Options Market Statistics: Nio Shares Up after Secures $471 Million in State-Backed Funding, Options Pop

News Highlights

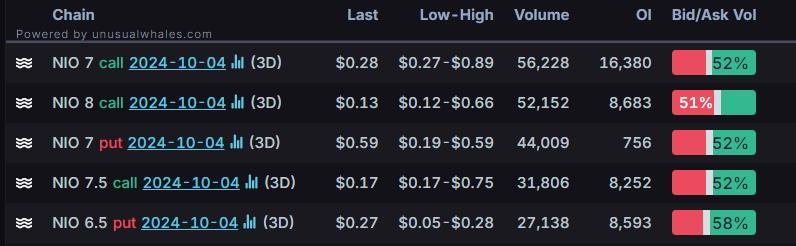

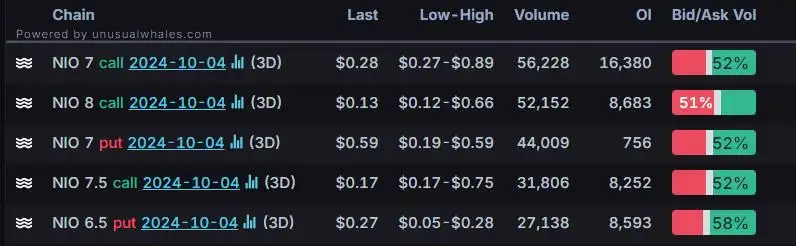

$蔚来(NIO.US)$shares increased 2.45% Monday to close at $6.68, with option volume of 878K, and calls accounted for 74.7% of the volume.The $7 calls expiring October 4 were traded most actively.

The company experienced a significant rise in early trading on Monday after the Chinese electric vehicle manufacturer revealed a new investment over the weekend. A consortium of Chinese investors has agreed to purchase newly issued shares of Nio China for a total of 3.3 billion Chinese yuan ($470 million), while Nio China's parent company will contribute an additional 10 billion yuan ($1.43 billion), resulting in a total investment of approximately $1.9 billion.

$GameStop (GME.US)$ saw an increase in its stock price of 2% to close at $22.93, with option volume of 272K, and calls accounted for 85.8% of the volume.The $25 calls expiring October 4 were traded most actively.

Recent financial results indicate that GameStop generated $798 million in revenue and achieved a net profit of $14.8 million. The earnings per share (EPS) were $0.04, and the gross profit totaled $249 million, resulting in a price-to-earnings (P/E) ratio of 168.29. Despite these results, both participating institutions issued a sell rating, with no buy or hold recommendations.

Unusual Stock Options Activity

There was a noteworthy activity in $United Parcel Service (UPS.US)$, where $140 calls have topped volume to open interest ranking. The highest volume over open interest ratio reaches 119.3x with 44,017 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

BloombergOption Volume:[Options Notes]Measuring liquidity: two key indicators to check

Call/Put Option:Trade Options: Quickstart Guide

Option Expiration:Trade Options: Quickstart Guide

Implied Volatility Rank:Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors readCharacteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103916021 : k

Dufrane1985 : sell

103634550 : k

101587649 : Ok

Alice Lim choo : Good