Options Market Statistics: MicroStrategy Soars 8% After Boosting Bitcoin Holdings to $14.6 Billion; Options Pop

News Highlights

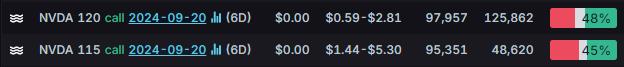

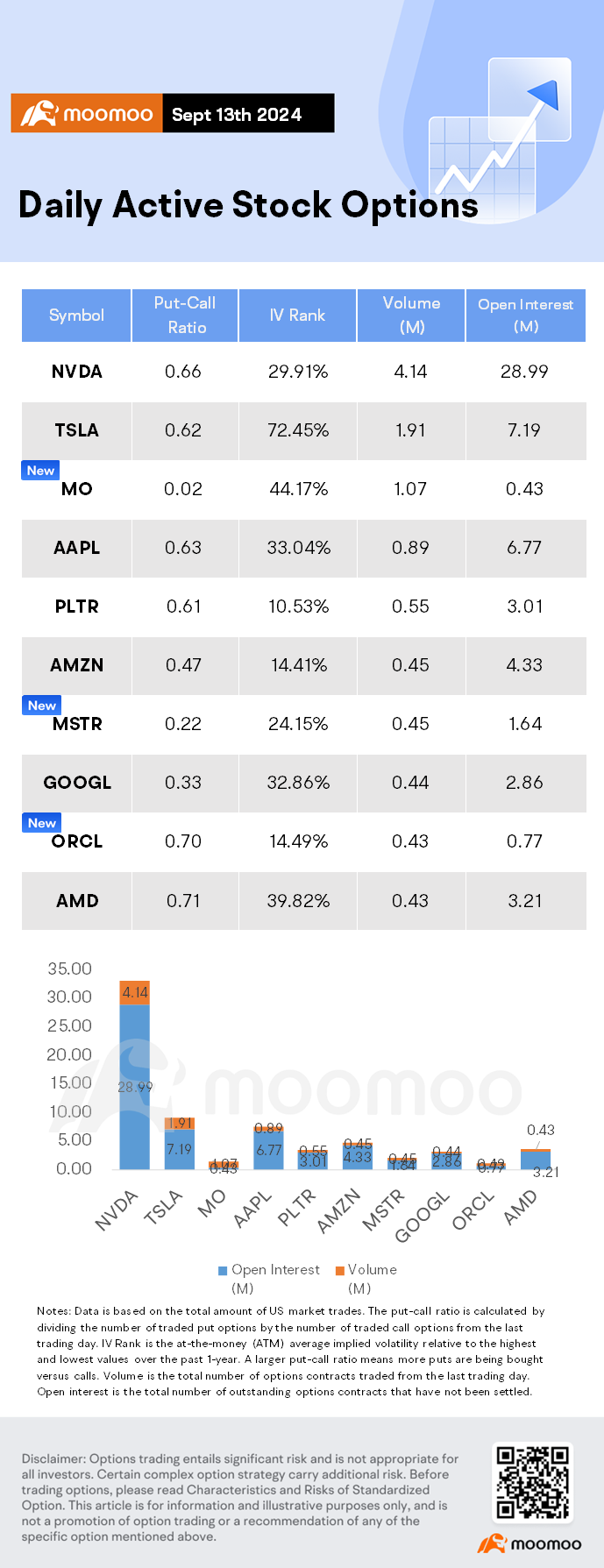

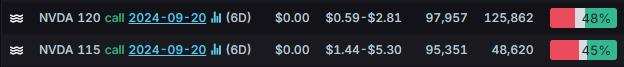

$NVIDIA (NVDA.US)$ shares slightly fell 0.03% Friday to close at $119.1, with option volume of 4.14 million, and calls accounted for 60.3% of the volume. The $120 calls expiring September 20 lead the flow with the highest volume.

Nvidia's massive 140% stock rally this year significantly influences the S&P 500, accounting for about a quarter of the index's 17% gain. This was evident when Nvidia's 8.2% surge lifted the S&P 500 from a 1.6% loss to a 1.1% gain in one day. The chipmaker's dominance in AI applications boosts its market value and drives overall market movement, raising concerns about market vulnerability if Nvidia's performance falters. Nvidia's options trading has also magnified its stock movements, with a significant portion of daily trading volume in the options market. Analysts warn that a downturn in Nvidia could negatively impact the broader market, similar to past influences from stocks like Tesla.

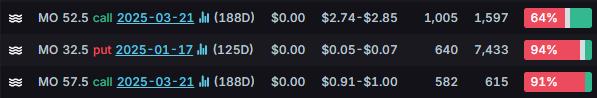

$Altria (MO.US)$ shares rose 0.61% Friday to close at $52.96, with option volume of 1.07 million, and calls accounted for 98.4% of the volume. The $52.5 calls expiring March 21 2025 lead the flow with the highest volume.

$MicroStrategy (MSTR.US)$ shares surged 8.18% Friday to close at $141.47, with option volume of 0.45 million, and calls accounted for 82% of the volume. The $220 calls expiring October 18 lead the flow with the highest volume.

MicroStrategy shares surged over 8% on Friday after founder Michael Saylor announced a $1.1 billion bitcoin purchase, bringing the company's bitcoin holdings to 244,800 coins worth $14.6 billion. The stock has climbed 24% this week and 124% this year. Saylor revealed that the company's average purchase price for bitcoin over four years is $38,585 per coin, while bitcoin currently trades near $60,000. MicroStrategy, primarily known for its enterprise software, has become a major proxy for bitcoin, holding the largest corporate stash of the cryptocurrency. Saylor emphasized that MicroStrategy aims to bridge traditional investors and bitcoin, offering a diversified way to invest in the digital asset. Despite the rally, the stock remains 26% below its March high, closing at $141.47 on Friday. MicroStrategy's performance outpaces bitcoin's 35% rise this year, providing investors with leveraged exposure and potential downside protection.

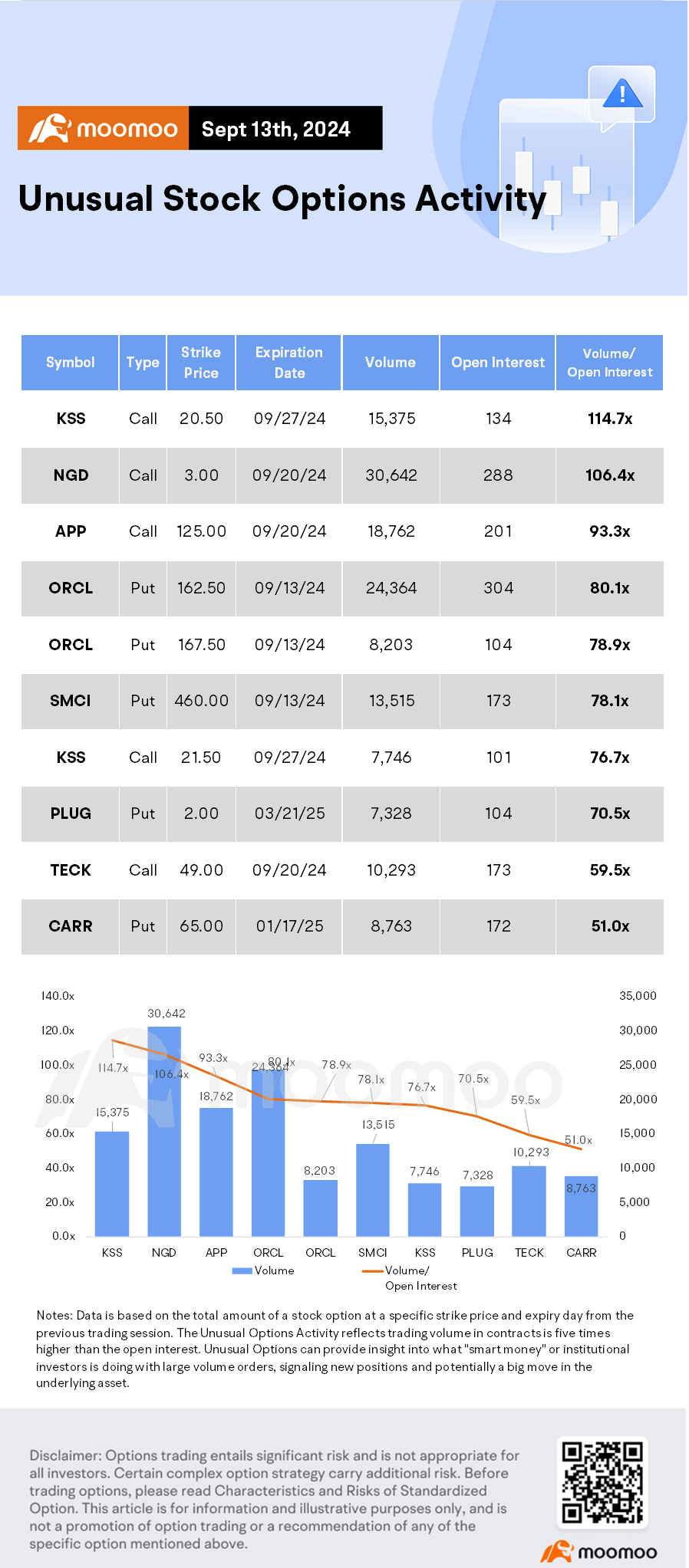

Unusual Stock Options Activity

There was a noteworthy activity in $Kohl's Corp (KSS.US)$, where $20.5 calls have topped volume to open interest ranking. The highest volume over open interest ratio reaches 114.7x with 15,375 contracts.

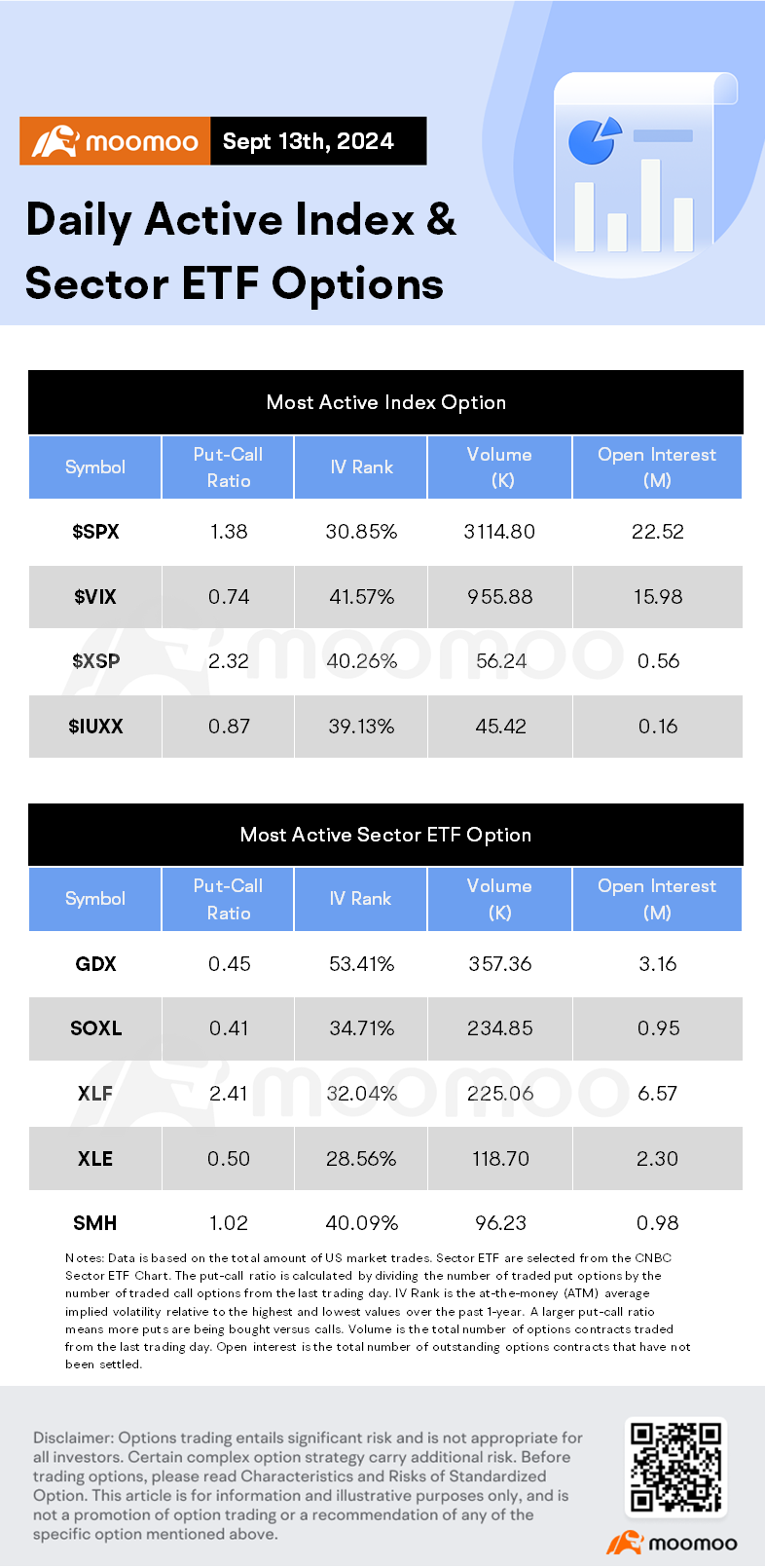

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

章允量 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Laine Ford : good stock

74423696 : Yes , Yes . Thank you so much, I love it .

102328260 Laine Ford : Yes very very good

103242247 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104476495 : h

Laine Ford : no comment now

身骑白马 : good