Apple unveiled the iPhone 16 and other new technology on Monday, aiming to entice customers to upgrade from older devices. Since the iPhone 12's 2020 launch, featuring 5G connectivity, Apple hasn't provided compelling reasons for upgrades, as phone cameras and screen resolutions have plateaued in perceptible improvements. Consequently, around 300 million iPhones haven't been upgraded in over four years, leading to sluggish iPhone sales, which account for half of Apple's revenue. Similarly, incremental updates to the Apple Watch and AirPods have failed to drive significant new sales. Apple hopes its latest announcements will spark a new major sales cycle.

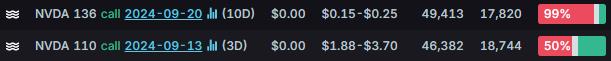

103721817 : $NVIDIA (NVDA.US)$

103721817 : good

103721817 : ok

scott l branstetter : cool

103323702 : cool