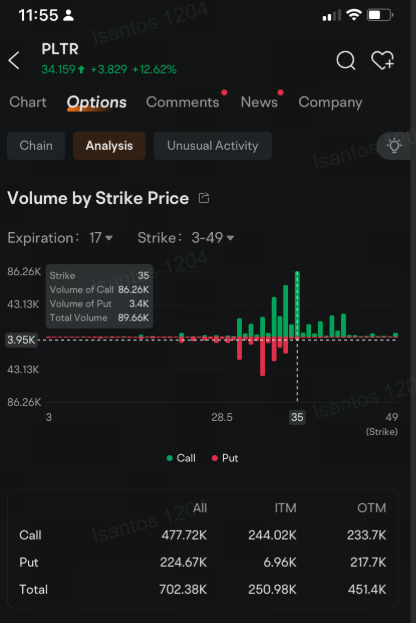

More than 86,000 call options with the $35 strike price changed hands as of 11:55 a.m. in New York across 17 expiration dates that stretch through Dec. 18, 2026. That's the most for any strike price both on call and put options. More than two-thirds of that volume is sitting in call options expiring this week and the next, data compiled by moomoo showed.

Agnes Timoh : Above t

power come in me :

104166257 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

山芭佬 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Meme_Short_Queen : it's not worth more than $5, period.

fadzil227 : ok