Options Market Statistics: Nvidia, Chip Stocks Rebound After Sell-Off, Options Pop

News Highlights

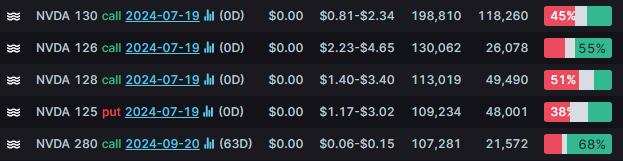

$NVIDIA (NVDA.US)$ ended 2.63% higher. Its options trading volume was 4.79 million. Call contracts account for 61.2% of the total trading volume. The $130 calls expiring July 19 were traded most actively.

Nvidia and other semiconductor stocks with exposure to China rebounded early Thursday after a sharp sell-off on Wednesday due to geopolitical concerns. Despite a 6.8% drop in the $PHLX Semiconductor Index (.SOX.US)$ on Wednesday, the SOX closed 0.5% higher today after being down 1.2% earlier. Semiconductor equipment vendors reacted negatively to potential increased U.S. trade restrictions on China, while chipmakers pulled back on comments from former President Donald Trump regarding Taiwan's defense costs.

$Tesla (TSLA.US)$ ended 0.29% higher. Its options trading volume was 2.16 million. Call contracts account for 55.2% of the total trading volume. The $260 calls expiring July 19 were traded most actively.

Ahead of Tesla's Q2 Earnings Call next week, various analysts and firms have updated their price targets for the company. Despite a lackluster year due to planned leveling in sales growth for next-gen platform and Robotaxi development, Tesla's price targets have improved thanks to a delivery beat and strong, unexpected energy deployment numbers.

$Palantir (PLTR.US)$ ended 1.49% higher. Its options trading volume was 0.72 million. Call contracts account for 73.5% of the total trading volume. The $28 calls expiring July 19 were traded most actively.

Wedbush analyst Dan Ives believes Palantir stock, which is already up 64% in 2024, could potentially double. Ives, a bullish tech analyst known for his accurate predictions during the AI boom, suggests Palantir's stock could reach twice its July 18 opening price of $28.41 per share. The company, with a market cap of $63 billion and expected 2024 revenue of $2.3 billion, is heavily utilized by the U.S. military and has developed civilian applications in cybersecurity, energy, and hospital scheduling. Despite skepticism regarding its proprietary software and growth limits in military contracting, Palantir continues to secure significant military deals, including a $100 million/year contract for its Maven AI system. Palantir is set to report on August 5, with expectations of commercial contract growth.

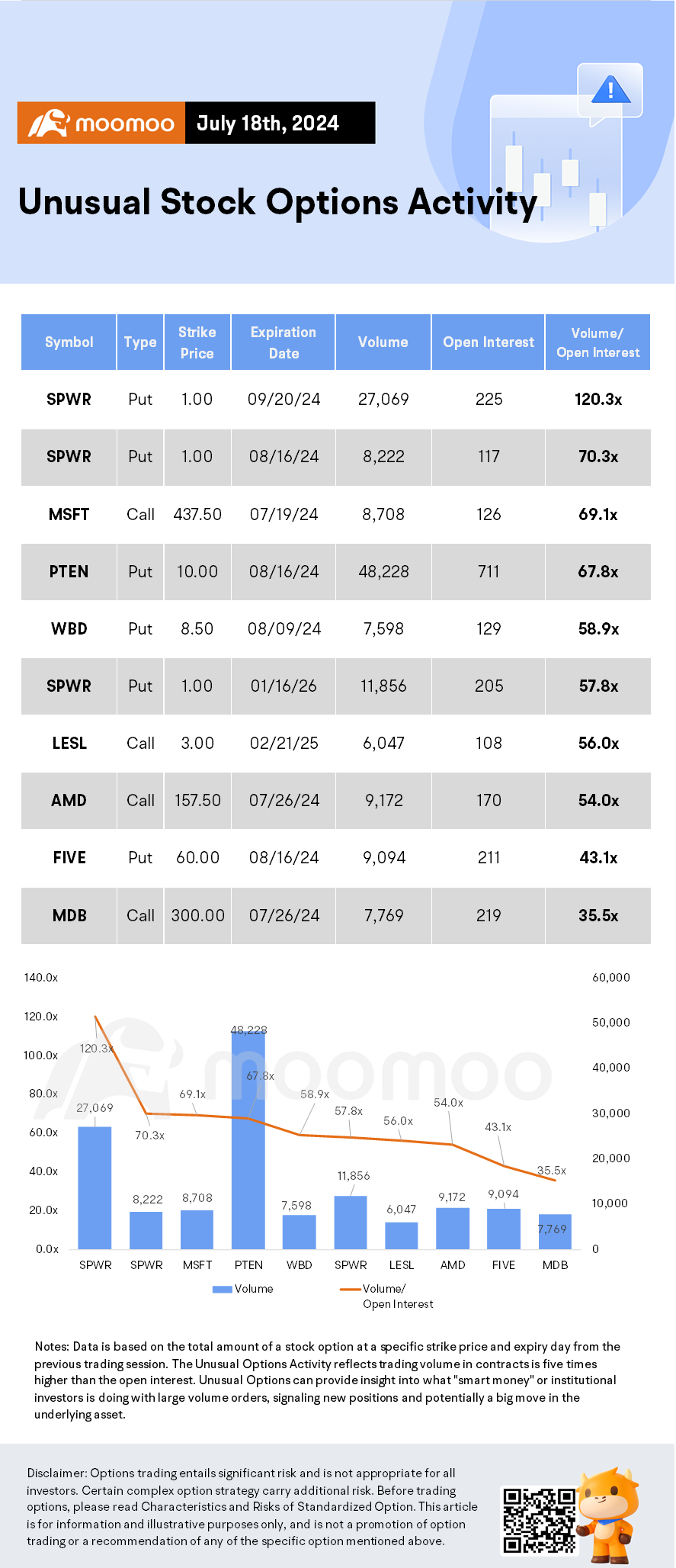

Unusual Stock Options Activity

There was a noteworthy activity in $SunPower (SPWR.US)$, where multiple puts have topped volume to open interest ranking. The highest volume over open interest ratio reaches 120.3x with 27,069 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

102820167 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Priscilla JJ : Very insightful.

Shootingstar : USA keep playing this move over and over. Won't be happy till China totally stops using the usd and others slowly follow. This is end game no?

Laine Ford : buy today

Laine Ford : maybe today

Laine Ford : out of town doctor appointment all day long can I buy my stocks to daylwhen it get daylight I am tired iam going to bed good night

PAUL BIN ANTHONY : brake fake News

103809741RahimiRamly : thanks