Options Market Statistics: Walmart Stock Rallies, Options Pop on Q2 Earnings Beat, Raised View

News Highlights

$NVIDIA (NVDA.US)$ stock rose 4.05%. Its options trading volume was 5.09 million. Call contracts account for 63.5% of the total trading volume. The $115 calls expiring August 16 were traded most actively.

Eric Schmidt, former CEO of Google, advised Stanford students that major tech companies are preparing to invest up to $300 billion in Nvidia-based AI data centers, suggesting a significant market opportunity. Though not an investment recommendation, Schmidt highlighted Nvidia's dominance in AI chips and its substantial revenue growth. He noted that large companies with significant investments in Nvidia would gain an edge over smaller competitors. Schmidt also mentioned that while Nvidia would not be the sole beneficiary in AI, other options are limited. This insight underscores Nvidia's central role in the AI boom, driven by increasing demand from major cloud and AI developers.

$Walmart (WMT.US)$ stock rose 6.58%. Its options trading volume was 0.76 million. Call contracts account for 84.1% of the total trading volume. The $66 puts expiring August 16 were traded most actively.

Walmart reported strong second-quarter fiscal 2025 results, surpassing both top and bottom-line expectations and prompting the company to raise its fiscal 2025 guidance. Shares surged over 7% in pre-market trading on August 15. All business segments experienced growth, including store and club sales, e-commerce, pickup options, and delivery services. New ventures like the marketplace, advertising, and membership also contributed to diversified profits. Adjusted earnings rose 9.8% to 67 cents per share, beating the estimate of 65 cents. Total revenues increased 4.8% year over year to $169.3 billion, exceeding the consensus of $168.5 billion. Global e-commerce sales jumped 21%, and global advertising revenue grew 26%. The gross profit margin expanded by 43 basis points to 24.4%, while adjusted operating income rose 7.2% to $7.9 billion.

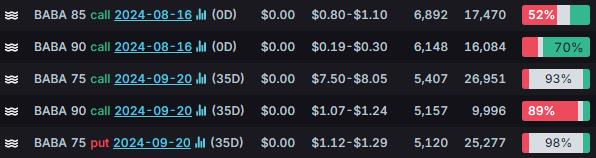

$Alibaba (BABA.US)$ stock rose 0.09%. Its options trading volume was 0.40 million. Call contracts account for 77.4% of the total trading volume. The $85 calls expiring August 16 were traded most actively.

Alibaba missed revenue and net income expectations for the June 2024 quarter, facing challenges in its core e-commerce business due to competition and cautious Chinese consumers. The company reported revenues of 243.24 billion Chinese yuan ($34.01 billion) and a net income of 24.27 billion yuan, both below estimates. Despite this, shares rose 2%. Year-on-year, revenue increased by 4%, but net income dropped 29% due to decreased operational income and investment impairments.

After significant restructuring in 2023 and new CEO Eddie Wu's leadership, Alibaba is focusing on third-party merchants on Taobao and Tmall and plans new monetization features by late 2025. Sales from Taobao and Tmall fell 1% year on year to 113.37 billion yuan, though gross merchandise value grew in double digits.

Internationally, e-commerce platforms like Lazada and Aliexpress saw a 32% sales increase. The cloud computing division, viewed as a future growth driver, posted a 6% revenue increase to 26.5 billion yuan, the fastest since June 2022, with AI-related product revenue growing significantly. Adjusted EBITA for the cloud division rose 155% year on year, focusing on higher-margin contracts and operational efficiency.

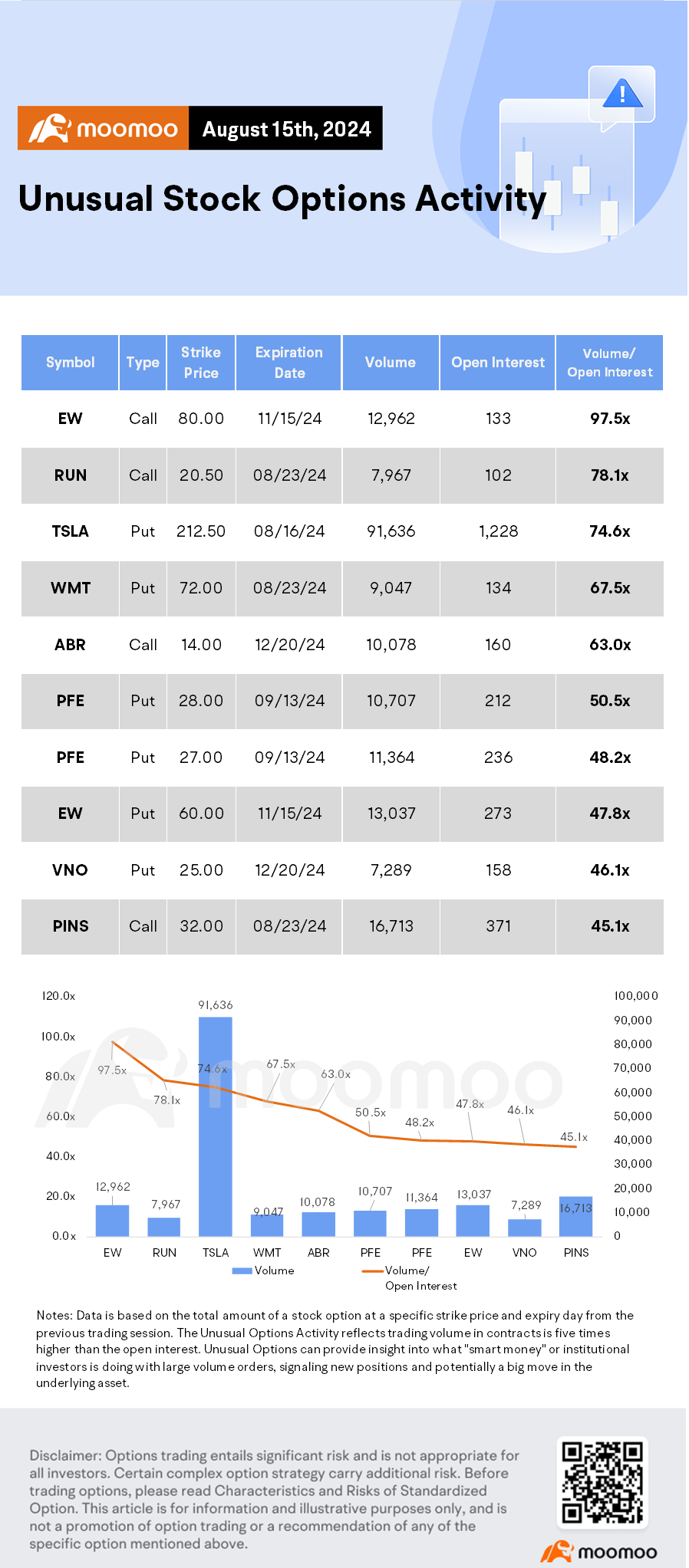

Unusual Stock Options Activity

There was a noteworthy activity in $Edwards Lifesciences (EW.US)$, where multiple calls have topped volume to open interest ranking. The highest volume over open interest ratio reaches 97.5x with 12,962 contracts.

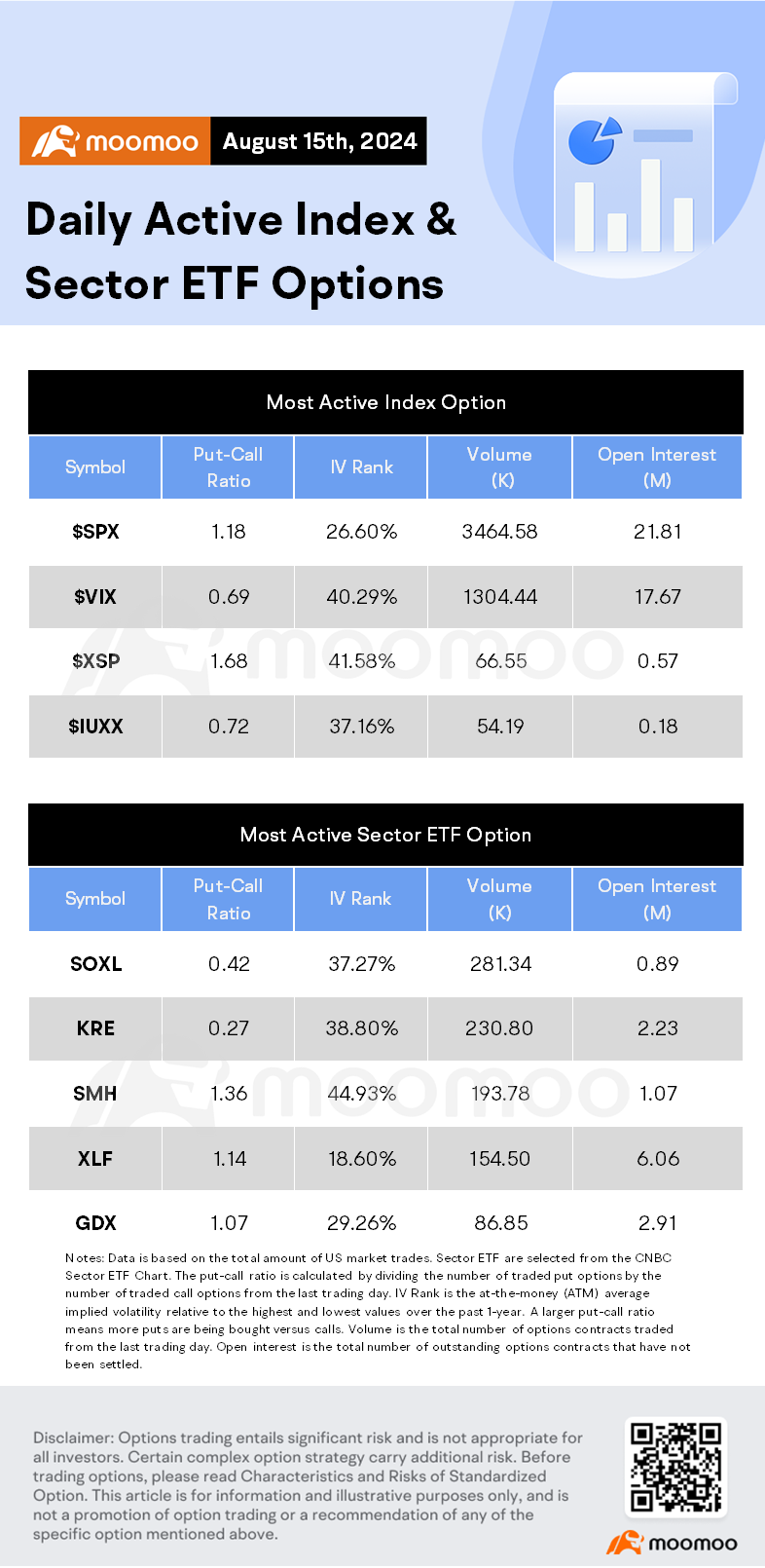

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

104309970 : Good morning everyone

xing6600 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

山芭佬 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)