Options Trading Essentials: Understanding the Options Greeks

Welcome back to moomoo! This is Options Explorer, and in today's episode of [Options Notes], we're diving deep into the world of options trading to decode the mysteries of the Greeks.

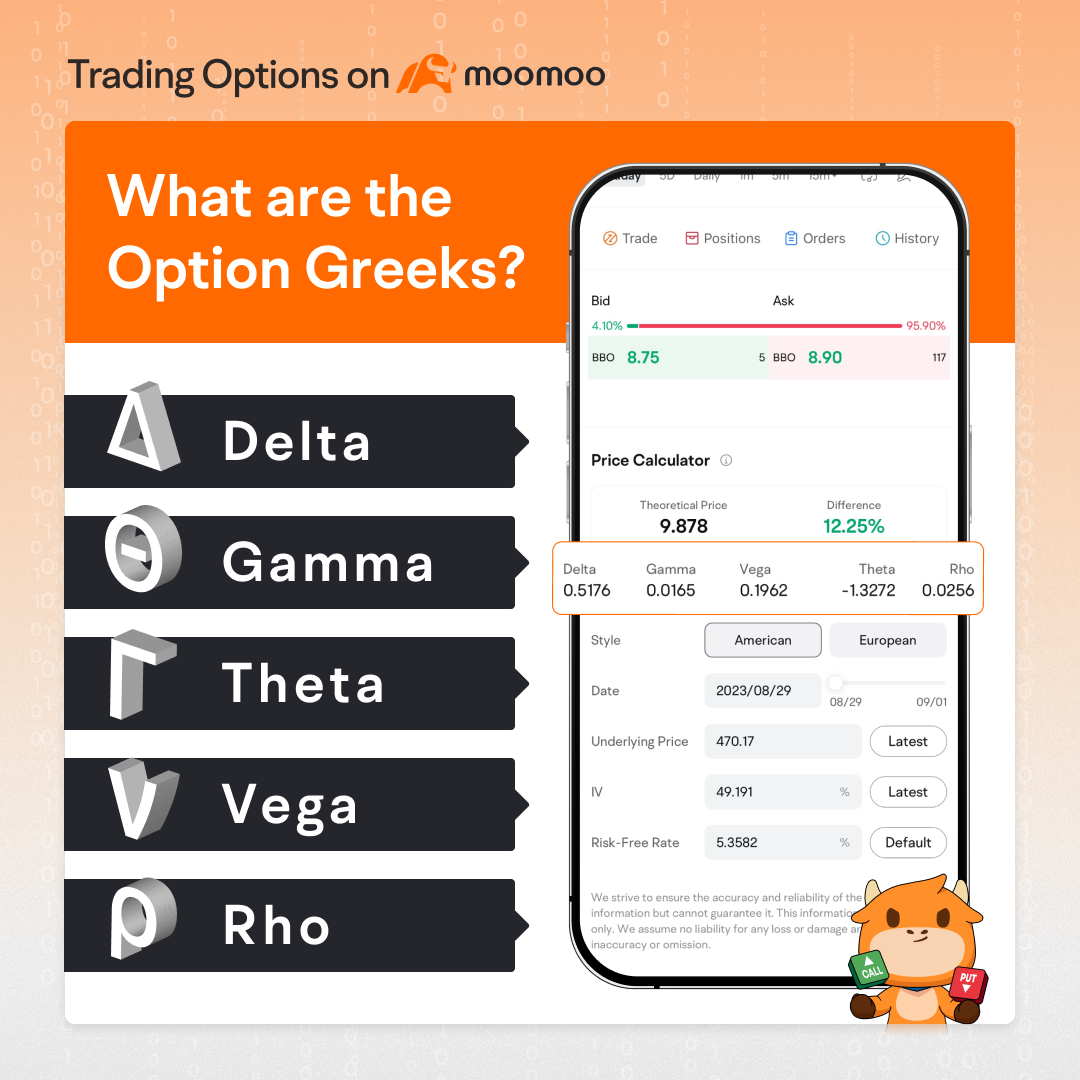

Delta = Option Price Change / Stock Price Change. Its symbol is Δ.

It measures the degree to which an option's price will move in relation to a 1 unit change in the stock price.

Delta is typically utilized in two key ways: for hedging purposes and for calculating leverage in options trading.

Gamma = Change in Delta / Stock Price Change. Its symbol is γ.

It represents the change in Delta value caused by changes in the underlying asset price. It measures how much the Delta will change in response to a 1 unit change in the stock price.

As such, Gamma can potentially be used to gauge the complexity of hedging risk. A higher Gamma value indicates that the option's Delta is more sensitive to changes in the underlying asset price, making it more challenging to hedge against potential losses.

Vega = Option Price Change / Stock Price Volatility Change. Its symbol is ν.

It is calculated as the amount of change in an option's price for every 1% change in implied volatility and is expressed in dollars.

Assuming other factors remain constant, generally, as the stock price volatility increases, the option price also increases.

Theta = Option Price Change / Time to Expiration. Its symbol is θ.

Theta is a measure of the impact of time value decay on options prices.

Assuming that other factors remain constant, as the expiration date approaches, the rate at which the option's time value decays generally increases, causing the option price to decrease at a faster pace.

Rho = Option Price Change / Risk-Free Interest Rate Change. Its symbol is ρ.

It measures the degree to which an option's price will move in relation to a 1% change in the interest rate.

However, since interest rates tend to remain stable for prolonged periods, Rho typically has a limited impact on option prices overall.

Learn more:

Gamma: Delta's Accelerator for End of Day Options

That's what today's lesson is all about. Please leave a comment if you have any questions or thoughts about it.

That's what today's lesson is all about. Please leave a comment if you have any questions or thoughts about it.

Additionally, I have some good news to share with you. Starting today, you have more options to choose from when it comes to pricing plans for US options trading. We're introducing a new Tiered Pricing Plan, offering you the flexibility to pay less based on your trading volume.

Don't forget to follow us to stay up-to-date on all things related to options trading. For more information on options learning, you can click on the image below to follow me immediately.

Risk Statement

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Opening new options positions close to or on their expiration date comes with substantial risk of losses for reasons that include potential volatility of the underlying security and limited time to expiration. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request.

This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty as to its adequacy, completeness, accuracy or timeliness for any particular purpose of the above content.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc.

In the U.S., investment products and services available through the moomoo app are offered by Moomoo Financial Inc., a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) and a member of Financial Industry Regulatory Authority (FINRA)/Securities Investor Protection Corporation (SIPC).

In Singapore, investment products and services available through the moomoo app are offered through Moomoo Financial Singapore Pte. Ltd. regulated by the Monetary Authority of Singapore (MAS). Moomoo Financial Singapore Pte. Ltd. is a Capital Markets Services Licence (License No. CMS101000) holder with the Exempt Financial Adviser Status. This advertisement has not been reviewed by the Monetary Authority of Singapore.

In Australia, financial products and services available through the moomoo app are provided by Futu Securities (Australia) Ltd, an Australian Financial Services Licensee (AFSL No. 224663) regulated by the Australian Securities and InvestmentCommission(ASIC). Please read and understand our Financial Services Guide, Terms and Conditions, Privacy Policy and other disclosure documents which are available on our websitehttps://www.moomoo.com/au.

In Canada, order-execution only services available through the moomoo app are provided by Moomoo Financial Canada Inc., regulated by the Canadian Investment Regulatory Organization (CIRO).Moomoo Technologies Inc.,Moomoo Financial Inc., Moomoo Financial Singapore Pte. Ltd.,Futu Securities (Australia) Ltd and Moomoo Financial Canada Inc. are affiliated companies.

Disclaimer: Moomoo Technologies Inc. is providing this content for information and educational use only.

Read more

Comment

Sign in to post a comment