Options Market Statistics: Used Car Retailer Carvana Spiked Amid the Approaching UAW Strike Deadline, Options Pop

News Highlights

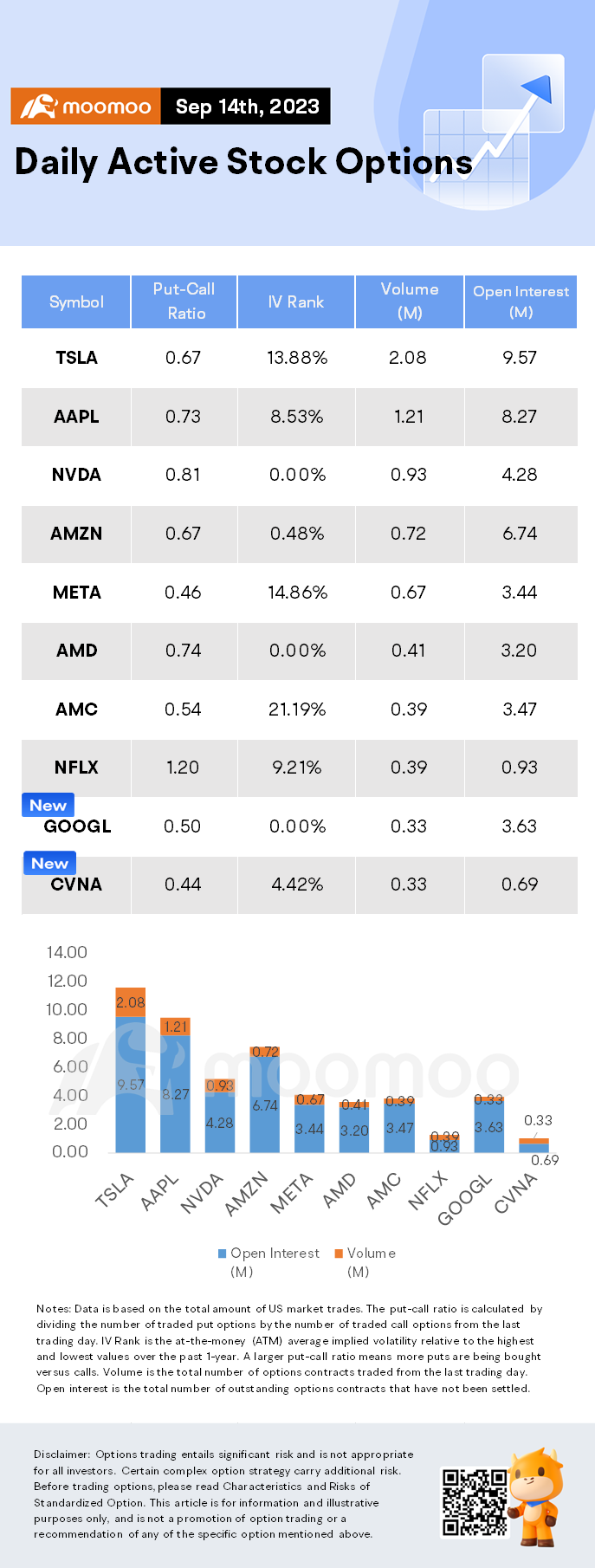

$Tesla (TSLA.US)$ shares rose by 1.75%, closing at $276.04. Its options trading volume is 2.08 million. Call contracts account for 60.1% of the whole trading volume. The most traded calls are contracts of $280 strike price that expire on September 15th. The total volume reaches 170,035 with an open interest of 44,749. The most traded puts are contracts of a $270 strike price that expires on September 15th; the volume is 109,257 contracts with an open interest of 21,261.

The UAW and $Ford Motor (F.US)$, $General Motors (GM.US)$, and $Stellantis NV (STLA.US)$ remain far apart ahead of the contract expiration at 11:59 p.m. Eastern time today.

The union plans to launch "stand up" strikes, targeting yet-to-be-determined plants for a walkout at the stroke of midnight if negotiations fail. The UAW also said it won't extend the current contract.

Tesla has for years fended off unionizing efforts at its U.S. factories, which has helped it widen the first-mover advantage that it has enjoyed on EVs, and it is likely to emerge as "the winner from the labor talks," Gene Munster, a managing partner at Deepwater Asset Management, said in a note Thursday.

$Alphabet-A (GOOGL.US)$ shares rose by 1.02%, closing at $138.10. Its options trading volume is 0.33 million. Call contracts account for 66.5% of the whole trading volume. The most traded calls are contracts of $138 strike price that expire on September 15th. The total volume reaches 42,920 with an open interest of 12,506. The most traded puts are contracts of a $135 strike price that expires on September 15th; the volume is 15,442 contracts with an open interest of 8,858.

Federal prosecutors opened a landmark antitrust trial against Alphabet Inc.'s Google on Tuesday with charges the search-engine giant for years intentionally snuffed competition through exclusive contracts with wireless carriers and phone makers.

Google spent billions of dollars on such contracts to cement its dominant position, a clear violation of U.S. antitrust law, prosecutors said.

"This case is about the future of the internet, and whether Google's search engine will ever face meaningful competition," Justice Department lawyer Kenneth Dintzer told the court. He said Google pays more than $10 billion a year to $Apple (AAPL.US)$ and other companies to ensure Google is the default or only search engine available on browsers and mobile devices used by millions of consumers.

Google's search business accounted for more than half of the $283 billion in revenue Alphabet recorded in 2022. Search in large part has fueled the company's $1.7 trillion market valuation.

$Carvana (CVNA.US)$ shares rose by 13.47%, closing at $55.86. Its options trading volume is 0.33 million. Call contracts account for 69.4% of the whole trading volume. The most traded calls are contracts of $60 strike price that expire on September 15th. The total volume reaches 16,974 with an open interest of 5,242. The most traded puts are contracts of a $50 strike price that expires on September 15th; the volume is 13,766 contracts with an open interest of 1,033.

JPMorgan analyst Rajat Gupta said a strike would help support retail demand for car dealers and pricing in the near term, although it would lead to potentially crippling supply shortages in the market and could create more affordability issues to prolong what is already a slow recovery. The UAW strike and broad macroeconomic backdrop has Gupta and team with a relatively unfavorable view on $CarMax (KMX.US)$ and Carvana.

Meanwhile, B2B marketplace players such as $ACV Auctions (ACVA.US)$ and $OPENLANE (KAR.US)$ are seen potentially keeping up their recent momentum in auction conversion with further impetus from industry used price stabilization and ongoing fee increases, although the strike could lead to depleted supply and higher prices further down the road. For B2C players such as $CarGurus (CARG.US)$, $Cars.com (CARS.US)$ , and $TrueCar (TRUE.US)$, a strike is seen delaying ongoing pricing initiatives and slowing the cyclical recovery, though subscription-based revenue streams are expected to help cushion the revenue impact to a degree.

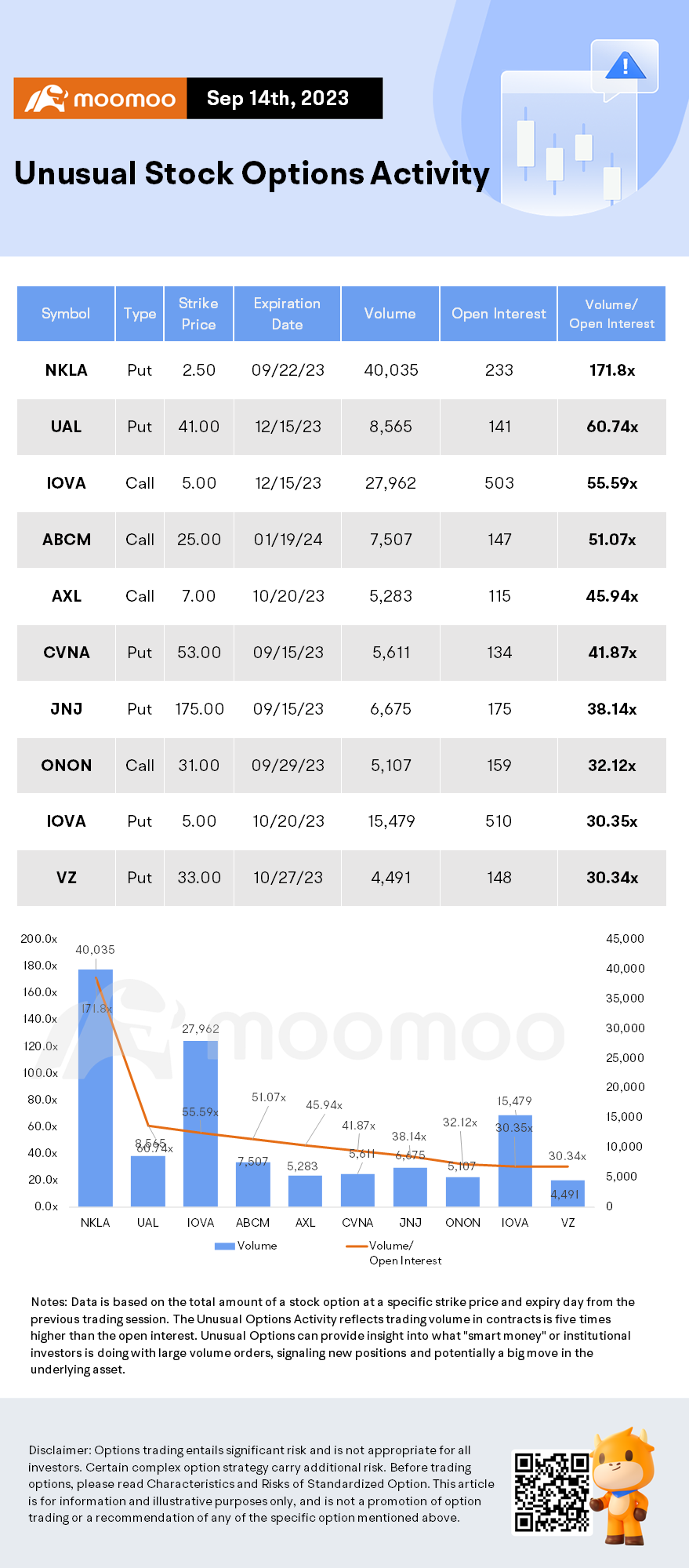

Unusual Stock Options Activity

Some notable put activity is being seen in $Nikola (NKLA.US)$, which is primarily being driven by activity on the September 22nd 2.50 put. Volume on this contract is 40,035 versus open interest of 233, so it's likely that nearly all of the volume represents fresh positioning.

Daily Active Index & Sector ETF Options

Source: Benzinga, Dow Jones, CNBC

Disclaimer: Options trading entails significant risk and is not appropriate for all investors. Certain complex option strategy carry additional risk. Before trading options, please readCharacteristics and Risks of Standardized Option.This article is for information and illustrative purposes only, and is not a promotion of option trading or a recommendation of any of the specific option mentioned above.

Source: Benzinga, WSJ

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment