Options Market Statistics: Ford Shares Plunge to Worst Day Since 2008 After Disappointing Earnings

News Highlights

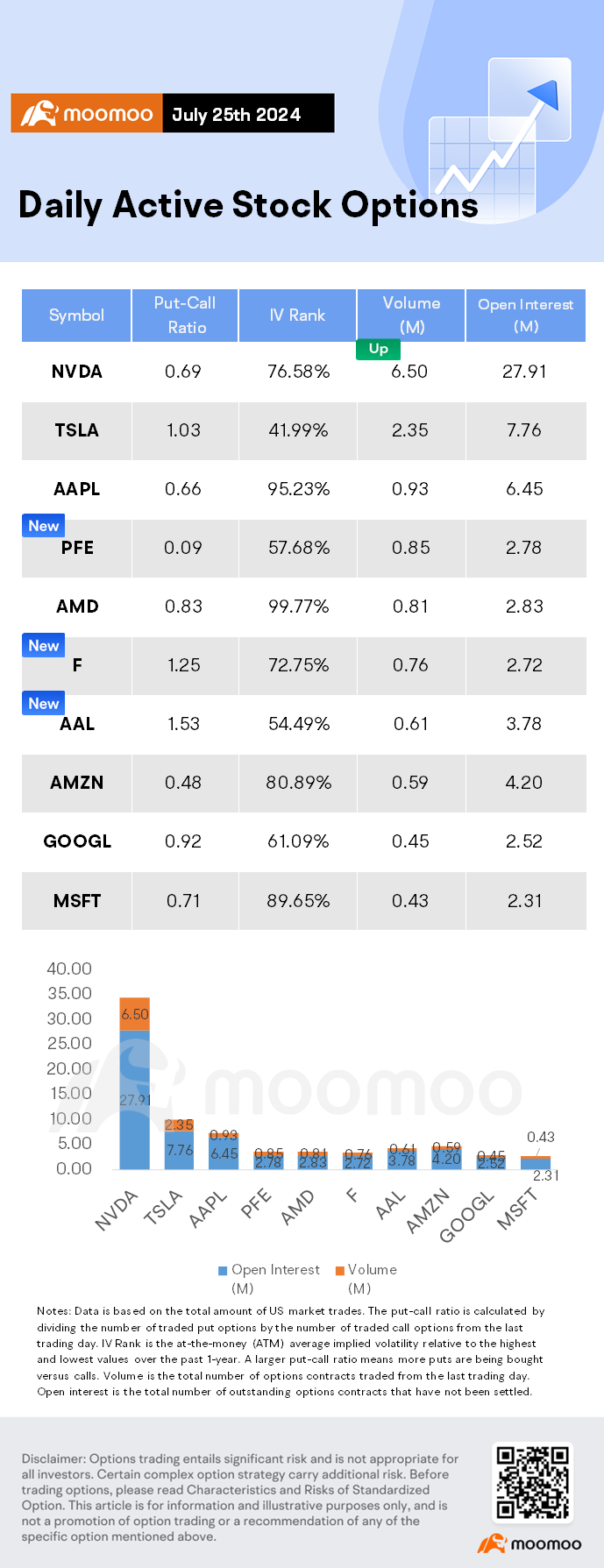

$NVIDIA (NVDA.US)$ fell 1.72%. Its options trading volume was 6.50 million. Call contracts account for 59% of the total trading volume. The $125 calls expiring July 26 were traded most actively.

Nvidia shares initially fell nearly 7% early Thursday, extending the previous session's drop, but later rebounded as investors 'bought the dip.' Despite recent declines, Nvidia remains up over 130% this year. The chipmaker, heavily favored for its AI-related prospects, has struggled amid a broader rotation out of mega-cap tech stocks.

Tech stocks, including Nvidia, suffered after disappointing earnings from Tesla and Alphabet led to a significant sell-off. The S&P 500 and Nasdaq Composite experienced their biggest drops since earlier this year and late 2022, respectively.

Once the poster child of the AI boom, Nvidia saw a 239% rise in 2023 and a further 172% increase this year before recent market shifts. Optimism for a Federal Reserve rate cut led investors to move from big tech to smaller companies, resulting in a 15% slump in Nvidia shares while the Russell 2000 gained 10%.

$Ford Motor (F.US)$ fell 18.36%. Its options trading volume was 0.76 million. Call contracts account for 44.5% of the total trading volume. The $14 calls expiring August 16 were traded most actively.

Ford Motor shares plummeted 18.4% to $11.16 on Thursday, marking their worst daily drop since 2008, after missing Wall Street's earnings expectations due to recurring warranty problems. This decline led a broader fall in U.S. automotive stocks, with General Motors and Stellantis also seeing significant drops following their earnings reports.

General Motors closed at $44.13, down 5% and off 8.6% for the week. Despite beating Wall Street expectations and raising its annual guidance, investor concerns over growth pullbacks and earnings peak contributed to the decline.

Stellantis shares fell 7.7% to $18.09, near a 52-week low, after disappointing first-half results, primarily due to issues in its North American operations. Despite this, Stellantis reaffirmed its 2024 guidance, emphasizing positive industrial free cash flow and substantial capital returns to investors.

Tesla, after reporting weaker-than-expected earnings and a drop in automotive revenue, saw its shares decline 12% on Wednesday, contributing to a 7.9% weekly drop and a 10.7% year-to-date decline.

Despite the setbacks, some analysts remain optimistic about Ford's long-term potential. Morgan Stanley's Adam Jonas maintained Ford as the firm's "top pick," although he downgraded GM due to concerns over sustained performance.

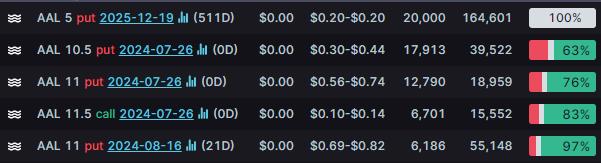

$American Airlines (AAL.US)$ rose 4.23%. Its options trading volume was 0.61 million. Call contracts account for 39.5% of the total trading volume. The $5 puts expiring Dec. 19 2025 were traded most actively.

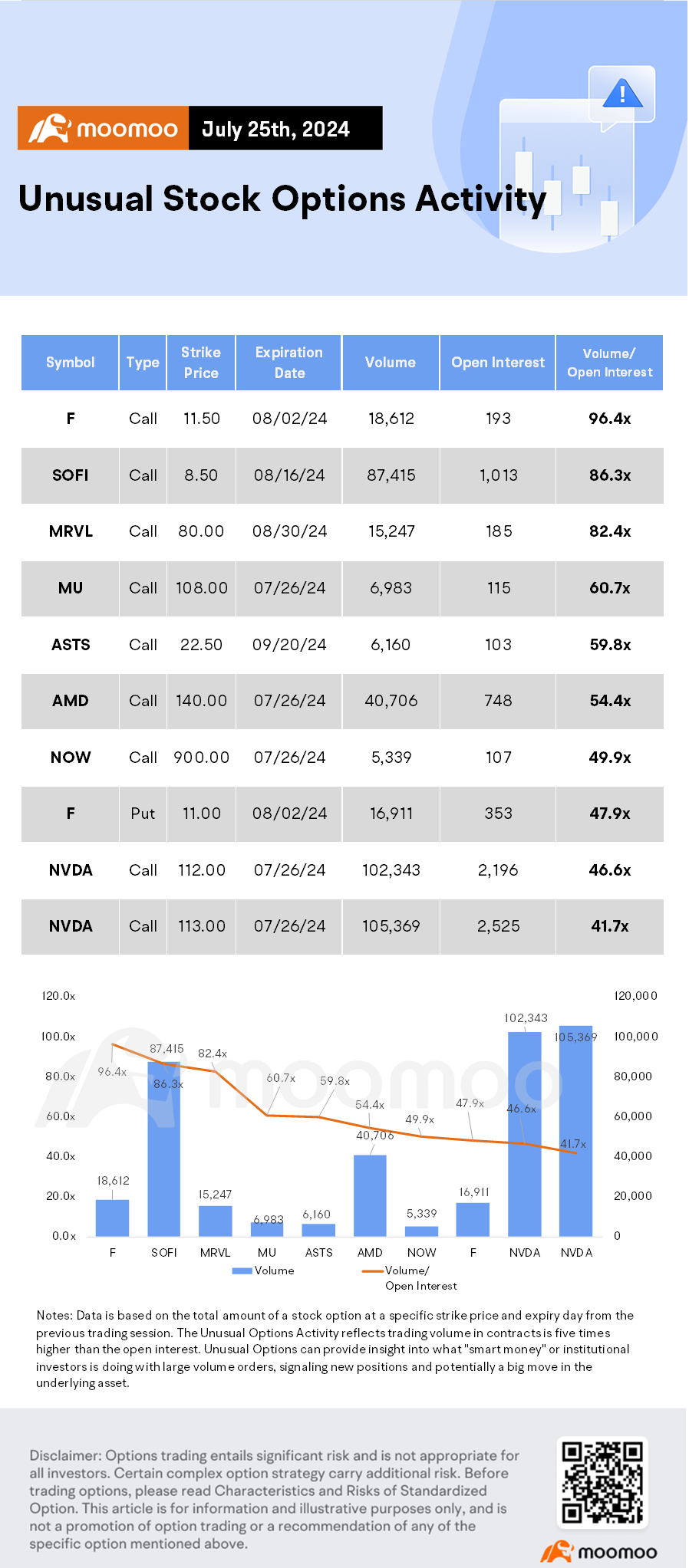

Unusual Stock Options Activity

There was a noteworthy activity in $Ford Motor (F.US)$, where multiple calls have topped volume to open interest ranking. The highest volume over open interest ratio reaches 96.4x with 18,612 contracts.

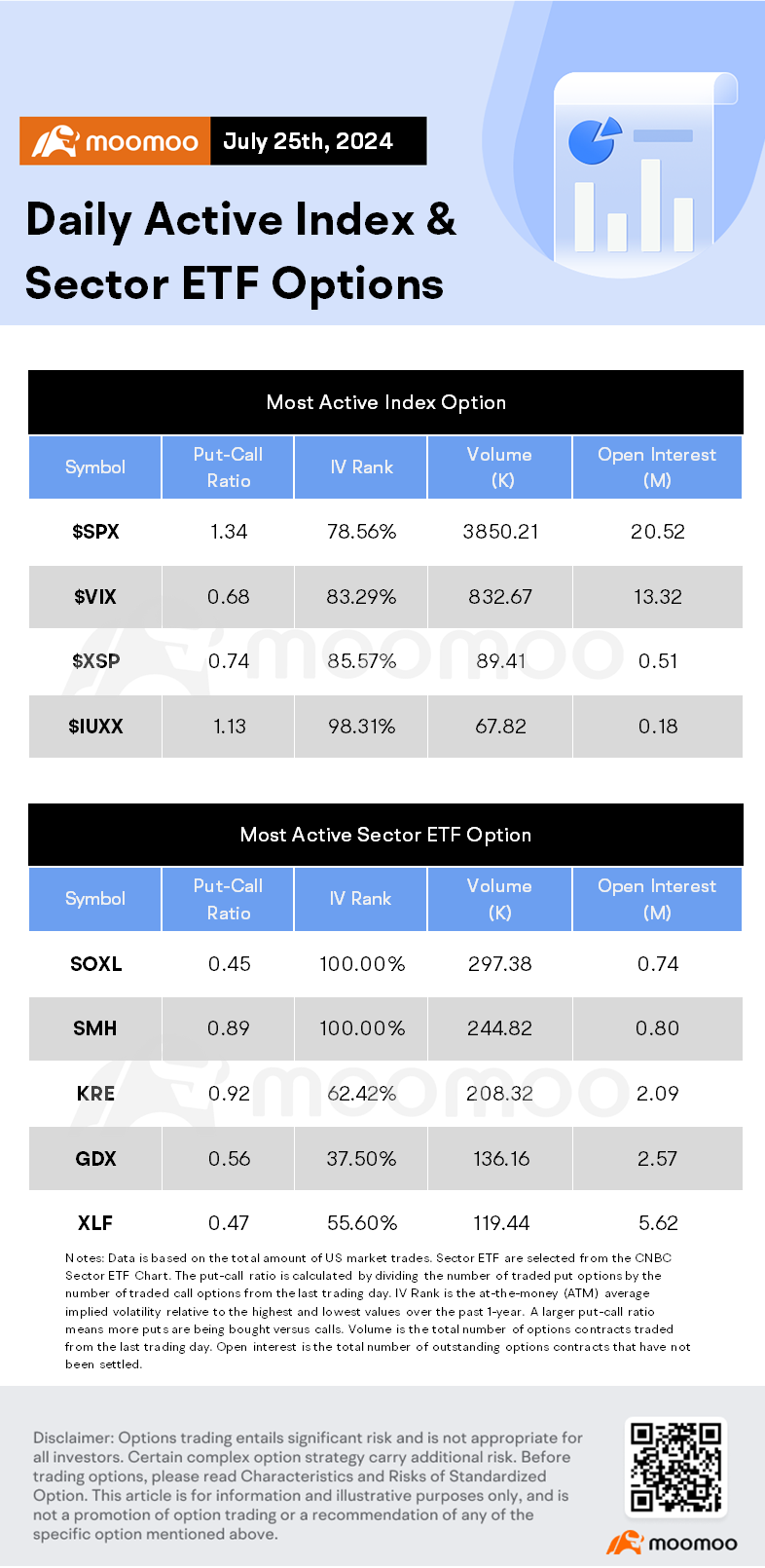

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer:Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Bill 3 : w

Laine Ford : I don't comment on the say stock no more