Options Market Statistics: Snowflake Stock Has Best Day in Four Years After Earnings; Options Pop

News Highlights

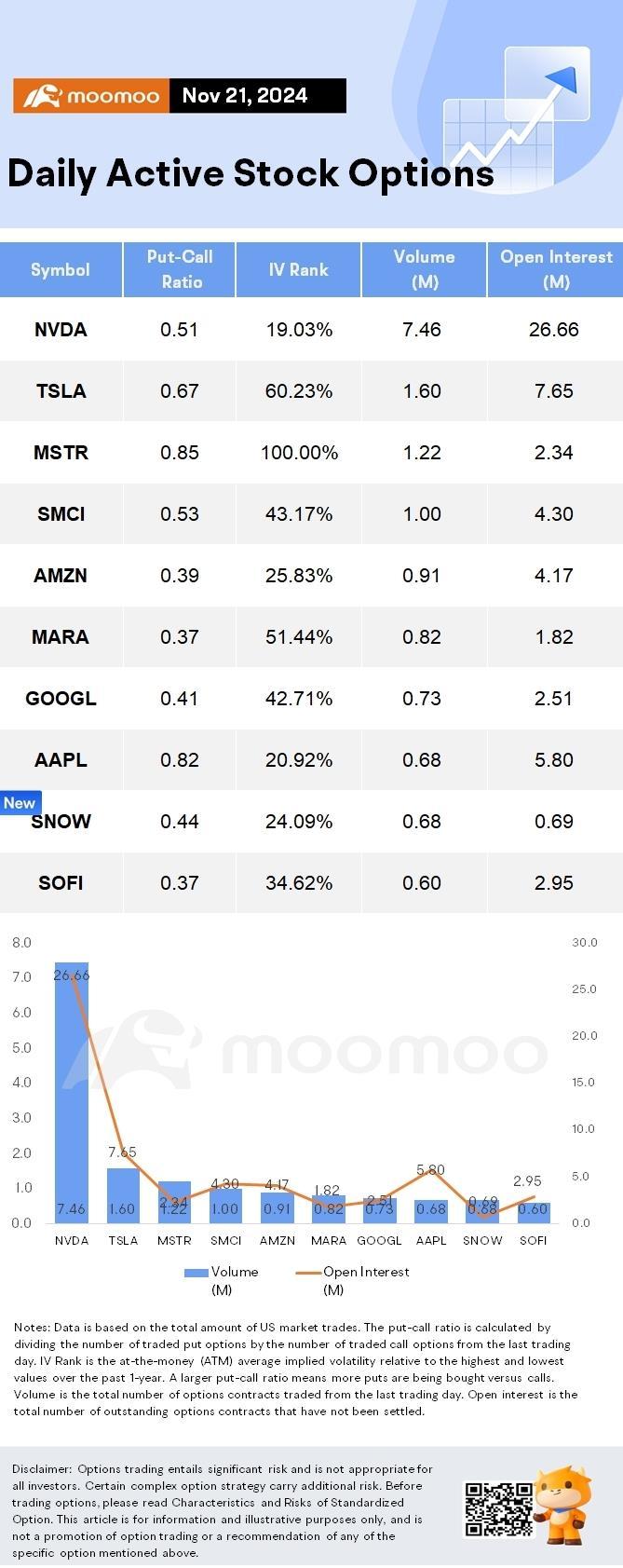

1. $Snowflake (SNOW.US)$ soared 32% after the data-software company posted third-quarter adjusted earnings of 20 cents a share, topping estimates of 15 cents. Revenue was $942 billion, higher than forecasts of $899 million and better than $734 million in the year-ago quarter. Product revenue -- derived from the consumption of compute, storage, and data transfer resources by Snowflake customers -- in the period jumped 29% to $900 million, and Snowflake said it expects fiscal fourth-quarter product revenue of $906 million to $911 million, above estimates of $882 million.

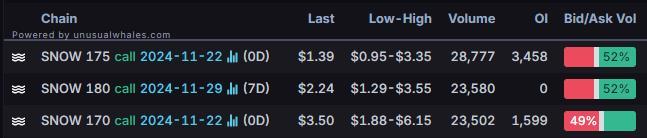

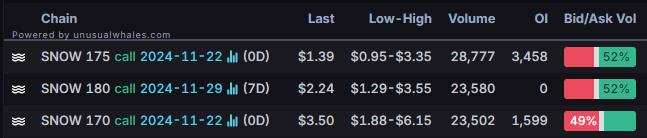

The most traded calls are contracts of $175 strike price that expire on Nov. 22. The total volume reaches 28,777 with an open interest of 3,458.

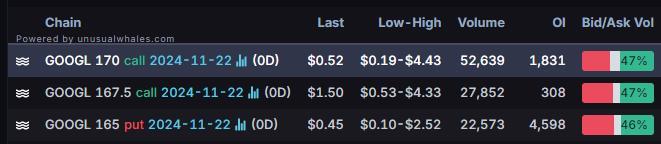

2. $Alphabet-A (GOOGL.US)$ stock fell 4% on Thursday, with the most traded puts are contracts of $165 strike price that expire on Nov. 22. The total volume reaches 22,573 with an open interest of 4,598, and the most traded calls are contracts of $170 strike price that expire on Nov. 22. The total volume reaches 52,639 with an open interest of 1,831.

Sundar Pichai, the CEO of Alphabet, sold a significant portion of his Class C Capital Stock, amounting to a total value of approximately $3.98 million. The transactions took place on November 20, 2024, and were executed at prices ranging from $176.096 to $178.6811 per share.

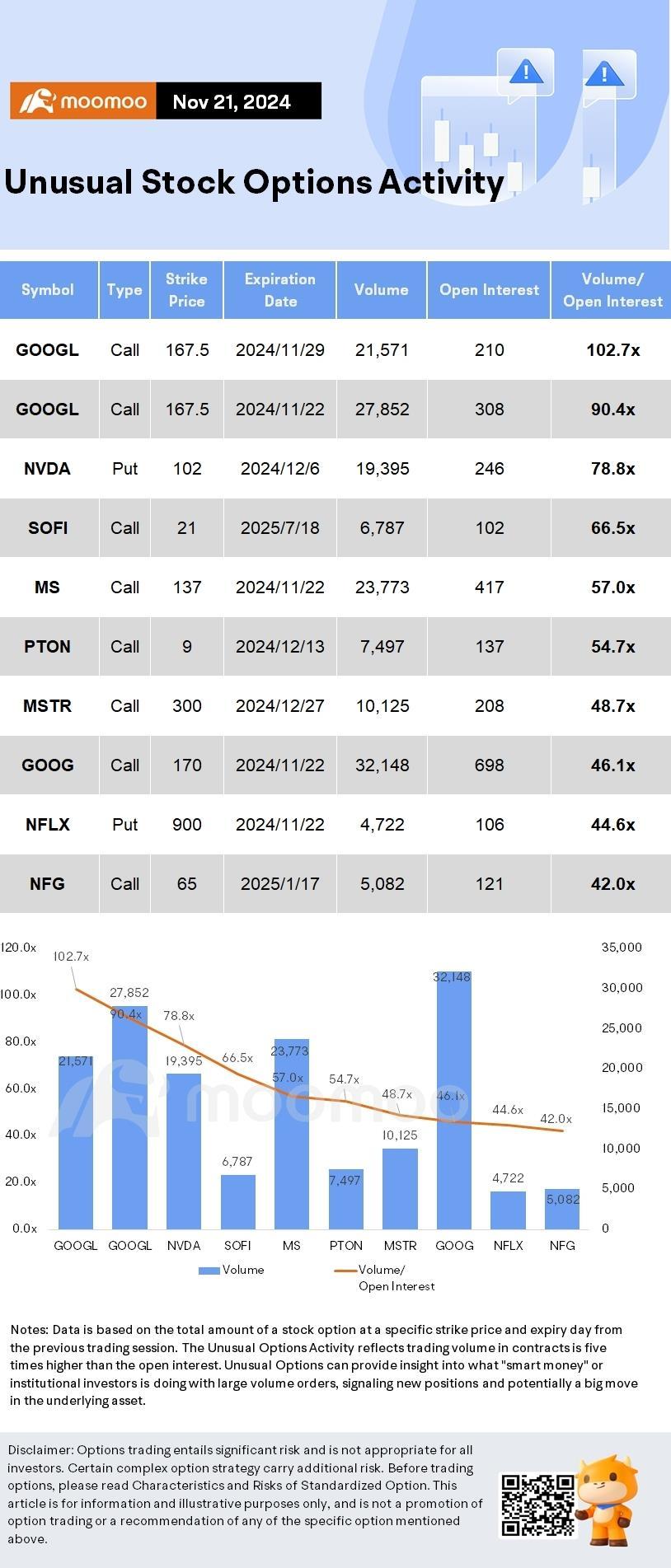

Unusual Stock Options Activity

There was a noteworthy activity in $Alphabet-A (GOOGL.US)$, with $167.5 calls topping the highest volume to open interest ranking. The highest volume over open interest ratio reaches 102.7x with 21,571 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg, MarketWatch

BloombergOption Volume: [Options Notes]Measuring liquidity: two key indicators to check

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

KT Number 1 Fan : "Revenue was $942 billion, higher than forecasts of $899 million" think there was a little typo there