Options Market Statistics: Nvidia Drops Nearly 10%, Leading Chip Stocks to Worst Day Since March 2020

News Highlights

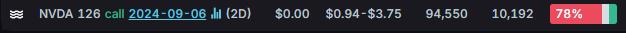

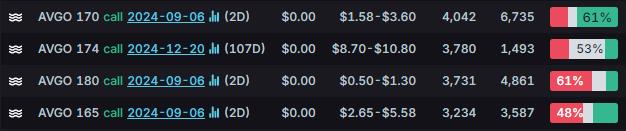

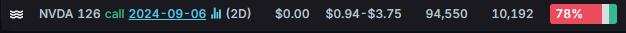

$NVIDIA (NVDA.US)$ shares slumped 9.53% Tuesday to close at $108.00. Its options trading volume was 5.94 million. Call contracts account for 60.0% of the total trading volume. The $126 calls expiring September 6 were traded most actively.

Nvidia plunged over 9% on Tuesday, erasing nearly $300 billion from its market cap and dragging down other chip stocks. The VanEck Semiconductor ETF (SMH) dropped 7.5%, its worst day since March 2020.

The market slump followed the ISM manufacturing index's below-expectation August figures, raising economic concerns but potentially increasing chances of a Federal Reserve rate cut.

Chip stocks had been rising on optimism about the AI boom, led by Nvidia, which dominates the AI data center chip market and remains up 118% in 2024. Nvidia reported $30 billion in quarterly revenue, surpassing expectations, with a 154% annual increase in its data center business. However, Nvidia's forecast of 80% sales growth for the current quarter disappointed some investors, briefly affecting suppliers.

$Apple (AAPL.US)$ shares fell 2.72% Tuesday to close at $222.77. Its options trading volume was 0.82 million. Call contracts account for 63.3% of the total trading volume. The $235 calls expiring September 6 were traded most actively.

Apple's stock has fallen on 12 of the last 17 iPhone launch days, according to Bloomberg News. Over the past decade, September has been the worst month for Apple shareholders, with AAPL shares dropping an average of 3.2%. This aligns with a broader trend noted by the Stock Trader's Almanac, where both the S&P 500 and the Dow experience their largest percentage losses in September.

$Broadcom (AVGO.US)$ shares fell 6.16% Tuesday to close at $152.79. Its options trading volume was 0.25 million. Call contracts account for 60.0% of the total trading volume. The $170 calls expiring September 6 were traded most actively.

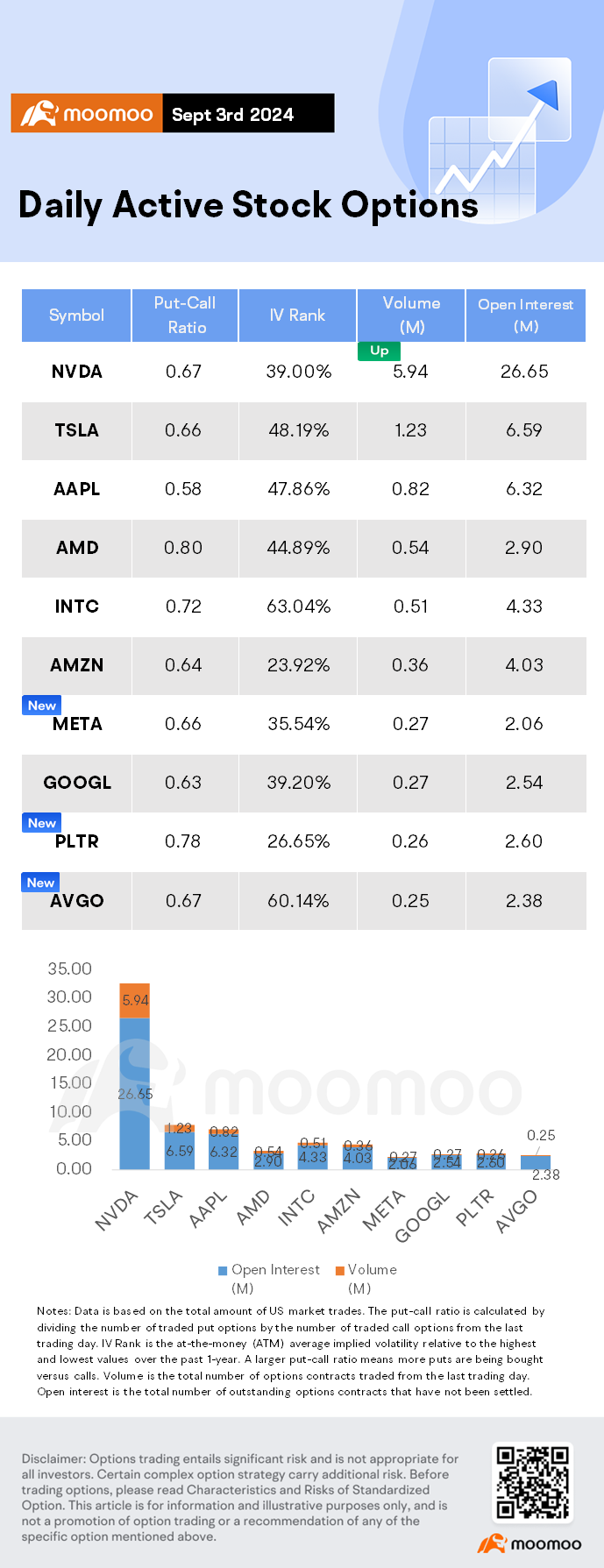

Unusual Stock Options Activity

There was a noteworthy activity in $NVIDIA (NVDA.US)$, where $90 PUTs have topped volume to open interest ranking. The highest volume over open interest ratio reaches 147.1x with 15,008 contracts.

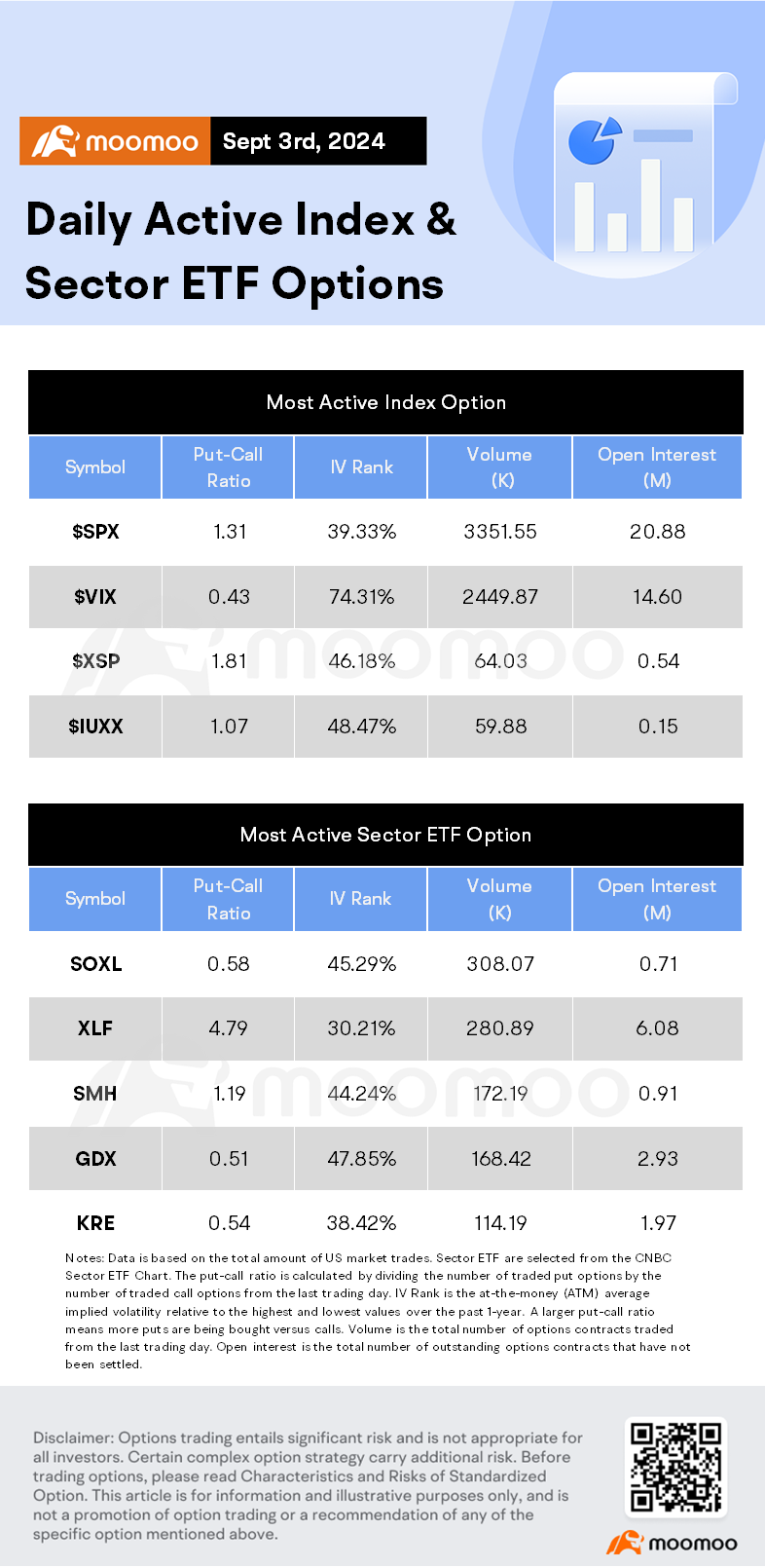

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Banana Milk : Chur! must of got jacked up from them putos

ahhhh nevermind nevertheless always the best

ahhhh nevermind nevertheless always the best

105742796 Learner : I would like to know is it a good idea to buy NVIDIA stock now?

Zamm 105742796 Learner : Check the support line for the past 3 months. It is good if we play save at this moment. Sentiment is powerful right now

105742796 Learner Zamm : Thank you so much. I’m new at all this. Thank you for your tip, guidance and advice.

Alice Lim choo : Why is it like this?

Cashmair : i am not sure

GM 1 : The anti trust news - to what extent will it impact the share price ….

105742796 Learner : Market seems slow.