Oracle's Post-Earnings Surge: Is Now the Time to Buy?

Following Oracle's announcement on Monday night that it had exceeded both top and bottom line estimates for its fiscal first quarter, the cloud provider's shares surged over 10%.

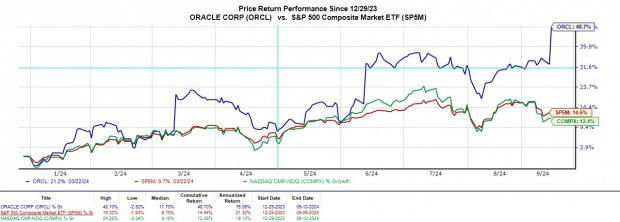

With ORCL up roughly +50% YTD and ranking among the best-performing tech stocks this year, investors may be considering whether to join the post-earnings rally.

Oracle's Q1 Financial Report

Oracle's strong first-quarter results were mostly driven by growth in revenue from cloud infrastructure. Through its collaboration with Nvidia, this includes high-performance AI apps that operate on Remote Direct Memory Access (RDMA).

Oracle's Q1 sales was $13.3 billion, exceeding projections of $13.21 billion by 7% year over year. In terms of profitability, Q1 EPS of $1.39 per share increased 17% from $1.19 a year earlier and above forecasts by 5%.

Additionally, Oracle and Amazon announced a new collaboration that will let users access Oracle databases through Amazon Web Services (AWS).

Revenue Guidance & Growth Trajectory

Oracle's sales growth forecast for the second quarter is between 8% and 10%, which is consistent with our Consensus of $14.01 billion in sales or 8% increase (see current quarter below).

Oracle's overall sales are predicted to rise 9% to $57.82 billion in its current fiscal year 2025 from $52.96 billion in FY24. Moreover, FY26 sales are anticipated to increase by an additional 11% to $64.02 billion.

Better yet, Oracle's yearly profits are expected to increase by 11% in FY25 and 13% more in FY26, reaching $6.98 per share.

Comparison of Valuations

Oracle's stock, which is currently trading at $155, has a forward earnings multiple of 22.6X, which is a nice discount to the Computer-Software Industry average of 33.6X and somewhat less than the S&P 500's 23X.

Oracle's market value is lower than that of several of its well-known technology partners, such as Nvidia and Amazon, which are valued at 38X and 36.9X, respectively, of their future profits.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment