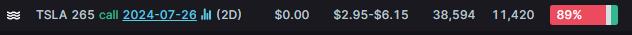

Shares of the electric vehicle maker dropped 7% after second-quarter earnings fell short of consensus estimates. Tesla reported adjusted earnings per share of 52 cents, whereas analysts surveyed by LSEG had projected 62 cents per share. However, the company did report $25.5 billion in quarterly revenue, slightly surpassing the Street's estimate of $24.77 billion.

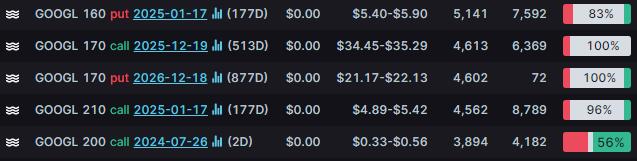

104371487 On Paris : #Mag 7 earnings: Tesla and Alphabet are up next,

what to expect?

Laine Ford : buy

101550592 :

Laine Ford : I ready all little time to buy stock maybe buy it here