Options Market Statistics: Wells Fargo Decreases Prime Rate to 7.75 Percent; Options Pop

News Highlights

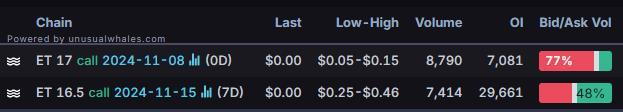

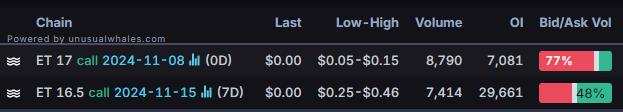

1. $Energy Transfer (ET.US)$'s most traded calls are contracts of $17 strike price that expire on Nov. 8. The total volume reaches 8,790 with an open interest of 7,081.

The company reports record crude pipeline volumes in Q324. In October 2024, Energy Transfer announced a cash distribution of US$0.3225 per common unit (US$1.29 annualised) for the quarter ended September 30, 2024. As of September 30, 2024, the Partnership’s revolving credit facility had US$3.34 billion available for future borrowings.

2. $Wells Fargo & Co (WFC.US)$ shares were down 3.6% on Thursday. The most traded calls are contracts of $69 strike price that expire on Nov. 29. The total volume reaches 29,707 with an open interest of 22,446, while the most traded puts are contracts of $50 strike price that expire on Jan. 17, 2025 with an open interest of 14,805.

The financial giant announced a prime rate reduction from 8.00 percent to 7.75 percent. The change will take effect on November 8, 2024. The announcement was made from the bank's San Francisco location.

Unusual Stock Options Activity

There was a noteworthy activity in $Tesla (TSLA.US)$, with $297.5 puts topping the highest volume to open interest ranking. The highest volume over open interest ratio reaches 147.5x with 38,947 contracts.

Daily Active Index & Sector ETF Options

Source: Barchart, Unusual Whales, The Guardian, Bloomberg, MarketWatch

BloombergOption Volume: [Options Notes]Measuring liquidity: two key indicators to check

Call/Put Option: Trade Options: Quickstart Guide

Option Expiration: Trade Options: Quickstart Guide

Implied Volatility Rank: Volatility Analysis: IV, HV, IV Rank, IV Percentile

Disclaimer: Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Optionsbefore engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including i potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment

103677010 : noted

AL MALIK PAIZA : are with you different types investment trust trading bet difficulty in register and terafer tax

MrG Moo : nice

74537620 : Great