The surge came after the software company that derives almost half of its revenue from government contracts, saw its shares gapped 22% higher Tuesday as revenue climbed by almost a third, buoyed by what CEO Alexander Karp described as an "unrelenting AI demand that won't slow down."

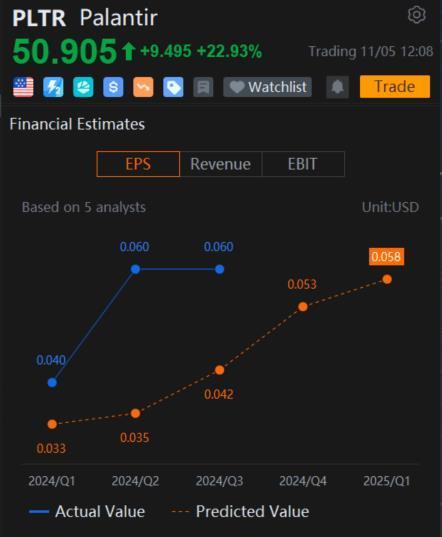

Third quarter adjusted earnings of 10 cents per share surpassed Bloomberg consensus by 11%. That's the fifth straight time that Palantir beat estimates, according to data compiled by Bloomberg. Revenue has exceeded Wall Street expectations every quarter since it became a public company in 2020, data showed. The company raised its 2024 operating profit outlook to a range of between $1.05 billion and $1.06 billion, also above consensus.

Coach Donnie : Let’s GOOO $Palantir (PLTR.US)$

104247826 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Histock : It's rising again![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

1994CM : Because of the US Presidential Election 2024 result.