PLTR raised revenue outlook and believed "AI demandwon’t slow down": Buy, Sell, or Hold?

PLTR raised revenue outlook and believed "AI demandwon’t slow down": Buy, Sell, or Hold?

Views 66K

Contents 199

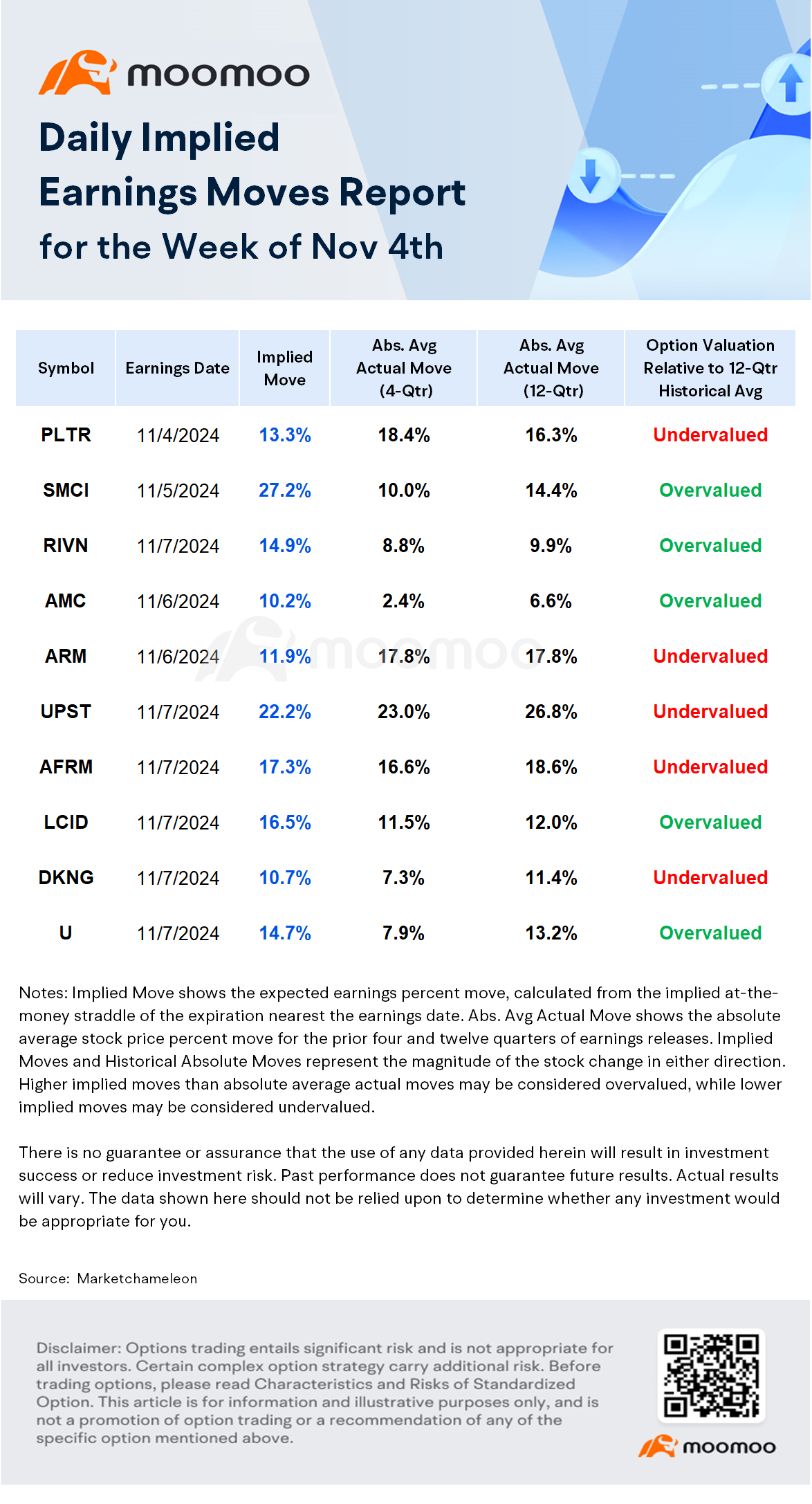

Options Market Indicate Elevated Volatility and Mixed Sentiment on Upcoming Earnings of PLTR, SMCI, and AMC

Implied volatility often spikes before a company releases its earnings, as market uncertainty drives up demand for options from speculators and hedgers. This heightened demand inflates both the implied volatility and the price of the options. Following the earnings announcement, implied volatility generally returns to normal levels.

Here are the top earnings and volatility for the week:

Earnings Release Date: PLTR is set to report earnings on November 4, 2024 after market close

The option open interest in Palantir climbed 1.4% to 3.1 million contracts. The current open interest is above its 52-week average of 2.9 million contracts according to Market Chameleon. Currently, the OI percentile rank is 80.4%. So, Palantir had a higher OI only 19.6% of the days in the last year. This indicates there is a lot more demand to trade and carry option positions in Palantir than normal. The most notable increase was in the 08-Nov-24 expiration which added +21,704 contracts.

The implied volatility (IV) is 73.8, which is in the 92% percentile rank. This means that 92% of the time the IV was lower in the last year than the current level. The current IV (73.8) is 9.6% above its 20 day moving average (67.3) indicating implied volatility is trending higher.

The largest option trades, with an expiration date of less than 30 days, over the past few trading sessions were mostly calls that expire Nov 8th. Yet, those calls trades were mostly mildly bullish or bearish.

Palantir beat analysts' revenue expectations by 3.9% last quarter, reporting revenues of $678.1 million, up 27.2% year on year. It was a very strong quarter for the company, with an impressive beat of analysts’ billings and EBITDA estimates.

This quarter, analysts are expecting Palantir’s revenue to grow 26.1% year on year to $703.7 million, improving from the 16.8% increase it recorded in the same quarter last year. Earnings are expected to come in at $0.04 per share.

Earnings Release Date: SMCI is set to report earnings on November 5, 2024 after market close

The options market overestimated SMCI stocks earnings move 50% of the time in the last 12 quarters. The predicted move after earnings announcement was ±12.3% on average vs an average of the actual earnings moves of 14.4% (in absolute terms). This shows that SMCI tended to be more volatile than the options market predicted for the earnings stock price reaction.

SMCI implied volatility (IV) is 178.7, which is in the 100% percentile rank. The current IV is 77.3% above its 20 day moving average (100.8) indicating implied volatility is trending higher. Besides, the implied volatility skew shows that the market pricing in volatility risk to the option premium of downside puts are significantly higher than upside calls. The current 25-Delta Put-Call Spread is +47.2, above its 20 day moving average +3.7, indicating that market sentiment is VeryBearish on SMCI.

Earnings Release Date: AMC is set to report earnings on November 6, 2024 after market close

The options market overestimated AMC stocks earnings move 82% of the time in the last 11 quarters. The predicted move after earnings announcement was ±13.5% on average vs an average of the actual earnings moves of 6.6% (in absolute terms).

Over the last 12 quarterly earnings day, AMC has a high probability of declining, at 75%. During regular trading hours after the earnings was released, the biggest increase was +18.9%, and the largest price decrease was -13.7%.

Source: Market Chameleon, Unusual Whale

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more 21

21 1

1

104088143 : Good

Adrianlim90 : 1

oobgood : OK