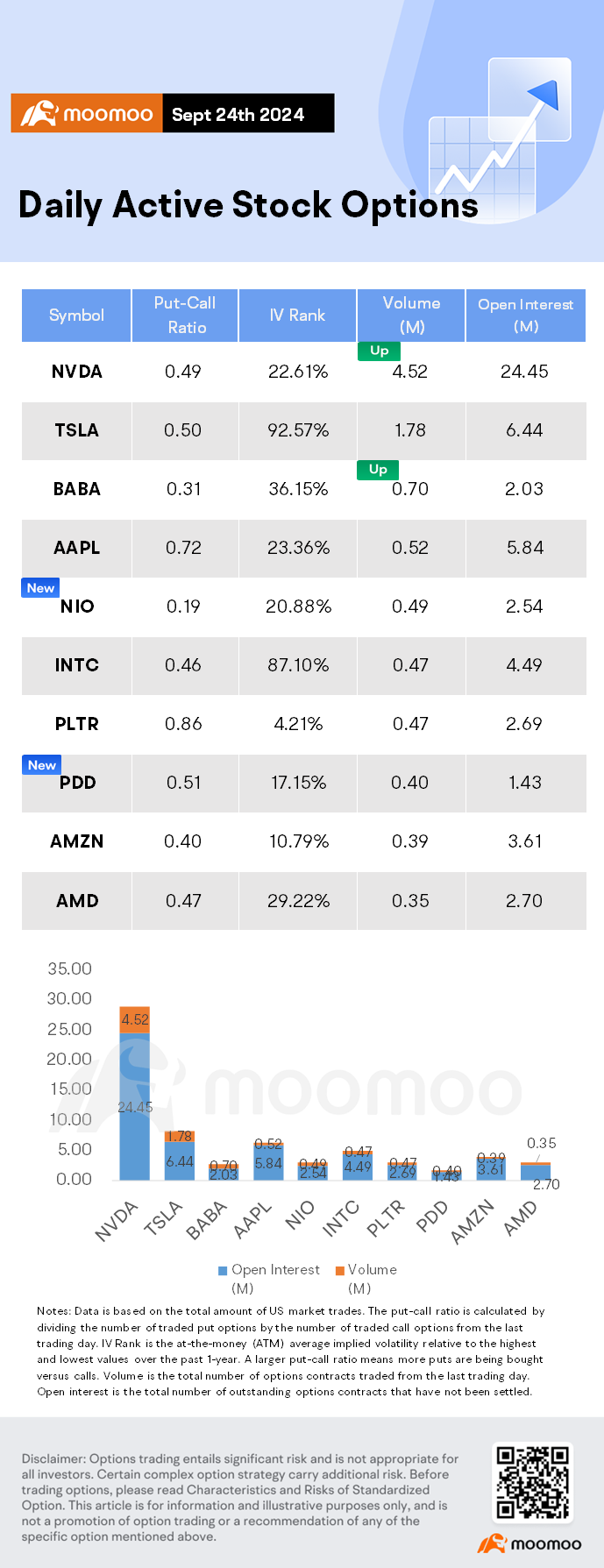

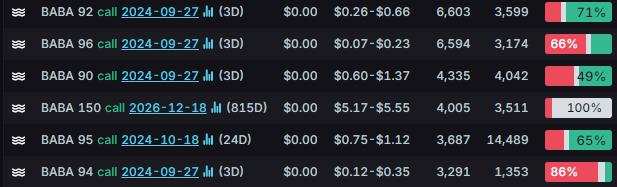

$Alibaba (BABA.US)$ shares climbed 7.88% Tuesday to close at $97.19, with option volume of 0.70 million, and calls accounted for 76.4% of the volume. The $92 calls expiring September 27 were traded most actively.

China-focused ETFs and U.S.-listed Chinese stocks surged Tuesday following Beijing's broad stimulus package targeting the sluggish economy. The $iShares MSCI China ETF (MCHI.US)$ and iShares $iShares China Large-Cap ETF (FXI.US)$ both rose around 9%. The measures included cuts to a key short-term interest rate, lower mortgage rates, reduced bank reserve requirements, and plans for 800 billion yuan ($114 billion) in liquidity. Despite the boost in investor sentiment, Nomura analysts warned that fiscal measures are still needed to effectively counter the economic slowdown. Major Chinese stocks like Alibaba, JD.com, and Tencent also saw significant gains, along with Chinese EV makers XPeng, Nio, and Li Auto.

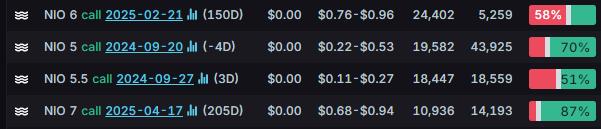

$NIO Inc (NIO.US)$ shares surged 11.65% Tuesday to close at $5.94, with option volume of 0.49 million, and calls accounted for 83.9% of the volume. The $6 calls expiring Feb. 21, 2025 were traded most actively.

$PDD Holdings (PDD.US)$ shares surged 11.24% Tuesday to close at $113.80, with option volume of 0.40 million, and calls accounted for 66.1% of the volume. The $135 puts expiring October 18 were traded most actively.

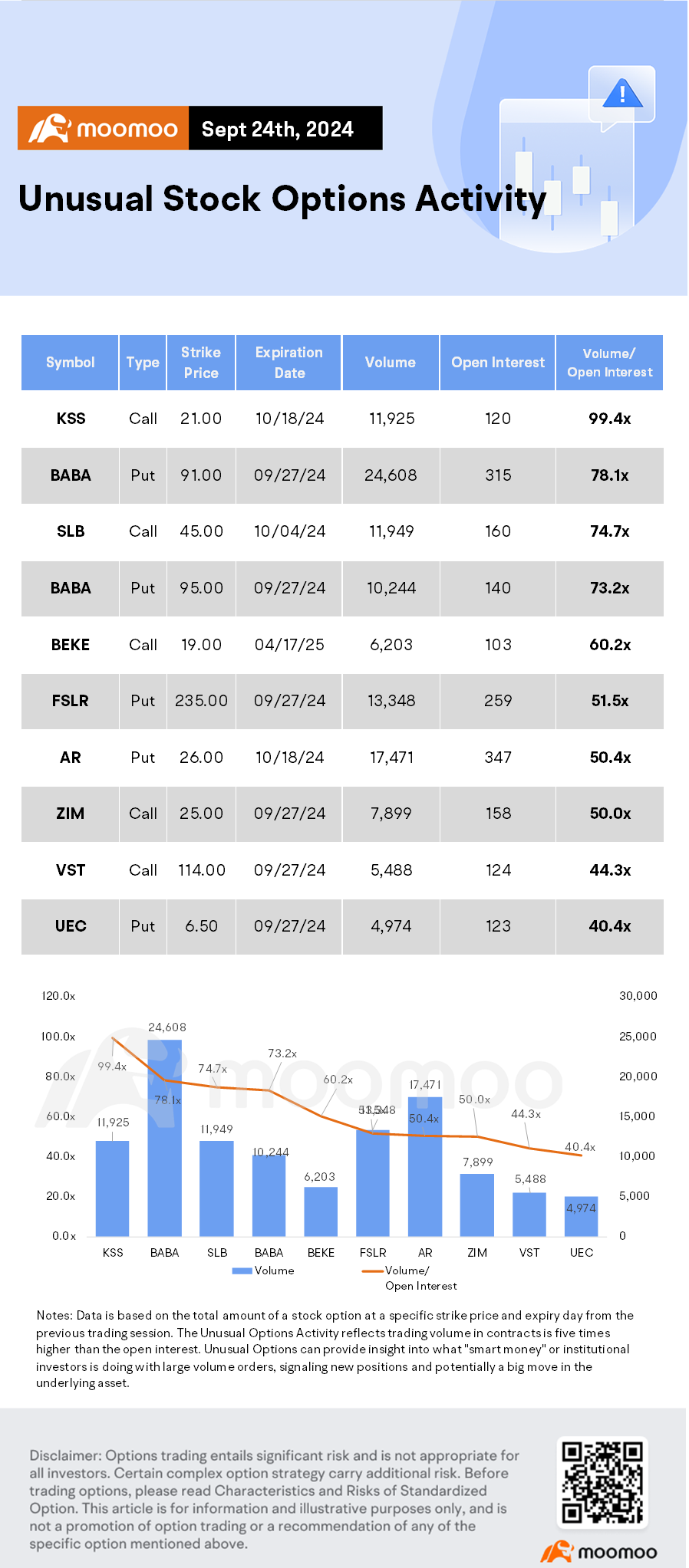

Unusual Stock Options Activity

There was a noteworthy activity in $Kohl's Corp (KSS.US)$, where $21.00 calls have topped volume to open interest ranking. The highest volume over open interest ratio reaches 99.4x with 11,925 contracts.

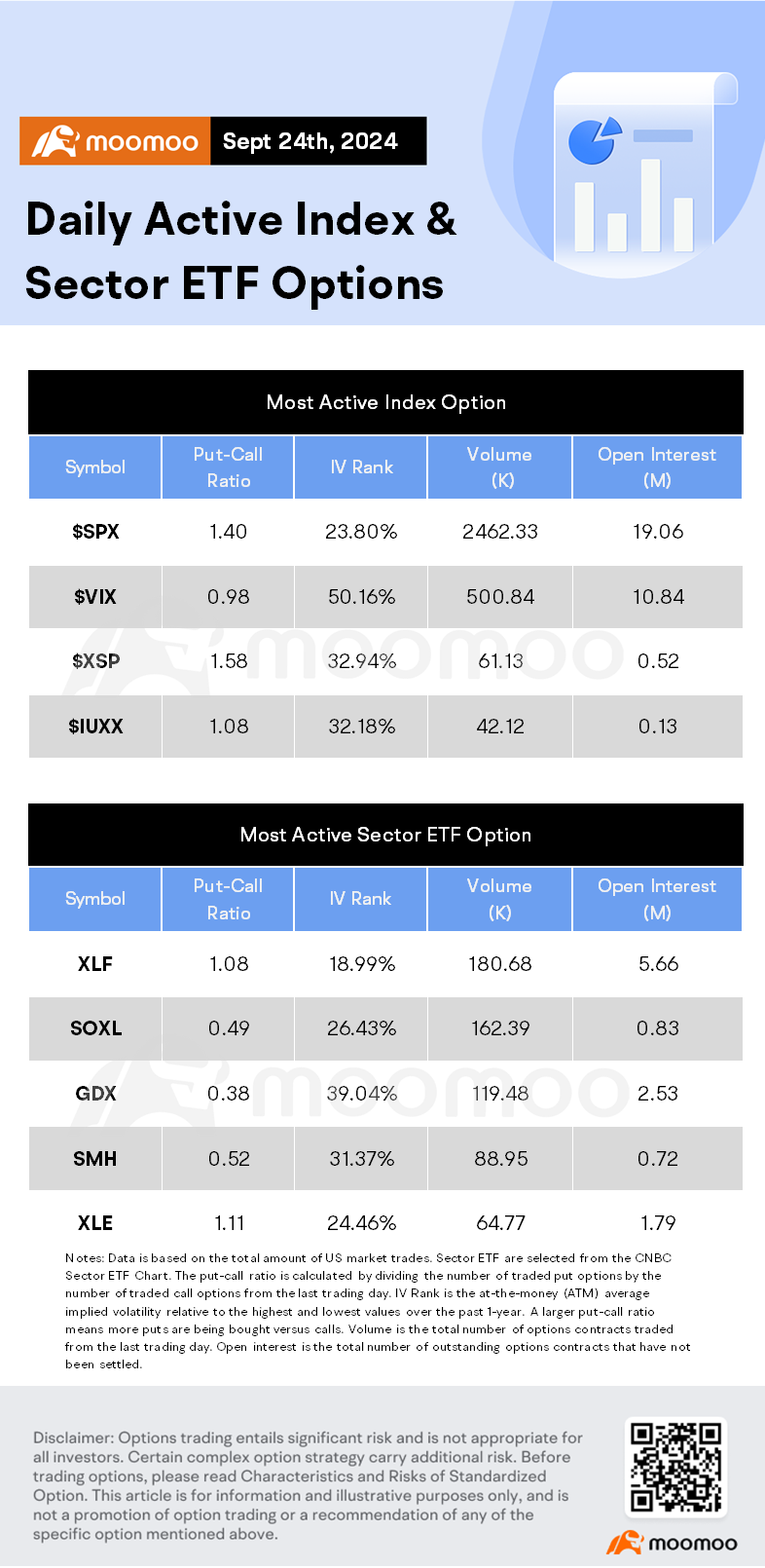

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

BloombergOption Volume: [Options Notes]Measuring liquidity: two key indicators to check

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103677010 : noted

john song : k