Options Market Statistics: Roblox Shares Drop and Options Pop As Company Cuts Annual Bookings Forecast On Muted Player Spending

News Highlights

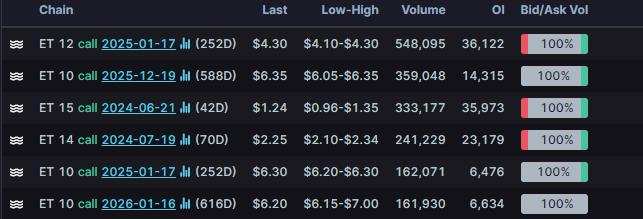

$Energy Transfer (ET.US)$ shares ended 0.12% lower, with option volume of nearly 2.45 million contracts, and calls accounted for 99.2% of the volume. The $12 calls expiring Jan. 17, 2025 were traded most actively.

Energy Transfer just reported results for the first quarter of 2024.

Energy Transfer reported earnings per share of 32 cents. This was below the analyst estimate for EPS of 40 cents.

The company reported revenue of $21.63 billion.

This was 2.80% better than the analyst estimate for revenue of $21.04 billion.

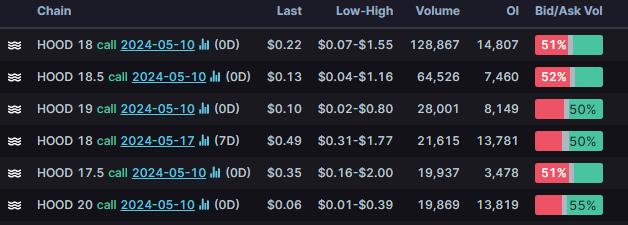

$Robinhood (HOOD.US)$ shares ended 3.08% lower, with option volume of nearly 0.64 million contracts, and calls accounted for 81.4% of the volume. The $18 calls expiring May 10, 2024 were traded most actively.

In the wake of the results, several banks and analyst firms, including Japan's Mizuho, raised their price targets on HOOD stock. Mizuho responded to the results by raising its price target on HOOD stock to $23 from $21. Calling Robinhood's performance "very strong," the firm cited crypto and monthly average users (MAUs) as two areas in which Robinhood had excelled. Meanwhile, JMP Securities increased its price target on shares to $30 from $28. Piper Sandler also boosted its target to $18 from $17.

$Roblox (RBLX.US)$ shares ended 22.06% higher, with option volume of nearly 0.37 million contracts, and calls accounted for 57.8% of the volume. The most traded calls are contracts of $40 strike price that expire on June 21st. The total volume reaches 16,134 with an open interest of 3,071. The most traded puts are contracts of $30 strike price that expire on May 10. The total volume reaches 14,760 with an open interest of 867.

Roblox cut its annual bookings forecast on Thursday, in a sign that people were dialing back on spending within its video-gaming platform amid an uncertain economic outlook and elevated levels of inflation.

Roblox shares closed 22% lower Thursday. The lowered forecast marks the latest downbeat report from the gaming industry, which has laid off hundreds of employees and shut studios this year to cope with declining demand.

Unusual Stock Options Activity

There was a noteworthy activity in $Arbor Realty Trust Inc (ABR.US)$, where multiple calls have topped volume to open interest ranking. The highest volume over open interest ratio reaches 162.6x with nearly 16,264 contracts.

For all the mooers in Singapore, you can now lower your options commssions with our new campaign. Come check the link: US Stock Option.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please readCharacteristics and Risks of Standardized Option.This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

Graddox : nice job giving source credit!

for those unfamiliar with the UW options interface, specifically on the $Energy Transfer (ET.US)$ ones listed, you may want to read up further about deep ITM options before a dividend payout, see the link at the bottom here:

Dividend