Options Market Statistics: Rivian Is Getting More Cash From Volkswagen; Options Pop

News Highlights

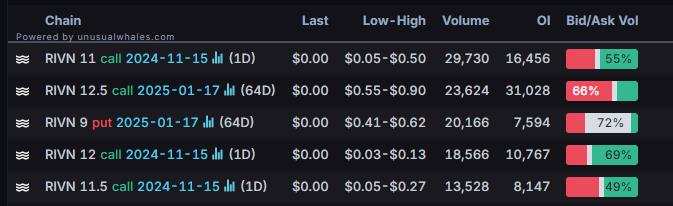

1. $Rivian Automotive (RIVN.US)$'s shares surged 13%, with the most traded calls are contracts of $11 strike price that expire on Nov. 15. The total volume reaches 29,730 with an open interest of 16,456.

The company is getting more cash from Volkswagen, sending shares of the electric-vehicle company higher early Wednesday. VW and Rivian agreed to a partnership in June that could provide the EV start-up with some $5 billion in capital in the coming years. Under the deal, the two auto makers will work on electrical architecture and software for EVs. Rivian will essentially contribute its technology while VW invests cash and takes a position in Rivian stock.

2. $Coinbase (COIN.US)$ shares were down 10% on Wednesday. Brian Armstrong, 10% Owner, Director, Chairman and CEO, on November 11, 2024, sold 325,000 shares in Coinbase Global for $99,883,468. Following the Form 4 filing with the SEC, Armstrong has control over a total of 526 shares of the company, with 526 controlled indirectly.

Unusual Stock Options Activity

There was a noteworthy activity in $MicroStrategy (MSTR.US)$, with $530 calls topping the highest volume to open interest ranking. The highest volume over open interest ratio reaches 187.7x with 34,163 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg, MarketWatch

BloombergOption Volume: [Options Notes]Measuring liquidity: two key indicators to check

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

152270698 : rivn to 100? 1000? 10000?

. but sadly its still around 10.

. but sadly its still around 10.

73459067 : Bitcoin just keeps goin up. I don’t get it

27182818 :