Options Market Statistics: PDD Options Pop as US-Listed Chinese Stocks Continue to Rise on Stimulus Strength

$PDD Holdings (PDD.US)$ shares increased 4.85%, with with option volume of 0.55 million, and calls accounted for 59.4% of the volume.The $160 calls expiring October 4 were traded most actively.

$JD.com (JD.US)$ shares climbed 4.36%, with with option volume of 0.31 million, and calls accounted for 66.4% of the volume. The $44.5 calls expiring October 4 were traded most actively.

Shares of US-listed Chinese stocks are trading higher on continued strength following recent stimulus measures.

Hedge funds are pouring $2.4 billion into ETFs focusing on Chinese equities over the last three trading sessions of September, driven by much bigger than expected stimulus packages, marking the largest weekly gains in over a decade, according to Goldman Sachs.

$Super Micro Computer (SMCI.US)$ shares increased 3.58%, with with option volume of 0.39 million, and calls accounted for 53.8% of the volume. The $42 calls expiring October 4 were traded most actively.

SMCI joined a growing list of semiconductor companies that have split their stocks after the market closed on Monday. A 10-for-1 stock split took effect after Monday's trading ends, and the shares began trading on a post-split basis starting on Tuesday.

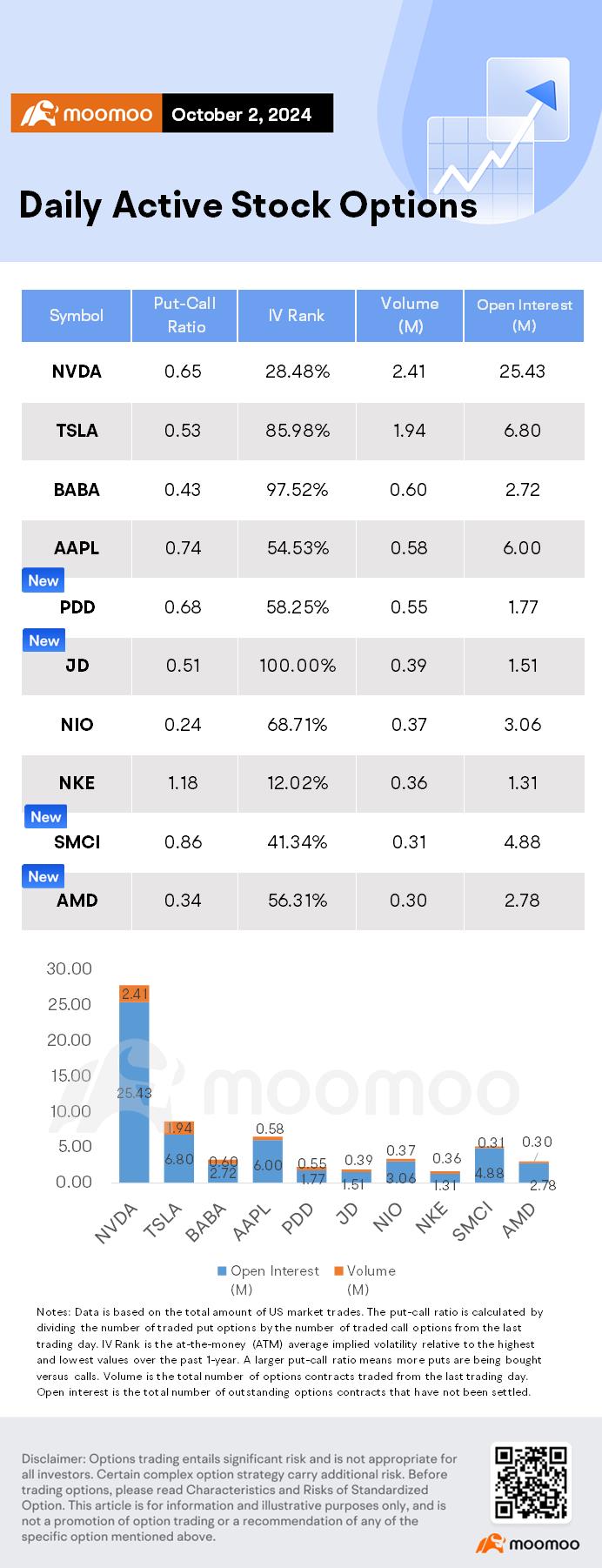

Unusual Stock Options Activity

There was a noteworthy activity in $UP Fintech (TIGR.US)$, where $12 calls have topped volume to open interest ranking. The highest volume over open interest ratio reaches 132.4x with 26,480 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

BloombergOption Volume: [Options Notes]Measuring liquidity: two key indicators to check

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

72289632 : Itry2worry

Terry Hutchinson587 : 000PP

103673586 : OOOPP

103773948 : OPP

72632936 : that's great I'll be ready for tomorrow

104556909 : good

Laine Ford : no comment

103677010 : noted