Options Market Statistics: Nvidia Stock, AI Chip Stocks Retreat From Record Highs, Options Pop

News Highlights

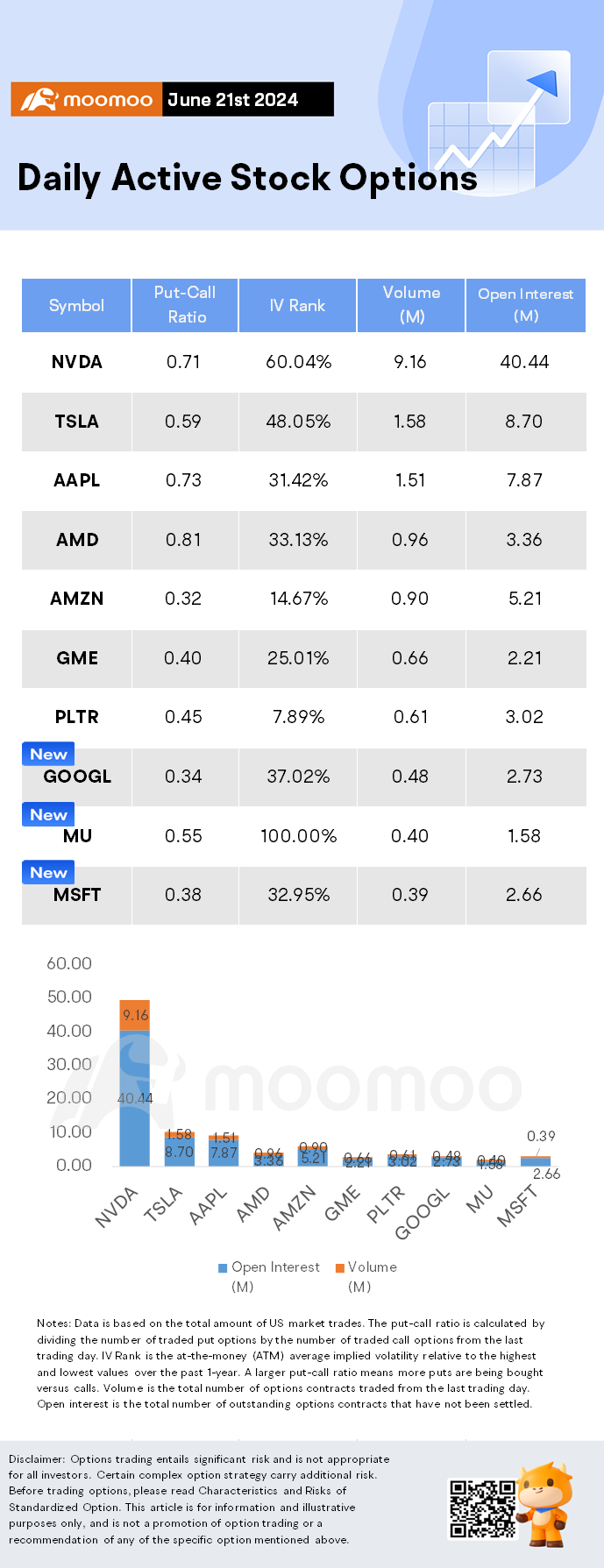

$NVIDIA (NVDA.US)$ shares ended 3.22% lower. Its options trading volume was 9.16 million. Call contracts account for 58.5% of the total trading volume.

Nvidia stock reversed lower recently as other chip stocks with artificial intelligence exposure also fell. On Tuesday, analysts at Barclays, Susquehanna and TD Cowen increased their price targets on the stock. With investors still loving Nvidia, the stock climbed to a record high Thursday before pulling back.

Barclay's analyst Tom O'Malley and Susquehanna analyst Christopher Rolland raised the price target to 145 from 120, split adjusted. Supply chain checks were reassuring and showed that the transition from Hopper chips to Blackwell will be smooth.

$Micron Technology (MU.US)$ shares ended 3.22% lower. Its options trading volume was 0.4 million. Call contracts account for 64.5% of the total trading volume.

A Wolfe Research analyst suggests that next week's earnings report for Micron Technology Inc. may not serve as a "meaningful catalyst" for its stock, despite recent gains. The analyst, Chris Caso, is more optimistic about Micron's medium-term earnings potential, specifically for 2025 and 2026. While Micron's shares have risen 63% this year and 22% in the past month, Caso believes current elevated expectations mean the upcoming earnings report won't significantly impact the stock. However, he maintains a bullish stance with a $200 price target, citing potential $20 earnings per share driven by high-bandwidth memory and tightening supply. Raymond James analyst Srini Pajjuri also sees strong fundamentals for Micron, raising his price target to $160.

$Alphabet-A (GOOGL.US)$ shares ended 1.89% lower. Its options trading volume was 0.48 million. Call contracts account for 74.7% of the total trading volume.

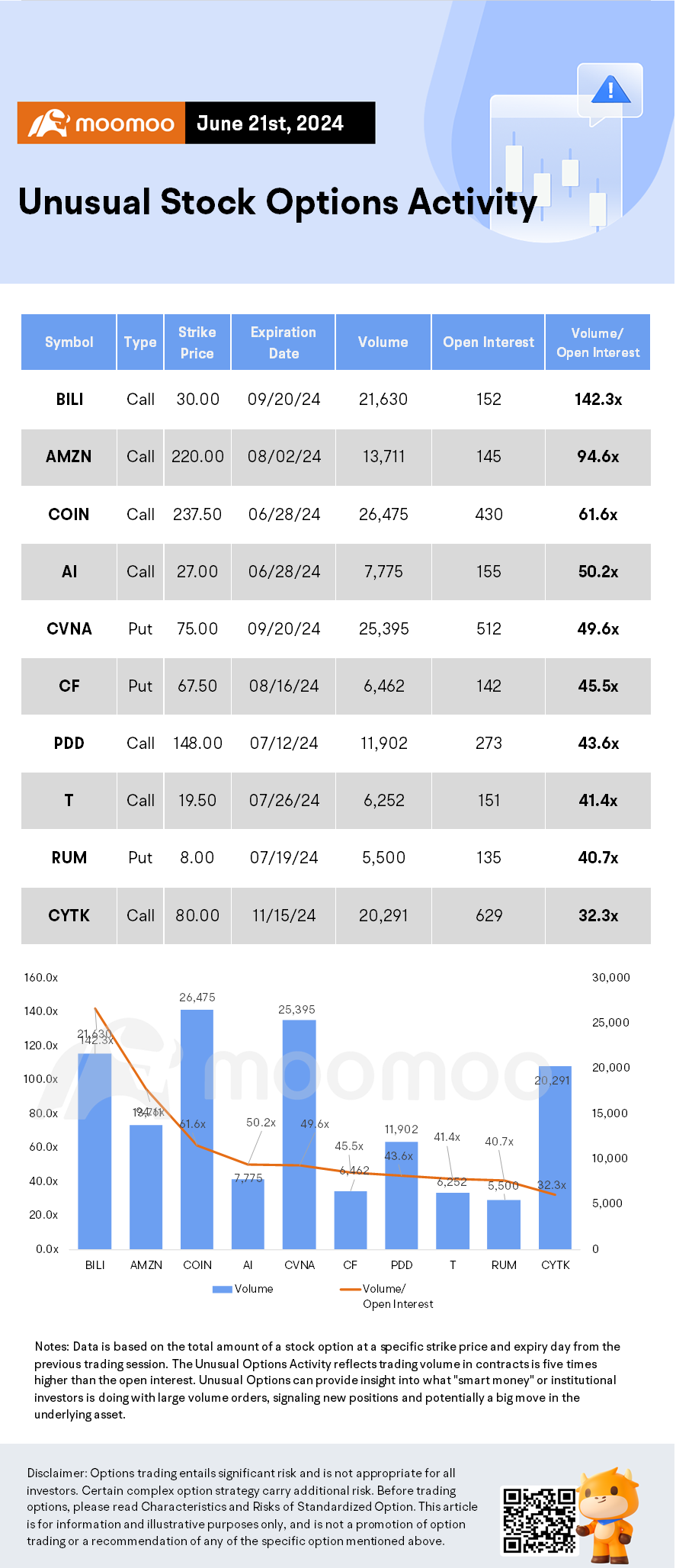

Unusual Stock Options Activity

There was a noteworthy activity in $Bilibili (BILI.US)$, where multiple calls have topped volume to open interest ranking. The highest volume over open interest ratio reaches 142.3x with 21,630 contracts.

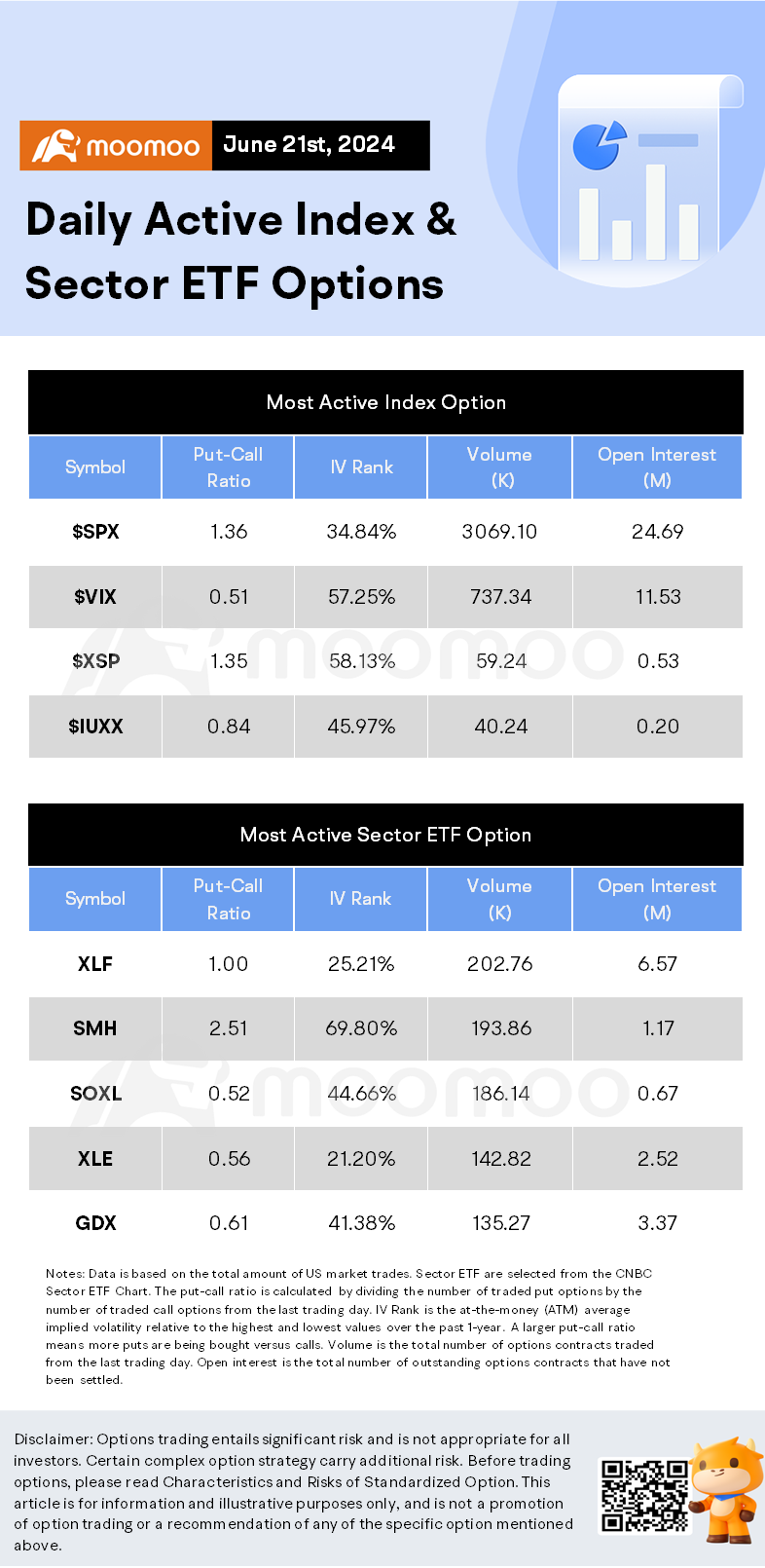

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Having trouble understanding the concepts of options trading? Check out these beginner-friendly guides:

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV、HV、IV Rank、IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk.

Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

PAUL BIN ANTHONY : good luck to all of your wonderful family together with this tq God bless All you amen together with this tq

PAUL BIN ANTHONY : very helpful thanks again for your help me tq so much

Duhaney Jones : Wish I had the funds