Options Market Statistics: Tesla Stock Went Down Again, Options Pop

News Highlights

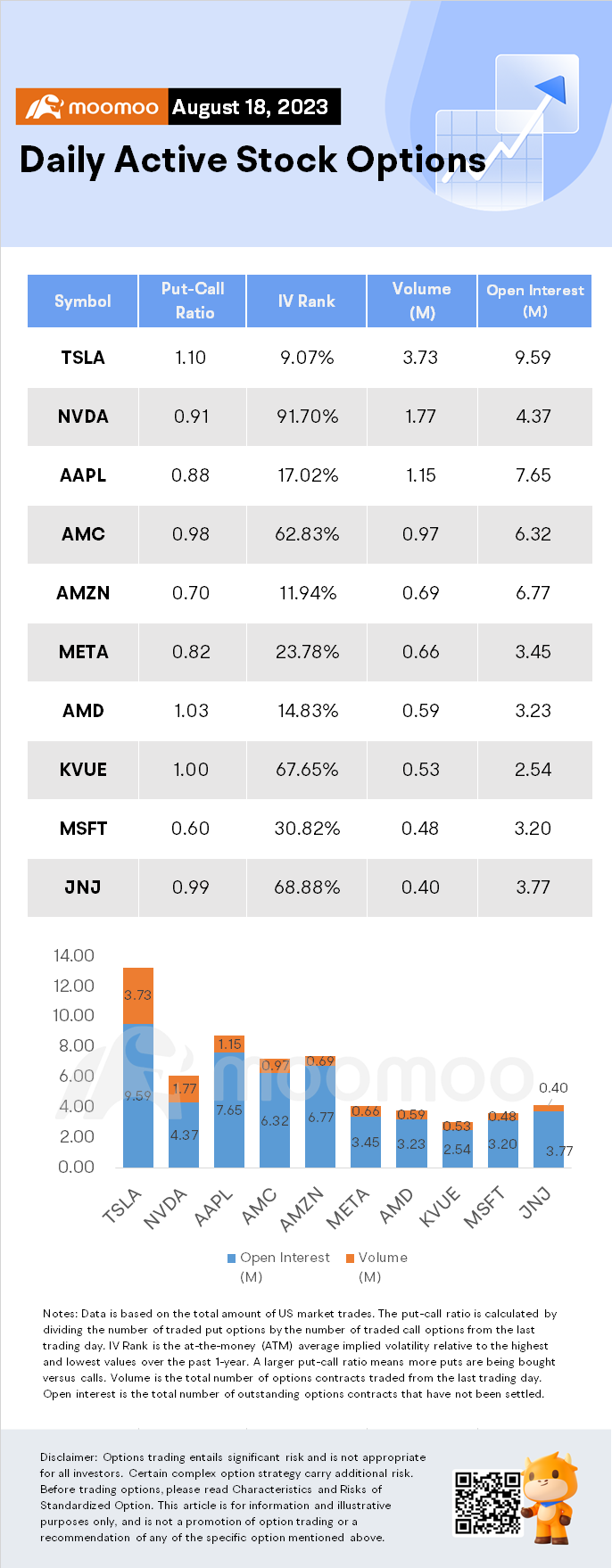

$特斯拉(TSLA.US)$shares fell by 1.70%, closing at $215.49. Its options trading volume is 3.73 million. Call contracts account for 47.6% of the whole trading volume. The most traded calls are contracts of $235 strike price that expire on August 18th. The total volume reaches 124,389 with an open interest of 13,295. The most traded puts are contracts of a $225 strike price that expires on August 18th; the volume is 118,385 contracts with an open interest of 20,924.

Mass production of $Tesla (TSLA.US)$'s revamped Model 3 may start in China as soon as next month, people familiar with the matter said.Mass production is set to follow, beginning as soon as September.

$NVIDIA (NVDA.US)$ shares fell by 0.10%, closing at $432.99. Its options trading volume is 1.77 million. Call contracts account for 52.3% of the whole trading volume. The most traded calls are contracts of $450 strike price that expire on August 18th. The total volume reaches 51,660 with an open interest of 20,608. The most traded puts are contracts of a $440 strike price that expires on August 18th; the volume is 38,449 contracts with an open interest of 12,297.

$NVIDIA (NVDA.US)$ slipped 1% in midday trading. Nvidia will report quarterly results next Wednesday, and analysts polled by FactSet are forecasting an adjusted $2.08 cents per share on $11.1 billion in revenue.

$Apple (AAPL.US)$ shares fell by 0.28%, closing at $174.49. Its options trading volume is 1.15 million. Call contracts account for 53.2% of the whole trading volume. The most traded calls are contracts of $180 strike price that expire on August 18th. The total volume reaches 63,397 with an open interest of 59,704. The most traded puts are contracts of a $190 strike price that expires on August 18th; the volume is 87,408 contracts with an open interest of 10,737.

$Apple (AAPL.US)$ inched 0.28% higher to $174.49 Friday. The stock's rise snapped a three-day losing streak.

Unusual Stock Options Activity

There were noteworthy activities in $特斯拉(TSLA.US)$where multiple options have topped volume to open interest ranking. The highest volume over open interest ratio reaches 119.28x with 245,355 contracts.

Source: Benzinga, Dow Jones, CNBC

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Option. This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Source: Benzinga, WSJ

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

charming Llama_7860 : Please help me understand the second table with options expiring 08/04 : 08/11: What is the benefit of this information on 08/18? The author just published something with no practical use

nicomo charming Llama_7860 : I was going to ask the same question…. I guess for us to just archive… but again not useful going forward to next week

charming Llama_7860 : On top is dated as 08/18 . Sometimes, members post articles to gain points .

Revelation 6 : At least use updated charts. You’re not going to slip the half-stepping weak crap past Moo investors. You should publish an apology and delete this post, post haste.

lightfoot : To me this is a sign of a serious pull back. I am predicting a serious crash . Feds Continuously raising IR, Biden's ridiculous spending, China economy failing, Forgiveness of school debt. destruction of fossil fuel energy, border immigration crises Bank failures. Continuous deception over growth. Why do stocks depreciate when they have Great PEG, low Beta but stagnant or falling prices . Why so many selloffs. Gold had fallen to low 1900's. We have become so pretentious to convince people we have low gas prices. low food prices. High fuel prices is an economy nightmare. Supply chain not keeping up. If you think those lobbyists will figure this out keep dreaming. . Washington is stuck on STUPID. They have not a clue. They use the eight ball for guidance . Shake it up!

Options Newsman OP charming Llama_7860 : Dear mooer, sorry for the mistake and thank you for pointing it out![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) .

.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) .

.

The mistake was caused by the disabled functions of our internal program and the functions have been updated.

The mistake in the above content has been corrected, and we'll double check next time

Options Newsman OP nicomo : Dear mooer, sorry for the mistake and thank you for pointing it out![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) .

.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) .

.

The mistake was caused by the disabled functions of our internal program and the functions have been updated.

The mistake in the above content has been corrected, and we'll double check next time

Options Newsman OP Revelation 6 : Dear mooer, sorry for the mistake![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) and thank you for pointing it out.

and thank you for pointing it out.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) .

.

The mistake was caused by the disabled functions of our internal program and the functions have been updated.

The mistake in the above content has been corrected, and we'll double check next time

Options Newsman OP charming Llama_7860 : Dear mooer, sorry for the mistake![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) and thank you for pointing it out.

and thank you for pointing it out.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) .

.

The mistake was caused by the disabled functions of our internal program and the functions have been updated.

The mistake in the above content has been corrected, and we'll double check next time