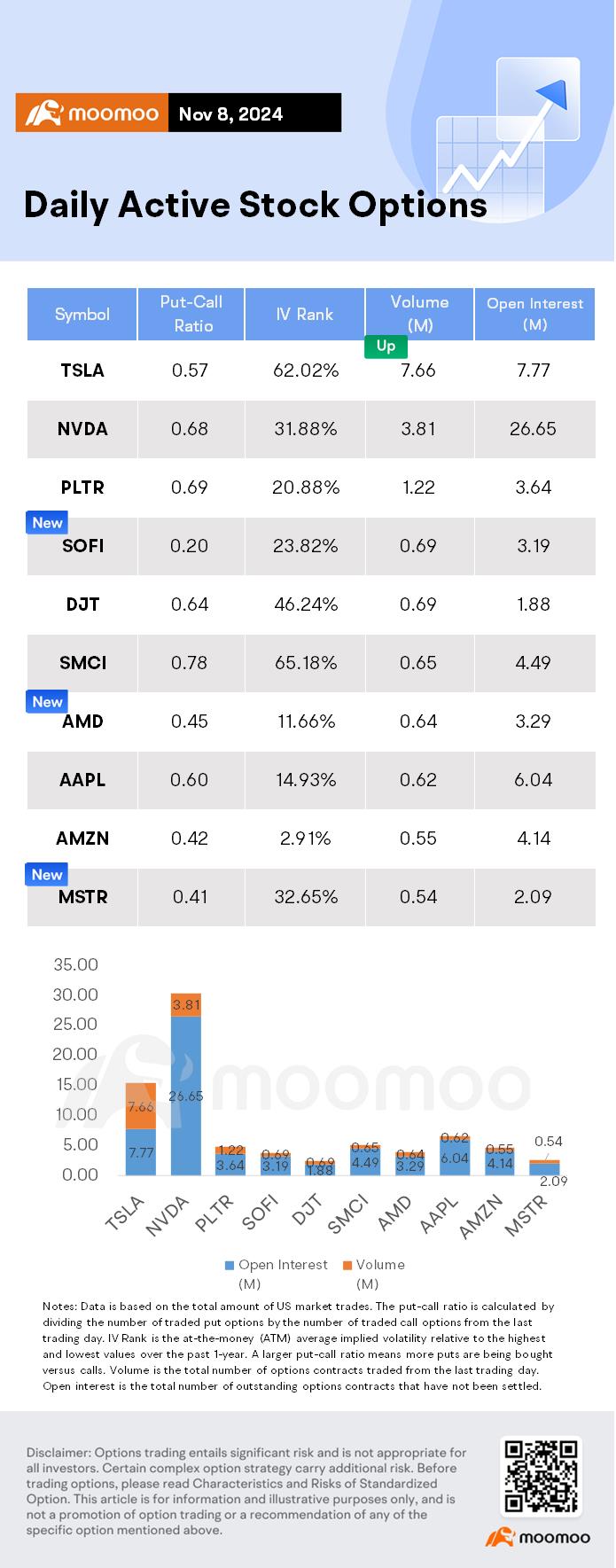

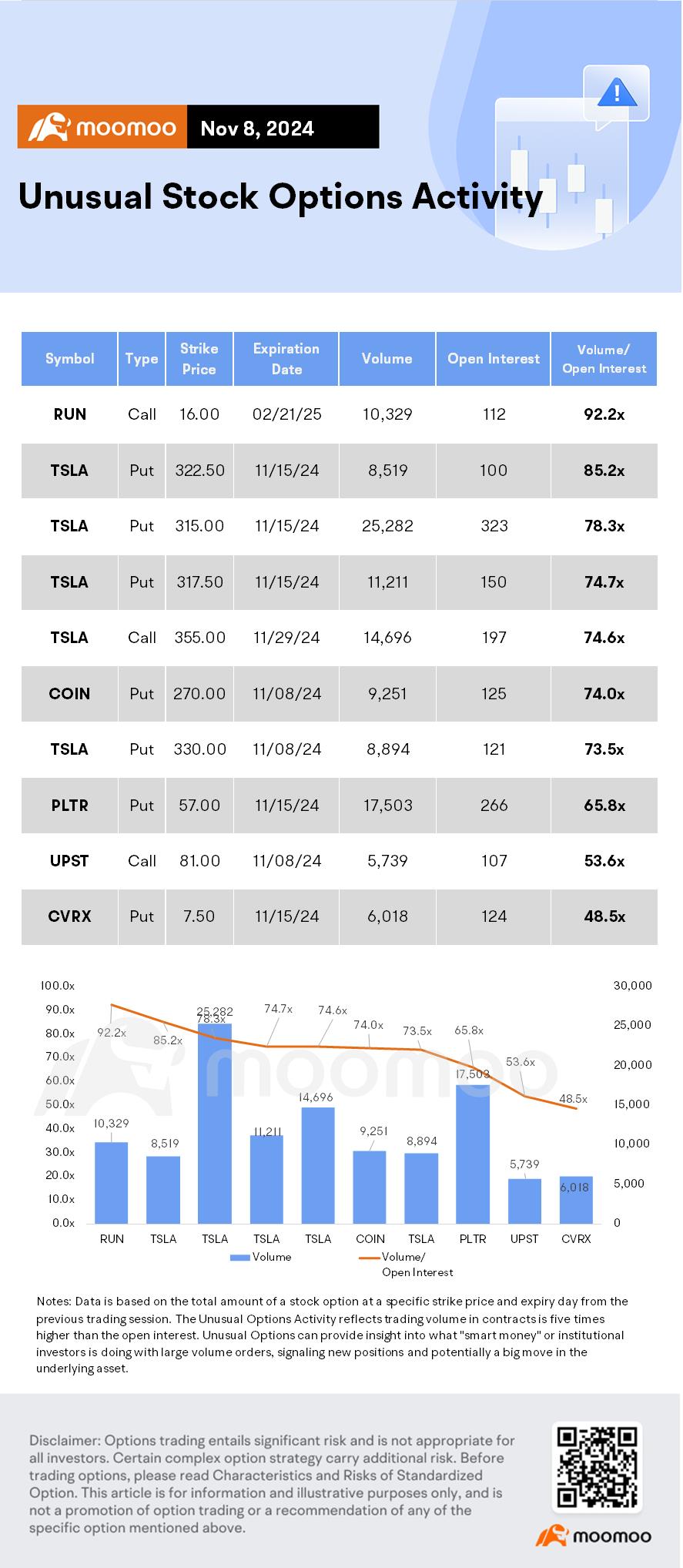

Since Tuesday, Tesla's stock has climbed by 30%, pushing its market valuation beyond the $1 trillion mark. The significant uptick in Tesla shares occurred after Donald Trump secured the presidential election. Tesla's CEO, Elon Musk, frequently accompanied Trump during his campaign and is rumored to possibly secure a role in Trump's administration. Investors are optimistic about Trump's policies on electric vehicles (EVs) and tariffs, which are perceived to favor the U.S.-based electric vehicle leader by potentially curtailing competition.

NoDragonsPlz : Tesla will make the moon

AL MALIK PAIZA : Tesla a model for serious response treadmill isn't available support during close profits income

Edmond low : Ok

105417756 : good

Travy-AL : Good information here thanks

101550592 :

103677010 : noted

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

54088 FROM RWS : 3299

103826785 : ok

View more comments...