Palantir Call Options Volume Jump, as Shares Rally After Revenue Outlook Beat

$Palantir (PLTR.US)$ investors who held on to their bullish call options at a time when the stock was wavering, are benefiting after the tech company provided a rosier outlook and better-than-expected second quarter financial results.

Shares of the company that builds and deploys software platforms advanced 12% Tuesday after boosting its revenue outlook, taking it above analyst estimates. It also reported record profit in the second quarter that beat Wall Street expectations.

"Our growth across the commercial and government markets has been driven by an unrelenting wave of demand from customers for artificial intelligence systems that go beyond the merely performative and academic," Palantir Chief Executive Officer Alexander C. Karp said in his letter to shareholders released Monday after the market closed.

About 425,000 Palantir options traded so far, landing the stock in the fourth spot for the most active stock options, behind $NVIDIA (NVDA.US)$, $Apple (AAPL.US)$ and $Tesla (TSLA.US)$. (To see the options ranking, click here.)

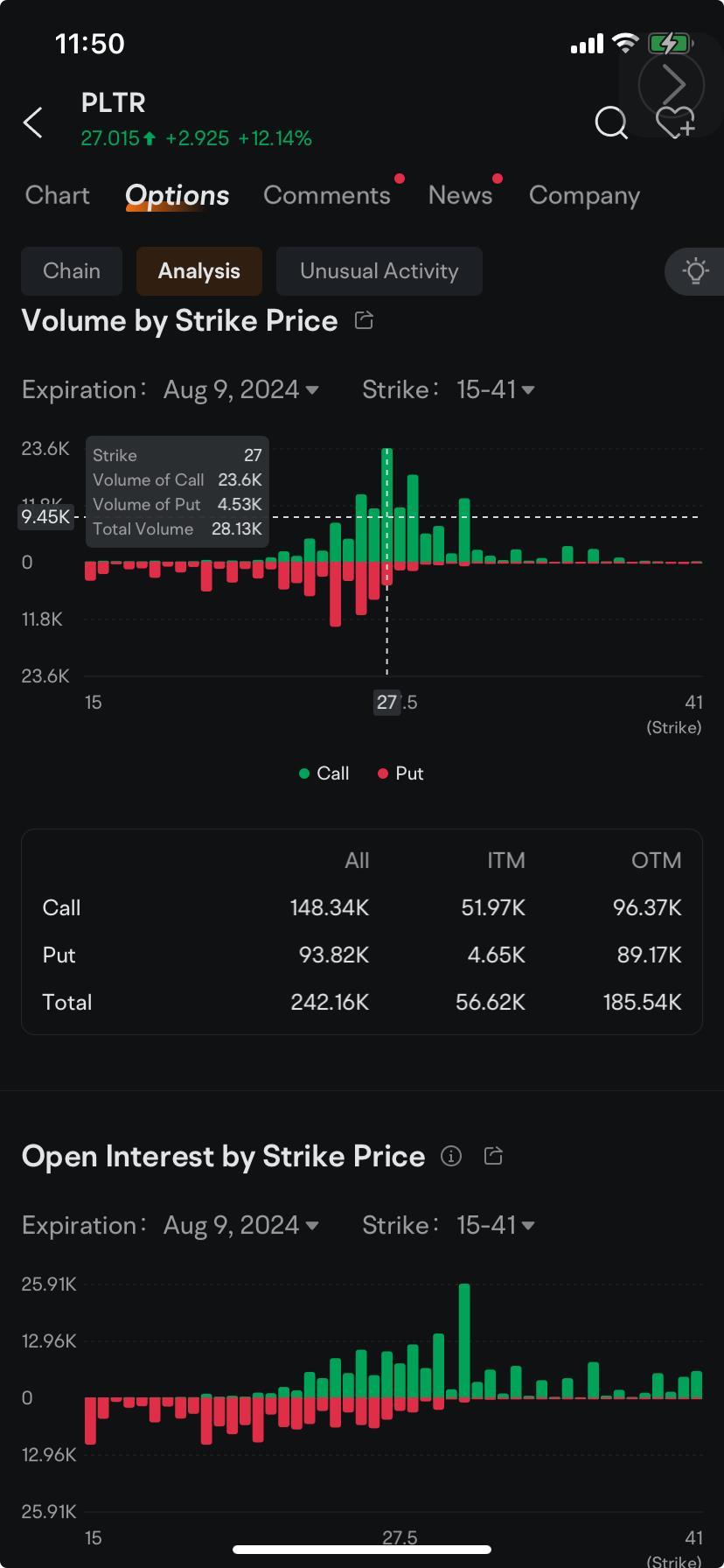

Call options that give the holders the right to buy Palantir shares at $27 each by the end of the week are seeing increasing volume as shares climbed above that level.

About 23,600 of those $27 call options changed hands before noon time in New York Tuesday, more than double their open interest. That made the contract the most heavily traded among options tied to Palantir across 17 expiration dates that stretch through Dec. 18, 2026.

(To see Palantir's option chain, click here.)

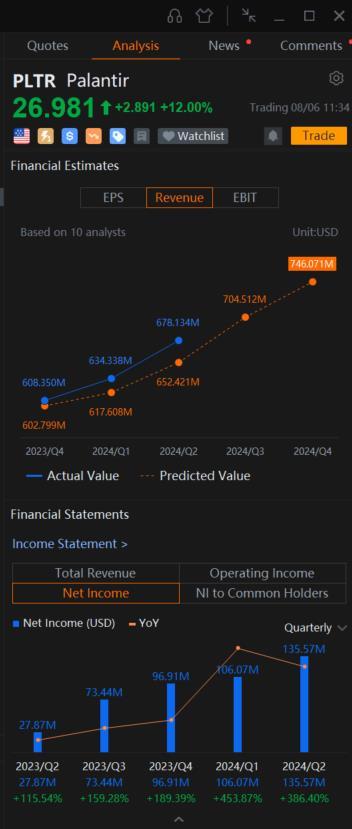

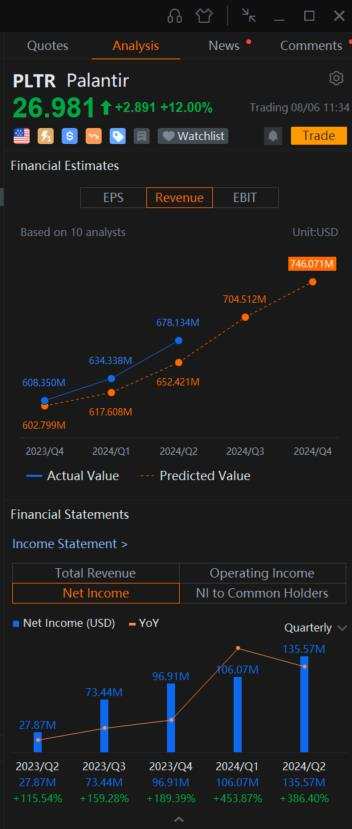

Late Monday, Palantir said it expects revenue for 2024 to reach $2.74 billion to $2.75 billion. That's higher than $2.698 billion expected by analysts, according to estimates compiled by Capital IQ. For the third quarter, the company sees revenue reaching between $697 million and $701 million, higher than the average estimate of $680.21 million seen by analylsts for the three months ending Sept. 30.

In the three months ended June 30, the company reported an 80& jump in adjusted earnings to 9 cents a share a year ago, as revenue gained 27% to $678 million. That exceeds the average earnings per share of 3 cents expected by analysts on revenue of $652.4 million.

"The large language models that have transfixed the world will only be capable of transforming the work of a multinational business or a defense agency's operations if their power is unleashed within the context of an enterprise software system that has an opinionated view of the world—its idiosyncratic objects, logic, and physics," Palantir CEO Karp said.

While the one-day technical indicators tracked by moomoo show no obvious signal, one of them, the oscillator, which measures momentum, is showing that the trend could be turning bullish

Fud inflows into the stock outpaced outflows by almost $136 million just before noon time. That trimmed this month's net outflow to $31.4 million.

Share your thoughts on Palantir below.

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Indexes are unmanaged and cannot be directly invested in. Past performance is no indication of future results. Investing involves risk and the potential to lose principal. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information regarding your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal. Moomoo makes no representation or warranty regarding its adequacy, completeness, accuracy, or timeliness for any purpose of the above content. See this link for more information.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Options trading entails significant risk and is not appropriate for all customers. It is important that investors read Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. Supporting documentation for any claims, if applicable, will be furnished upon request. Moomoo does not guarantee favorable investment outcomes. The past performance of a security or financial product does not guarantee future results or returns. Customers should consider their investment objectives and risks carefully before investing in options. Because of the importance of tax considerations to all options transactions, the customer considering options should consult their tax advisor as to how taxes affect the outcome of each options strategy. All company analysis information is provided by third parties and not by Moomoo Financial Inc. Any illustrations, scenarios, or specific securities referenced herein are strictly for informational purposes and is not a recommendation. Past investment performance does not guarantee future results. Investing involves risk and the potential to lose principal. This content is also not a research report and is not intended to serve as the basis for any investment decision. The information contained in this article does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Furthermore, there is no guarantee that any statements, estimates, price targets, opinions or forecasts provided herein will prove to be correct.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Clement Lemons : okk

104166257 : hi

103539497 : hi

StealthTrader : I’m

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

104476495 : hi

74423696 : Hello and good morning. I applied for that in may 31 2024 .Another person helped me for applying, but after applying he call me Shahin come to my company, here is scam. And I Ignored . He every day was calling me and reporting how much money was added . And repeated come out of this company, and joined my company. And all the times I Ignored. 2 weeks ago a person called me and told me I am Martin s friend, who is working with you in his company. And I was very upset, and told him , I didn’t work with him anytime. I will call to Government . And cut him. But he called me again and made me angry. After that I wrote for Elan Mask. I have to add he changed his number.

Thank you so much for your support.

Kind regards

Shahin Alizadeh

August 7 2024

山芭佬 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

山芭佬 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

ManomikalakOkituk Clement Lemons : what okk?