Options Market Statistics: Meta Shares Rise as Q2 Revenue Beats Estimates, Options Pop

News Highlights

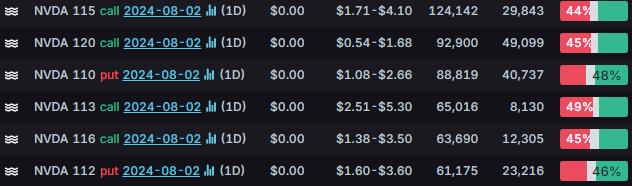

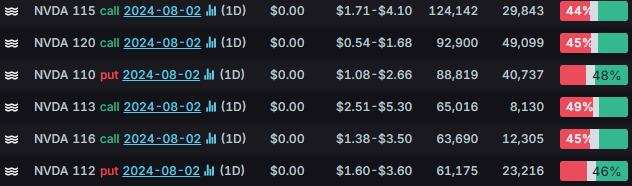

$NVIDIA (NVDA.US)$ stock rose 12.81%. Its options trading volume was 5.55 million. Call contracts account for 59% of the total trading volume. The $115 calls expiring August 2nd were traded most actively.

Nvidia shares surged on Wednesday after Morgan Stanley reinstated it as a "top pick" following a recent sell-off, seeing it as a good entry point due to unchanged strong indicators. Nvidia's shares rose over 12%, extending their year-to-date gain above 130%. Despite concerns over trade restrictions and AI spending, analysts are optimistic about strong demand for Nvidia's upcoming AI chip, Blackwell, and continued resilience for its H100 chip. Nvidia will report its Q2 fiscal 2025 earnings on August 28.

The selloff presents a good entry point as we continue to hear strong data points short term and long term, with overblown competitive concerns," the analysts wrote, noting that Nvidia's shares have "sold off on a large list of concerns that we think are likely to fade with time."

$Meta Platforms (META.US)$ stock rose 2.51%. Its options trading volume was 0.39 million. Call contracts account for 56.4% of the total trading volume. The $470 puts expiring August 2nd were traded most actively.

Meta Platforms, the parent company of Facebook and Instagram, exceeded market expectations for Q2 revenue and issued a positive sales forecast for Q3, easing concerns over its AI and metaverse investment costs. Q2 revenue rose 22% to $39.1 billion, surpassing analysts' forecasts of $38.3 billion. Meta anticipates Q3 revenue between $38.5 billion and $41 billion, with a midpoint above consensus estimates. Despite a 7% increase in costs, Meta's operating margin improved from 29% to 38%. Daily active users across Meta's apps grew 7% year-over-year to 3.27 billion in June. Meta increased its full-year AI-related capital expenditure forecast to $37-40 billion, up from $35-40 billion. Following the results, Meta shares rose over 7% in after-hours trading. This comes as Meta, alongside $Alphabet-A (GOOGL.US)$ and $Microsoft (MSFT.US)$, continues to invest heavily in AI and data centers. Meta also launched its open-source large language model, Llama 3, aiming to compete with Microsoft-backed OpenAI.

$SoFi Technologies (SOFI.US)$ stock rose 1.62%. Its options trading volume was 0.35 million. Call contracts account for 79.1% of the total trading volume. The $7 puts expiring August 2nd were traded most actively.

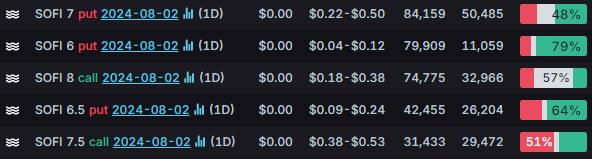

Unusual Stock Options Activity

There was a noteworthy activity in $Microsoft (MSFT.US)$, where multiple puts have topped volume to open interest ranking. The highest volume over open interest ratio reaches 97.2x with 30,047 contracts.

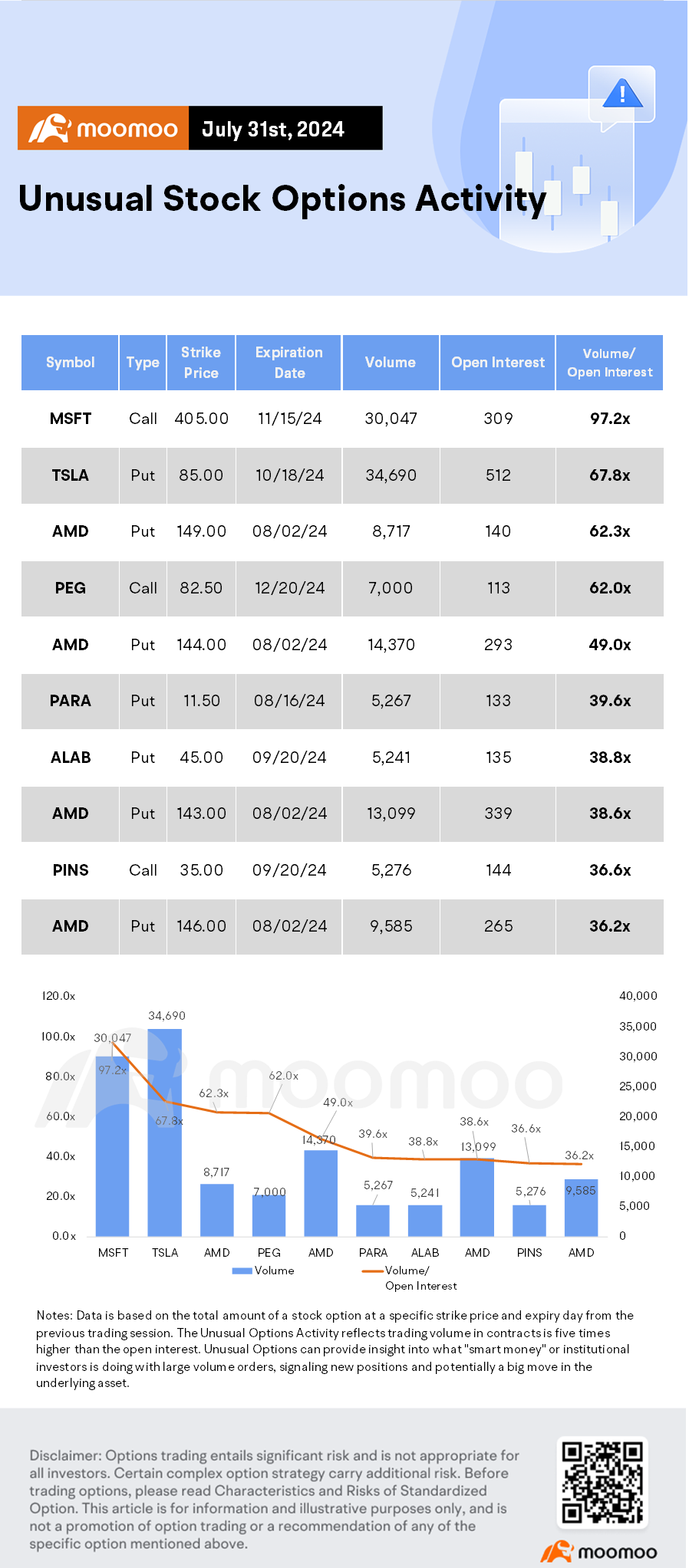

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Ernestine : k