Options Market Statistics: CrowdStrike Shares Dive 11% Following Global Tech Outage, Options Pop

News Highlights

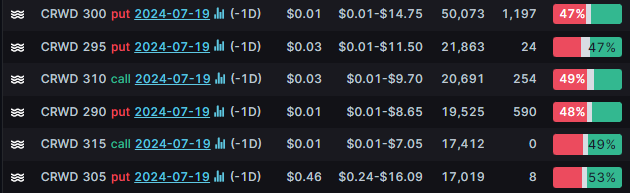

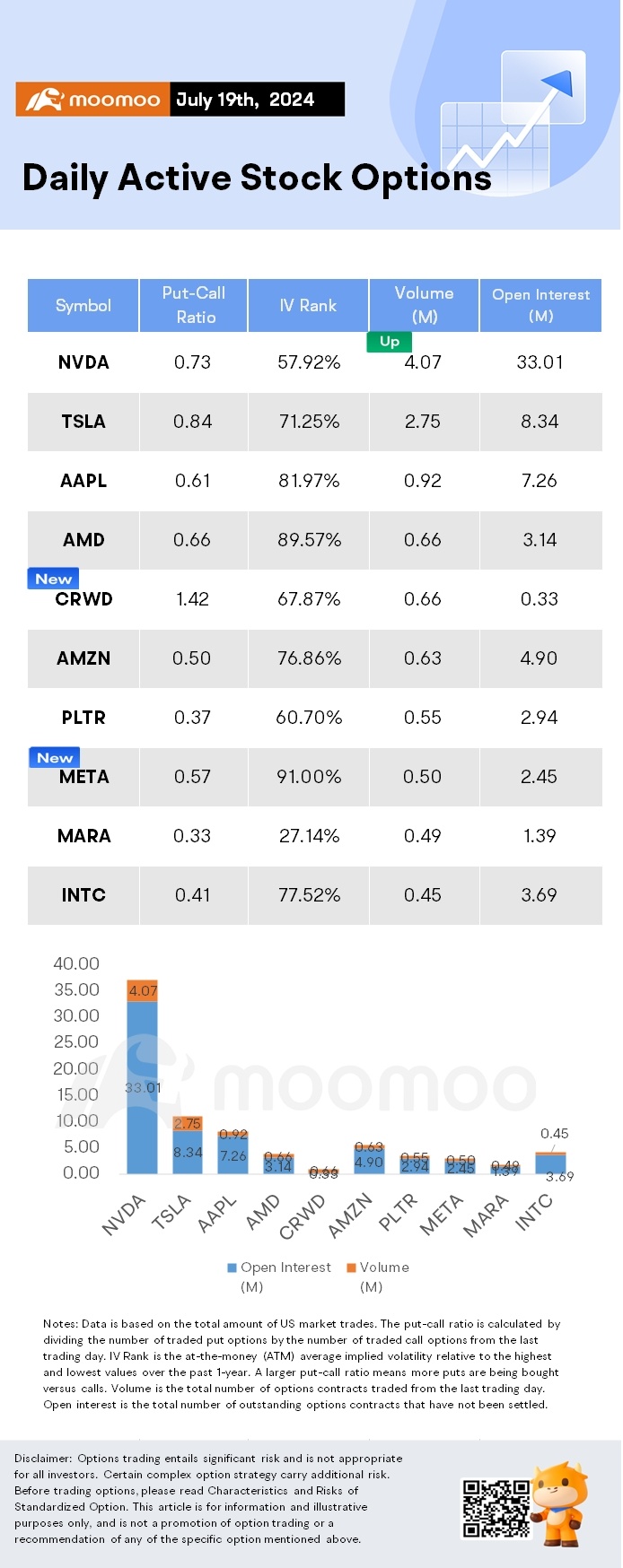

$CrowdStrike (CRWD.US)$ declined 11%. Its options trading volume was 0.66 million. Call contracts account for 41.4% of the total trading volume. The $300 puts expiring July 19 were traded most actively.

On Friday, a buggy update sent overnight by the cybersecurity company CrowdStrike caused millions of Windows computers to crash, resulting in operational disruptions for global airlines, hospitals, enterprises, and banks using Windows and CrowdStrike.

Despite CrowdStrike's statement that the incident was not caused by hackers or other security issues and their apology and acceptance of responsibility for the inconvenience caused, they failed to prevent the sell-off that day.

According to Ittai Kidron of Oppenheimer: "this is a major blow to CrowdStrike's reputation and would most likely weigh not only on investor sentiment but also on business activity for several quarters ahead."

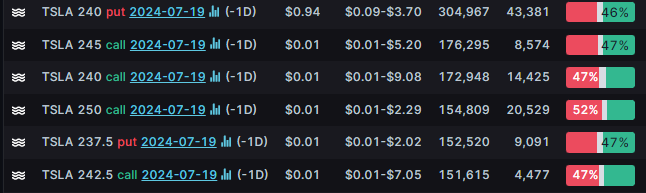

$Tesla (TSLA.US)$ ended 4.02% lower. Its options trading volume was 2.75 million. Call contracts account for 54.5% of the total trading volume. The $240 puts expiring July 19 were traded most actively.

The stock price of Tesla has suffered a double blow from the remarks made by Trump and the CrowdStrike incident. Following his nomination as the Republican presidential candidate, Trump stated that he would terminate Biden's electric vehicle policy on his first day in office if elected. In addition, media reports indicate that an IT system outage caused by the $CrowdStrike (CRWD.US)$ resulted in a temporary halt of production on some of Tesla's assembly lines in Texas and Nevada.

$MARA Holdings (MARA.US)$ ended 4.57% higher. Its options trading volume was 0.49 million. Call contracts account for 75% of the total trading volume. The $28 calls expiring July 19 were traded most actively.

The leader of the cryptocurrency market, Bitcoin, surged by nearly 6% to $67,434 on Friday, breaking the $67,000 mark for the first time in over a month. As investors digest reports that President Biden may withdraw from the US presidential race and Trump's bullish attitude towards cryptocurrencies increases optimism surrounding Bitcoin, the large-scale global IT disruption caused by the CrowdStrike update intensified the sell-off of large tech stocks.

As Bitcoin prices continue to rise, stocks of cryptocurrency-related companies like $MARA Holdings (MARA.US)$ are also on the rise.

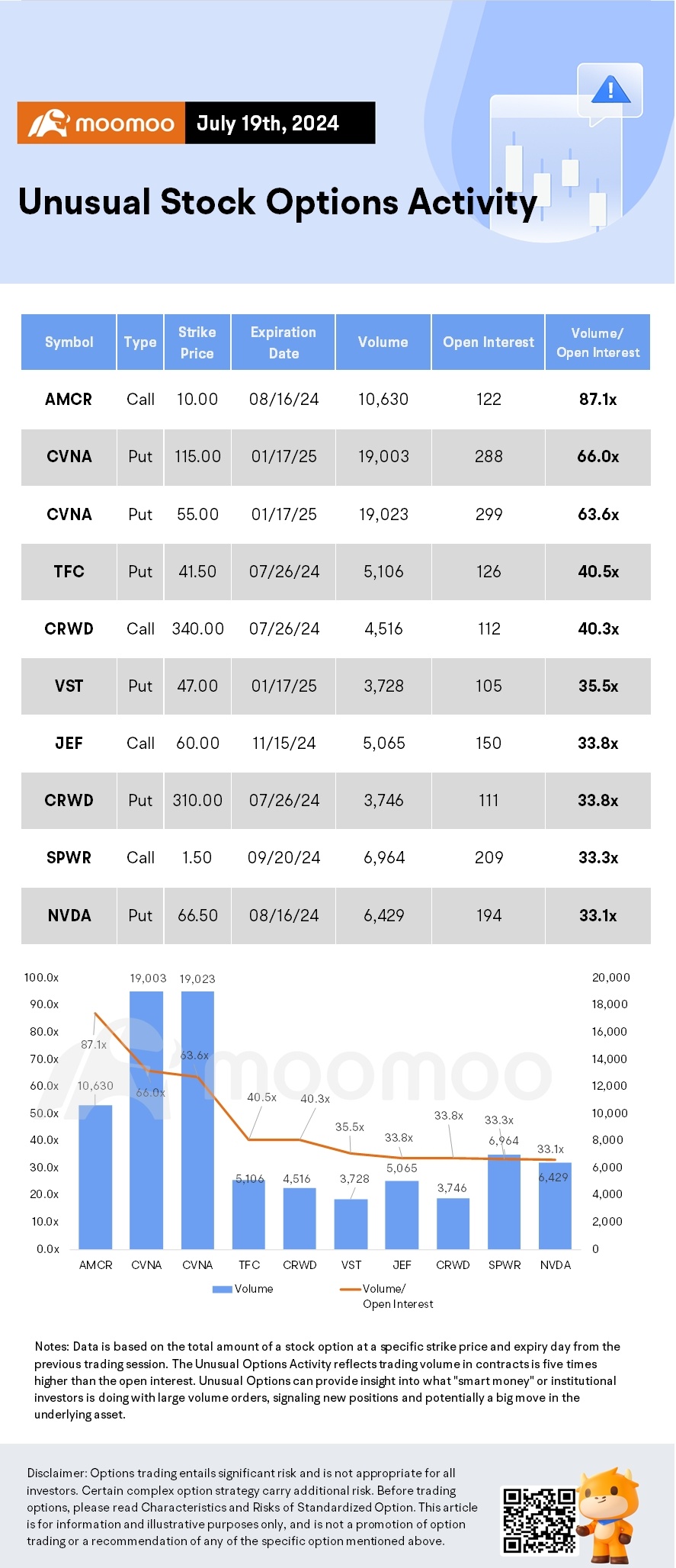

Unusual Stock Options Activity

There was a noteworthy activity in $Amcor (AMCR.US)$, where multiple calls have topped volume to open interest ranking. The highest volume over open interest ratio reaches 87.1x with 10,630 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103469626 :

NoDragonsPlz : so we shorting CrowdStrike now?

PAUL BIN ANTHONY : very helpful thanks

Souxiesue : This even affected the Boarder patrol

Malik ritduan : pad

104953415 :

muhamad Hazairudin s : Muhammad Hazairudin Shadan

Ivan Celestin : Hi