Options Market Statistics: Marathon Stock Rises Ahead of Bitcoin Conference, Options Pop

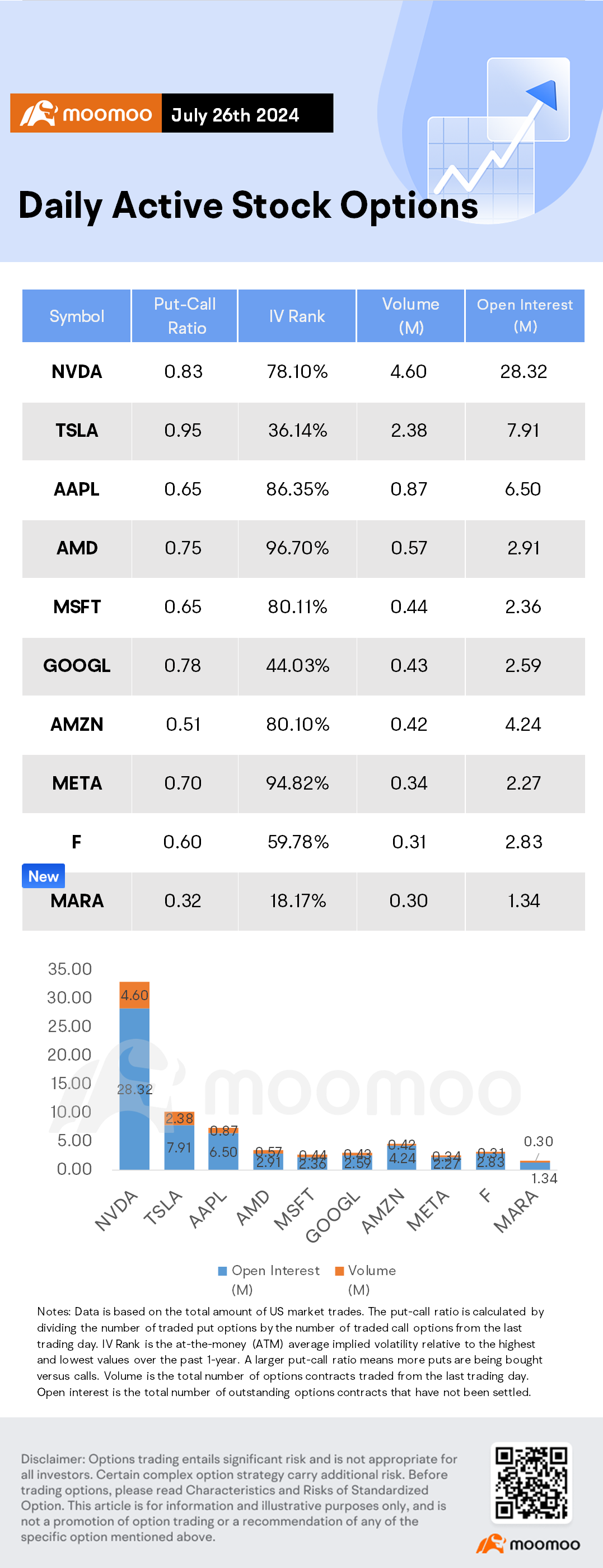

$NVIDIA (NVDA.US)$ stock rose 0.69%. Its options trading volume was 4.60 million. Call contracts account for 54% of the total trading volume. The $115 calls expiring August 2nd were traded most actively.

While shares of the chip maker have risen almost 129% this year, they have hit a rough patch, tumbling over the past week as Alphabet stuck to, rather than raised, its spending guidance for the rest of 2024, and as investors rotated out of big technology stocks.

$Tesla (TSLA.US)$ stock slightly declined 0.20%. Its options trading volume was 2.38 million. Call contracts account for 51% of the total trading volume. The $220 calls expiring August 2nd were traded most actively.

Electric-vehicle maker Tesla reported a second consecutive decline in profit and missed Wall Street's estimates on Wednesday.

$MARA Holdings (MARA.US)$ stock climbed 6.36%. Its options trading volume was 0.30 million. Call contracts account for 75% of the total trading volume. The $123 calls expiring August 2nd were traded most actively.

Major digital assets rallied Friday, with Bitcoin (BTC-USD) soaring toward the $68,000 level ahead of the Bitcoin Conference on Saturday. A key highlight of the event will be Donald Trump’s 30-minute keynote address on the final day, Saturday, July 27. His speech is expected to resonate with voters and gain support from influential cryptocurrency advocates like the Winklevoss twins.

Trump’s participation shows his growing interest in the cryptocurrency sector. In June, he met with Bitcoin mining companies at his Mar-a-Lago resort, expressing interest in expanding U.S.-based Bitcoin mining operations. Some Bitcoin enthusiasts think Trump might use this platform to push for the U.S. government to adopt Bitcoin as a “strategic reserve” asset, similar to foreign currencies or oil. This speculation has already influenced the market.

Unusual Stock Options Activity

There was a noteworthy activity in $Alphabet-C (GOOG.US)$, where multiple calls have topped volume to open interest ranking. The highest volume over open interest ratio reaches 62.4x with 11,791 contracts.

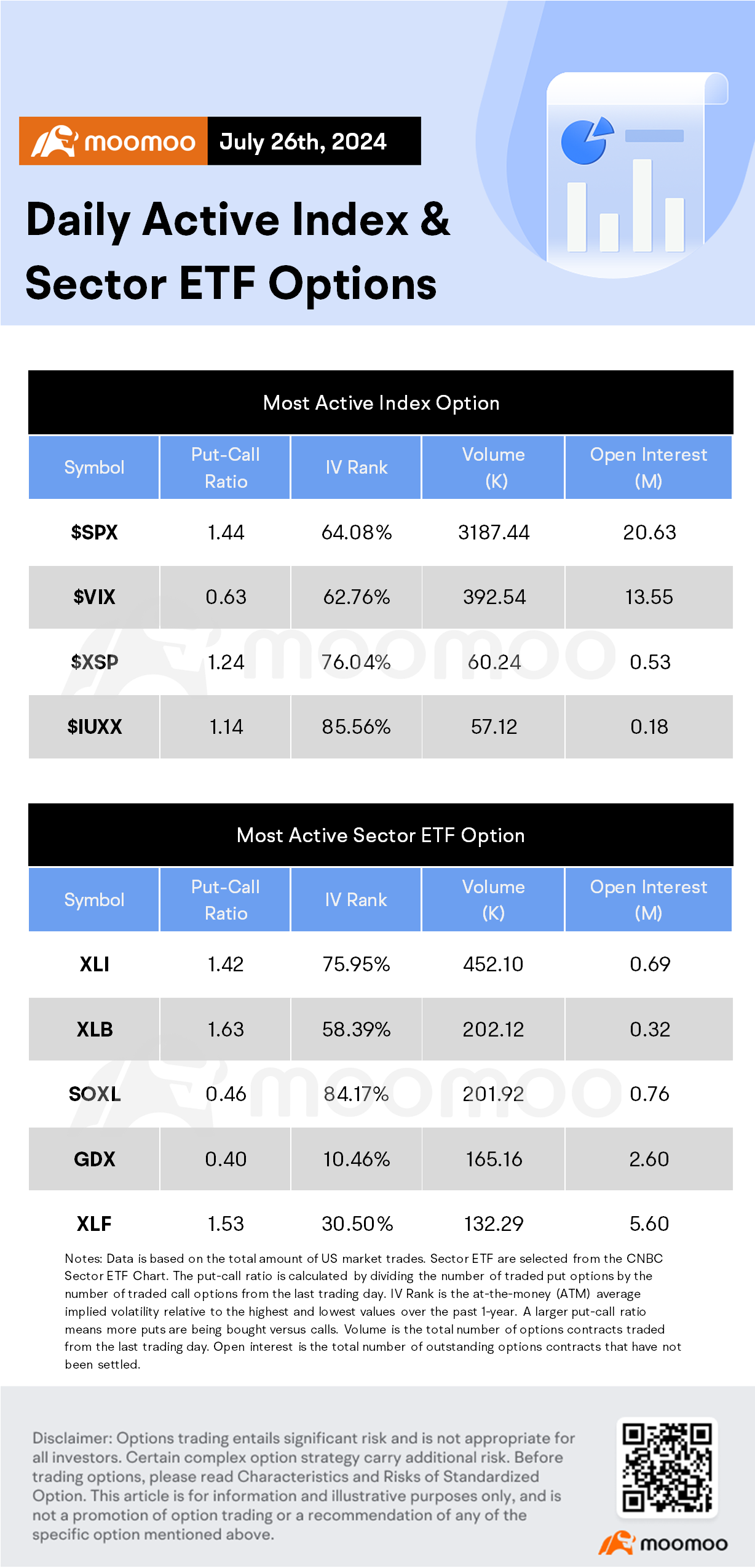

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

machucs1 : Hey

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Dinie Hamdan : ok

Eric ng :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Laine Ford : maybe buy all them

Supermengg :

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

103993153 : GD

Jack QU : How to operate a call option after it expires

Dinie Hamdan : ok

View more comments...