Options Market Statistics: Investors Cheered Tesla's Long-Awaited FSD Update; Options Pop

News Highlights

1. $Tesla (TSLA.US)$ stock rose more than 3% in Monday's trading, with the most traded calls are contracts of $360 strike price that expire on Dec. 6. The total volume reaches 122,601 with the open interest of 44,139

Investors cheered the long-awaited update to electric-vehicle giant's Full Self-Driving software.

The "significant" potential from Tesla's artificial intelligence-based FSD offering, which fuels Chief Executive Elon Musk's Robotaxi dreams, led Stifel analyst Stephen Gengaro to lift his stock price target to be the highest on Wall Street.

Also, a Delaware judge has reaffirmed her ruling that Tesla must revoke Elon Musk's multibillion-dollar pay package

Chancellor Kathaleen St. Jude McCormick on Monday denied a request by attorneys for Musk and Tesla's corporate directors to vacate her ruling earlier this year requiring the company to rescind the unprecedented pay package.

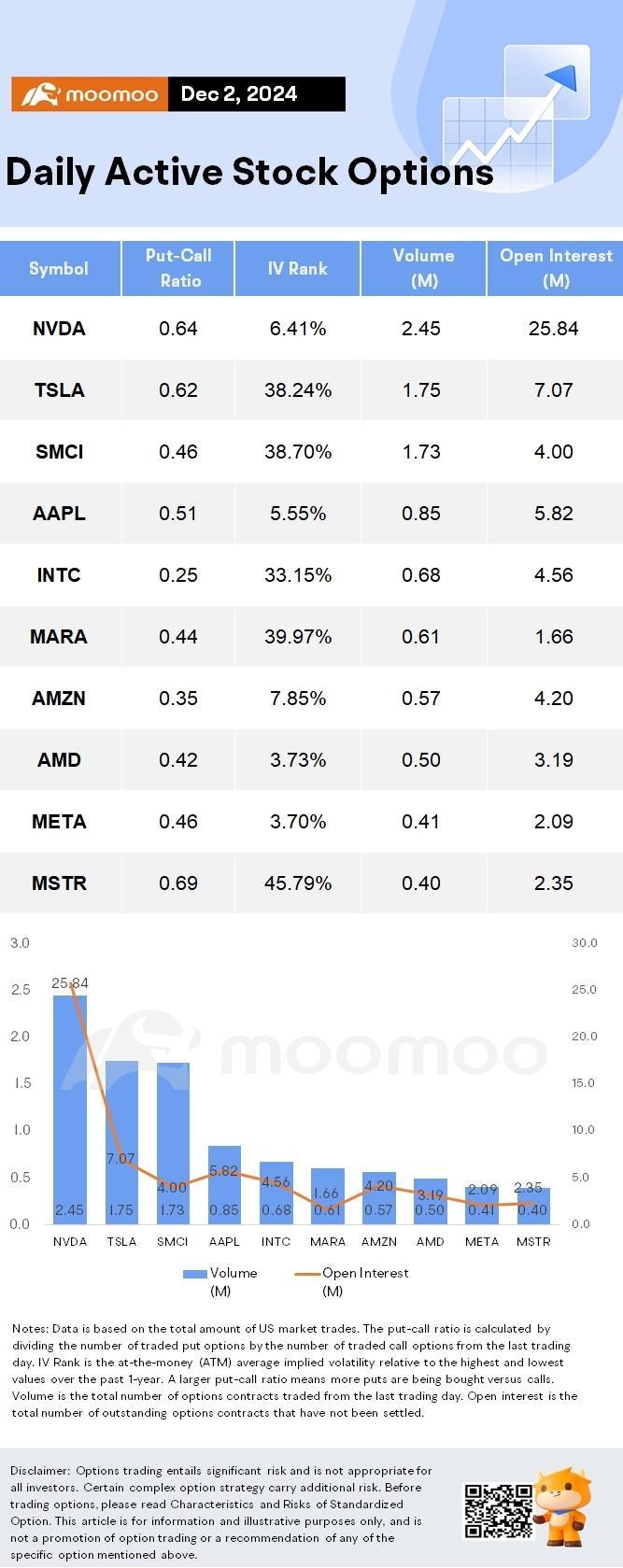

Unusual Stock Options Activity

There was a noteworthy activity in $Super Micro Computer (SMCI.US)$, with $42 puts topping the highest volume to open interest ranking. The highest volume over open interest ratio reaches 165.5x with 17,546 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg, MarketWatch

BloombergOption Volume: [Options Notes]Measuring liquidity: two key indicators to check

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

passionate Auroch_84 : how come

Kamaliyah : tq

105232125 : tq

NoDragonsPlz : go to the moon

Adrianlim90 : 1