Oracle's Earnings Review: Up 9% Post-Earnings, Is Oracle's Future Promising?

On September 9th, after the U.S. stock market closed, Oracle released its earnings report for the first quarter of fiscal year 2025 (ending August 31, 2024). This report exceeded expectations in terms of revenue, earnings, and the highly-watched cloud revenue. The stock price surged nearly 9% in after-hours trading, making it one of the few tech stocks to perform well post-earnings recently. This article will analyze the positive factors contributing to Oracle's stock price surge and propose corresponding trading strategies.

Key Financial Data:

Revenue:Increased by 7% year-over-year to $13.3 billion, compared to analysts' expectation of $13.23 billion.

EPS:Non-GAAP earnings increased by 17% year-over-year to $1.39 per share, compared to analysts' expectation of $1.33 per share. GAAP earnings increased by 20% year-over-year to $1.03 per diluted share, compared to $0.86 per share in the same period last year.

OperatingIncome:Non-GAAP operating income increased by 14% year-over-year to $5.7 billion at constant exchange rates, compared to analysts' expectation of $5.59 billion. GAAP operating income was $4 billion.

Old Tree with New Blossoms: Committed to Cloud Transformation

If your impression of Oracle is still that of a database company, it's severely outdated. After a decade of transformation, Oracle has finally reached a significant milestone this year—its cloud revenue surpassed its software license support revenue for the first time.

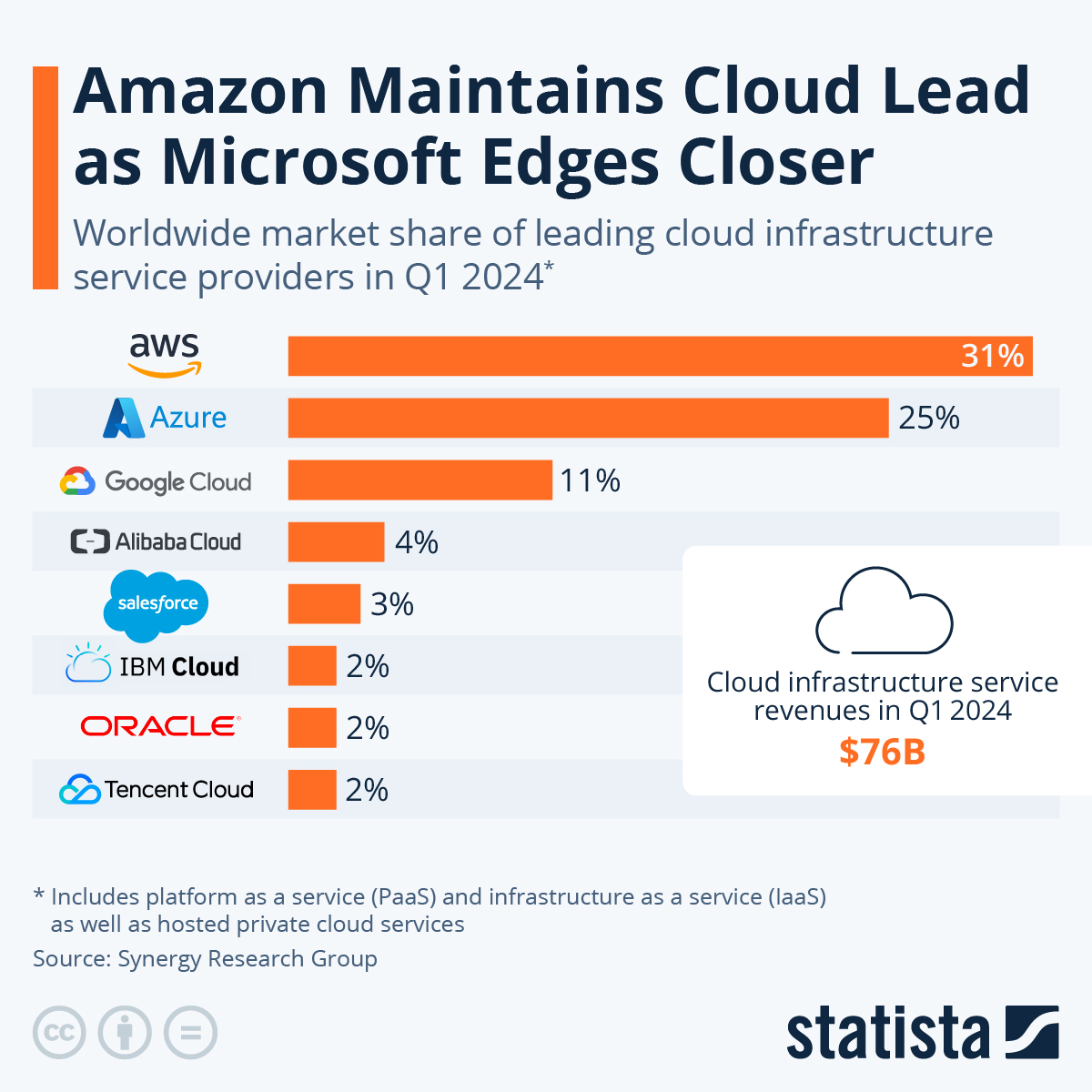

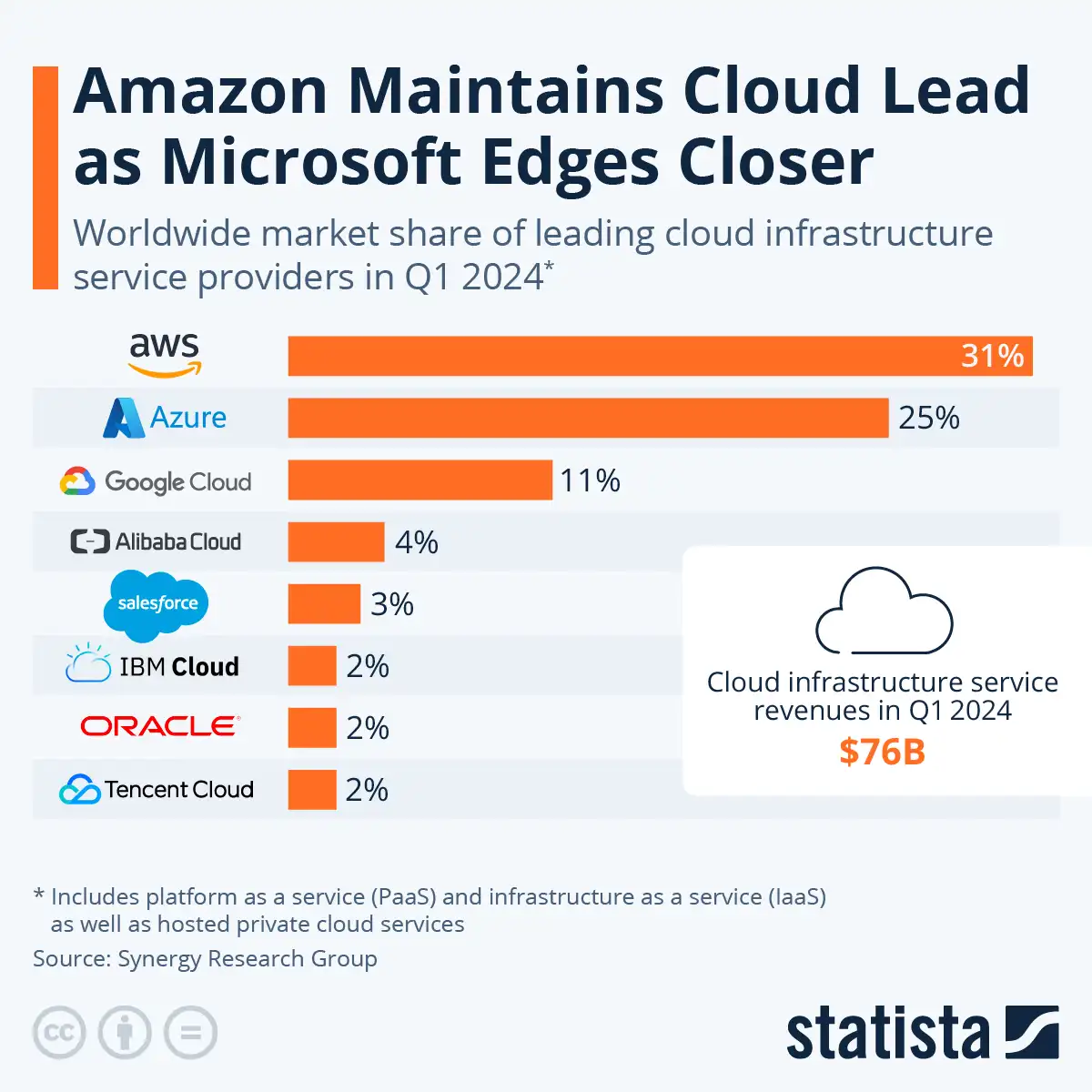

Today, Oracle is an IT services company primarily focused on cloud services, providing comprehensive solutions (products) to enterprises. In Q1 of fiscal year 2024, Oracle's market share in the cloud services market was around 2%, ranking 7th. Although the database business has become a smaller proportion of Oracle's revenue, Oracle still possesses two of the world's most successful database products (the commercial Oracle database and the open-source MySQL), which are fundamental to its standing as an IT service provider.

Oracle's current revenue streams are divided into four categories: cloud service and license support, cloud and on-premise license, hardware, and services.

Cloud service and license support: This is the core revenue source, accounting for approximately 80% of revenue in FY25Q1. Oracle SaaS and OCI (Oracle Cloud Infrastructure) are collectively known as Oracle Cloud Services. OCI is a critical part of Oracle's transformation from a traditional database company to an enterprise cloud service provider and directly competes with Amazon AWS and Microsoft Azure, attracting significant attention.

Oracle on-premise license deployment services: This includes product deployment licenses for non-Oracle cloud service models, such as Oracle applications, Oracle databases, and Oracle middleware software services. This includes the Oracle databases and application system licenses that we typically purchase. Therefore, this part of the database revenue is becoming less significant for Oracle.

Hardware services: This includes a wide range of enterprise hardware products and related software products, such as Oracle integrated systems and servers. Service business includes consulting services and advanced customer services.

At the current stage, Oracle's growth is primarily driven by cloud service revenue, with OCI (IaaS) being the fastest-growing segment.

Why Did Oracle Surge?

1.Three Factors Contributing to Oracle's Surge: First, cloud revenue and OCI business exceeded expectations.

Total cloud service revenue (SaaS and IaaS) grew 21% to $5.6 billion, with SaaS revenue at $3.5 billion (up 10%) and OCI IaaS revenue at $2.2 billion (up 46%), both exceeding market expectations. The company expects OCI revenue to grow over 50% year-over-year for fiscal year 2025. As OCI scales up, its profit margins are also gradually improving.

In the FY2024 earnings call, CEO Safra Catz highlighted OCI's advantages:

"Why partner with Oracle? OCI moves data faster. When you're billed by the minute, faster means cheaper. OCI trains large language models several times faster than other cloud services and at a fraction of the cost."

If Oracle aims to continue achieving double-digit total revenue growth, it will need to see sustained OCI demand and increasing OCI capacity. To support capacity growth, Oracle's capital expenditure in Q1 was $2.3 billion, and it expects FY2025 capital expenditure to be twice that of FY2024 to meet growing demand.

2. A 53% Increase in Remaining Performance Obligations is a Highlight of Oracle’s Latest Performance and a Key Driver of ItsStockPrice Surge.

Remaining Performance Obligations (RPO) refer to all commitments related to customer contracts that the company has yet to fulfill, including the delivery of goods or services, technical support, maintenance, etc.

Oracle's RPO grew 53% year-over-year this quarter to a record $99 billion, equivalent to 7 times the quarter's revenue. This indicates that Oracle's strong cloud business growth momentum is likely to continue. It is expected that approximately 38% of the total RPO will be recognized as revenue over the next 12 months, paving the way for growth in fiscal year 2025.

3. A New Partnership with AWS Could Accelerate Overall Growth.

Oracle announced a multi-cloud strategic partnership with Amazon AWS, launching Oracle Database@AWS. Previously, Oracle had already entered into several partnerships with companies like OpenAI, Microsoft, and Google to expand its cloud infrastructure and attract more business.

In simple terms, a multi-cloud strategy involves offering open and diverse cloud service solutions to meet the needs of different customers. Oracle's founder Larry Ellison mentioned that most enterprise users would use more than one cloud provider, thus Oracle advocates for a multi-cloud approach to offer customers more choices. To this end, Oracle collaborates with multiple cloud service providers to expand its cloud business coverage.

This partnership is expected to benefit Oracle in the near future for several reasons:

AWS customers can deploy their Oracle databases using AWS's existing development tools. The new service, Oracle Database@AWS, allows customers to access Oracle database services, facilitating the migration of Oracle's existing customers' workloads to AWS's cloud infrastructure without significant changes to their database configurations.

Compared to Microsoft Azure and Google Cloud Services (GCS), AWS is currently the leading company in cloud service market share. Partnering with AWS can help Oracle gain a broader customer base, especially those who have already migrated their workloads to the cloud.

Oracle Database@AWS can integrate with Amazon's existing storage services, allowing customers to use both database and storage functionalities within AWS.

As AI training/inferencing drives growth in cloud infrastructure revenue, Oracle's cloud service and license support business could grow at double-digit rates. Through collaboration with Amazon, Oracle is more likely to attract more potential customers in the near future.

Don't Rush to Celebrate Oracle Just Yet

Apart from the cloud business, the other three segments have shown weak growth in recent years due to the rise of cloud computing and the decline of the on-premise database market, as shown in the chart below.

This quarter, hardware and service revenues declined by 8% and 9%, respectively. As database products evolve, many companies are exploring more options beyond Oracle, choosing to work with new providers like MongoDB, Databricks, and Snowflake. Customers only need to pay subscription fees to database providers without purchasing hardware or paying annual service fees for real-time support and upgrades. This will negatively impact Oracle's hardware and service revenues, which account for approximately 6% and 10% of total revenue, respectively, and are expected to decrease over time.

Although on-premise license revenue grew by 7% in the first quarter of fiscal year 2025, this growth was primarily due to a weak comparison base with FY24Q1. The trend of weak growth is expected to continue as more customers migrate to the cloud, reducing demand for on-premise databases. However, the migration of traditional databases to new providers takes a long time, so the revenue decline may be slow.

Trading Strategy in the Current Environment

Oracle's moat is still not solid enough. Although cloud business revenue is expected to maintain double-digit growth, the other three business segments are facing shrinkage. The macro environment is fraught with uncertainties, and if the business environment deteriorates, companies may reduce IT expenditures, potentially leading to a gradual decline in demand for Oracle cloud services.

From a macro perspective, the overall valuation of U.S. tech stocks is currently high. This year, Oracle's stock price has risen by 34%, significantly outperforming the Nasdaq. After continuous growth, the current price-to-earnings ratio, based on Oracle's non-GAAP earnings for fiscal years 2025 and 2026, has reached 23 times and 20 times, respectively, approaching a reasonable valuation, suggesting limited upside potential for the current stock price. In terms of shareholder returns, the quarterly dividend is $0.40 per share, and with an annual buyback of $2.5 billion, the overall shareholder return is about 1.6%, which is not very attractive.

It is recommended that investors holding the stock consider a covered call strategy, selling call options. Investors not holding the stock can wait for a further price correction before buying.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

搞经济 抄底 加仓 : Thanks to Tiktok. this company is still around .

英明神武的加里 搞经济 抄底 加仓 : Are you treating TikTok as a savior?

搞经济 抄底 加仓 英明神武的加里 : When it rises, it's miraculous; when it falls, it's evil.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)