Options Market Statistics: Nvidia's AI Chip Demand Strong, Sales Growth Slows; Options Pop

News Highlights

1. $NVIDIA (NVDA.US)$ once again posted a beat-and-raise quarter fueled by booming artificial-intelligence demand, but its stock was down 2% in Wednesday's extended session. Wall Street may be taking issue with two factors.

One is that the company isn't topping expectations with its guidance by the same magnitude as before. Nvidia's $37.5 billion revenue forecast for the January quarter topped the consensus view of $37.1 billion. But "whisper" numbers on the buy side were perhaps more in the $39 billion to $40 billion range. And prior to the last two reports from Nvidia, the company's revenue guidance exceeded estimates by well upwards of $1 billion for five quarters in a row.

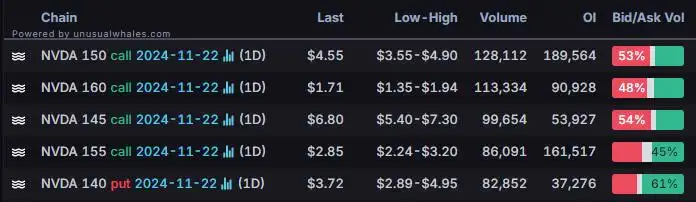

The most traded calls are contracts of $150 strike price that expire on Nov. 22. The total volume reaches 128,112 with an open interest of 189,564, while the most traded puts are contracts of $140 strike price that expire on Nov. 22.

2. $Target (TGT.US)$ stock took a dive, down 21%, Wednesday, with the most traded puts are contracts of $120 strike price that expire on Nov. 22. The total volume reaches 18,208 with an open interest of 880.

The retail giant reported a triple miss for the fiscal third quarter and provided a downbeat outlook, citing "unique" challenges and costs. Target also reported margins that fell due to higher digital fulfillment and supply-chain costs resulting from the costs of managing higher inventory levels and increased digital sales volumes.

Unusual Stock Options Activity

There was a noteworthy activity in $e.l.f. Beauty (ELF.US)$, with $125 calls topping the highest volume to open interest ranking. The highest volume over open interest ratio reaches 204.0x with 25,497 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg, MarketWatch

BloombergOption Volume: [Options Notes]Measuring liquidity: two key indicators to check

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

101550592 :

103502792 : Sir, I have transferred money to the Moomoo app but the money has not arrived in my Moomoo account yet.

山芭佬 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

PhotoSynth 103502792 : Call them….