PLTR POSTS EARNINGS 😱 GOOD BUY OR GOODBYE⁉️ PALANTIR posted accelerating quarterly GROWTH 📈 Fueled by A.I.

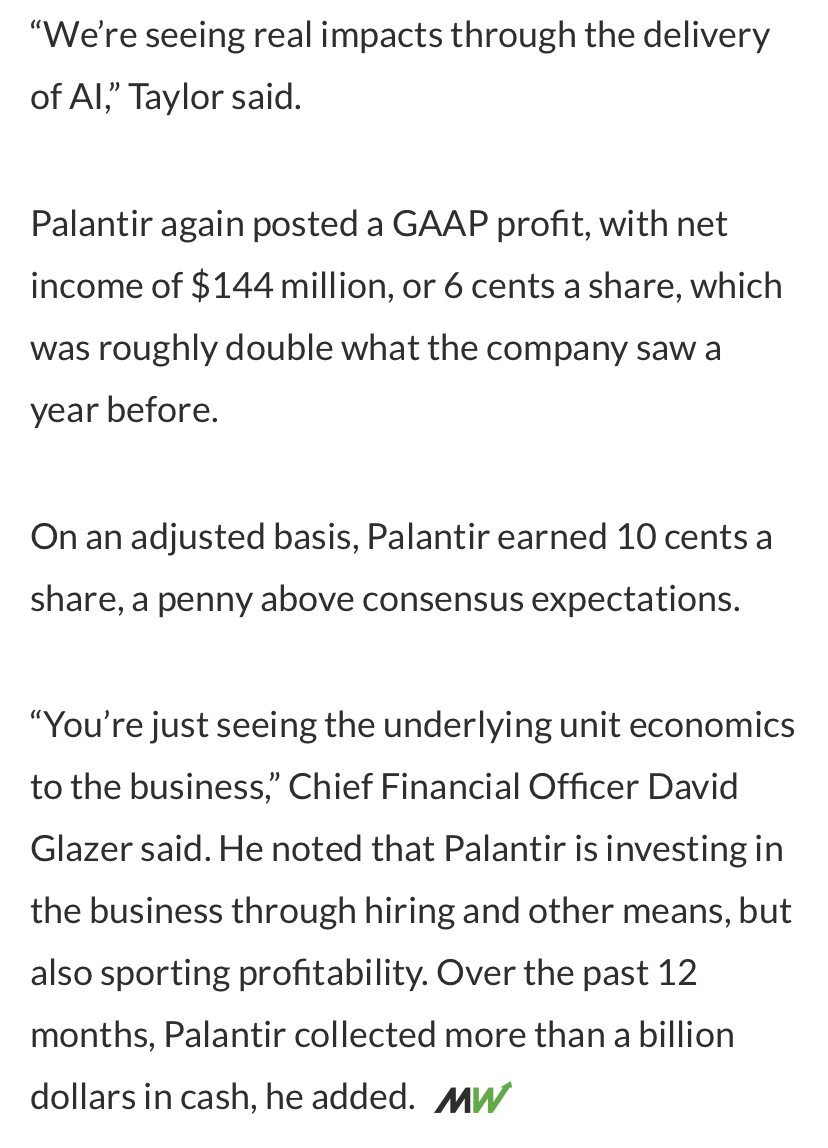

$Palantir (PLTR.US)$ posted accelerating quarterly growth on Monday afternoon, again fueled by artificial intelligence.

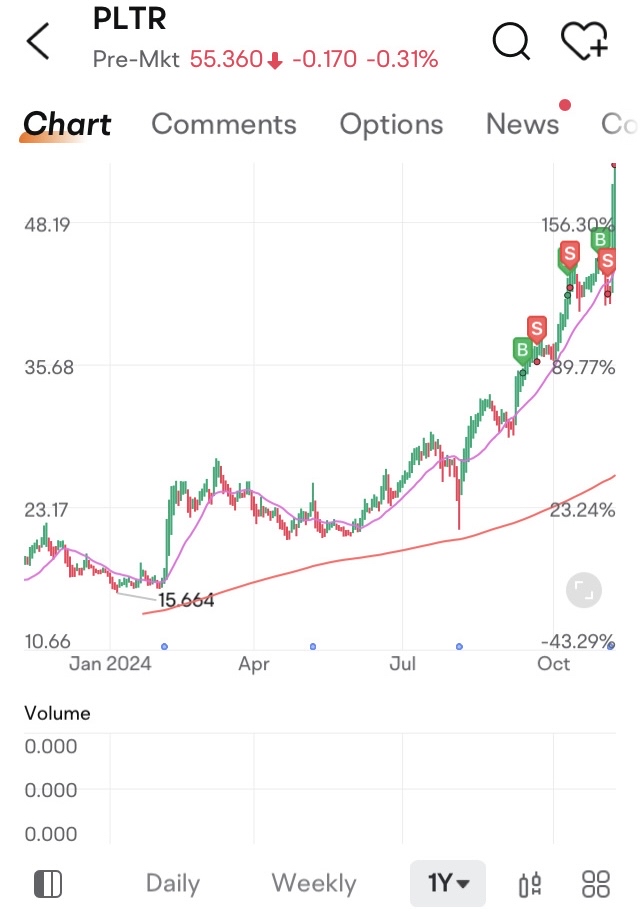

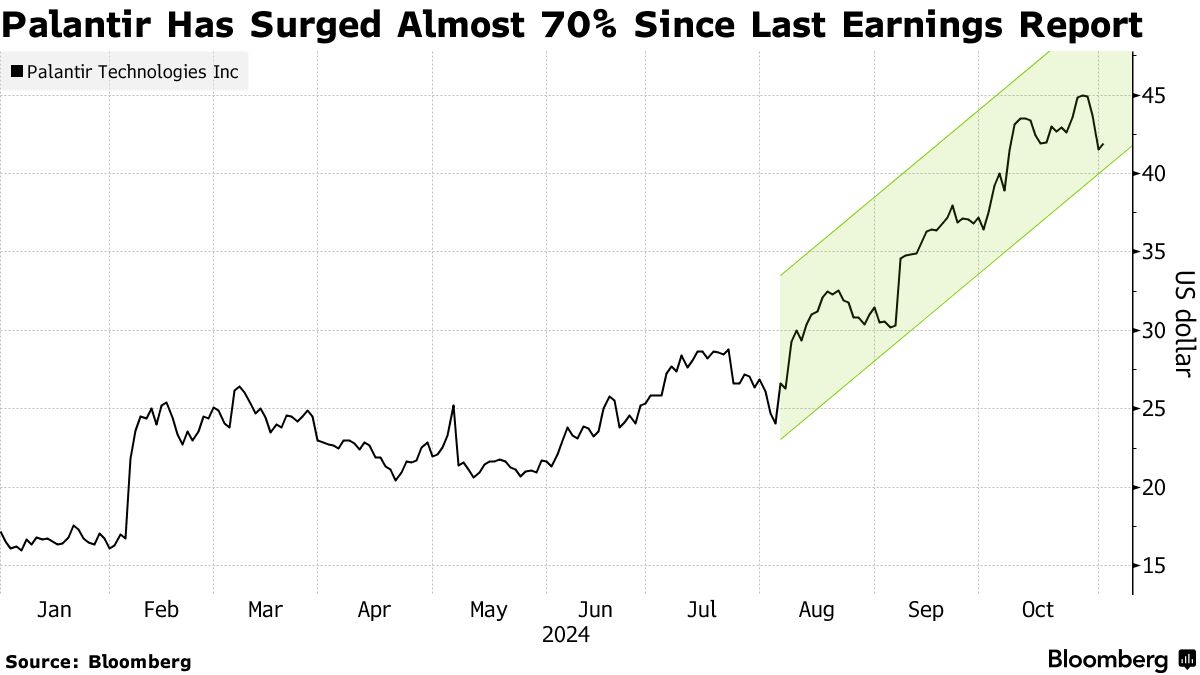

Roughly 150% stock rally so far in 2024 shows that investors have given the enterprise software company respect for its own AI initiatives.

Roughly 150% stock rally so far in 2024 shows that investors have given the enterprise software company respect for its own AI initiatives.

$Palantir (PLTR.US)$ Buying after my research is now done. Palantir only has like 300-400 customers. It's unique what they offer and company's know they can save on costs and get the latest technology. The cat is out the bag 💰 and I predict the growth rates will shock people even though some are already priced in. Software companies can get up to 10,000+ customers easily.

.

I've followed $Palantir (PLTR.US)$ for years bought some years ago…

The talking heads didn’t like it because the CEO has always said he's not interested in pleasing people with good quarterly reports. He's always been about setting up the company to be profitable long-term.

Wall street prefers good quarterlies. Now who's laughing? 🤣

The talking heads didn’t like it because the CEO has always said he's not interested in pleasing people with good quarterly reports. He's always been about setting up the company to be profitable long-term.

Wall street prefers good quarterlies. Now who's laughing? 🤣

.

$Palantir (PLTR.US)$ Climbed 8% 📈 the highest on the S&P 500, after news it would move its class A shares from the New York Stock Exchange to the Nasdaq.

.

PLTR is BIGGER than you think - YouTube

.

• PLTR was just awarded a Billion dollar deal with the navy effective January 2025. You may or may not find this on Google. I’m long on this stock. Do your Own Due Diligence

https://sam.gov/opp/462a1d9ed13244e2a7089b4308216aa7/view

https://sam.gov/opp/462a1d9ed13244e2a7089b4308216aa7/view

.

$Palantir (PLTR.US)$ will do good for many months to come.

From an article on the Medium website - DD research into this company revealed the same information.

.

.

.

Palantir's earnings prospects have several positive aspects:

Positive Cash Flow: The company has demonstrated the ability to generate positive cash flow, which is a good indicator of financial health and sustainability.

Strong Demand for Data Analytics: As organizations increasingly rely on data-driven decision-making, Palantir's software solutions are positioned well to meet this growing demand.

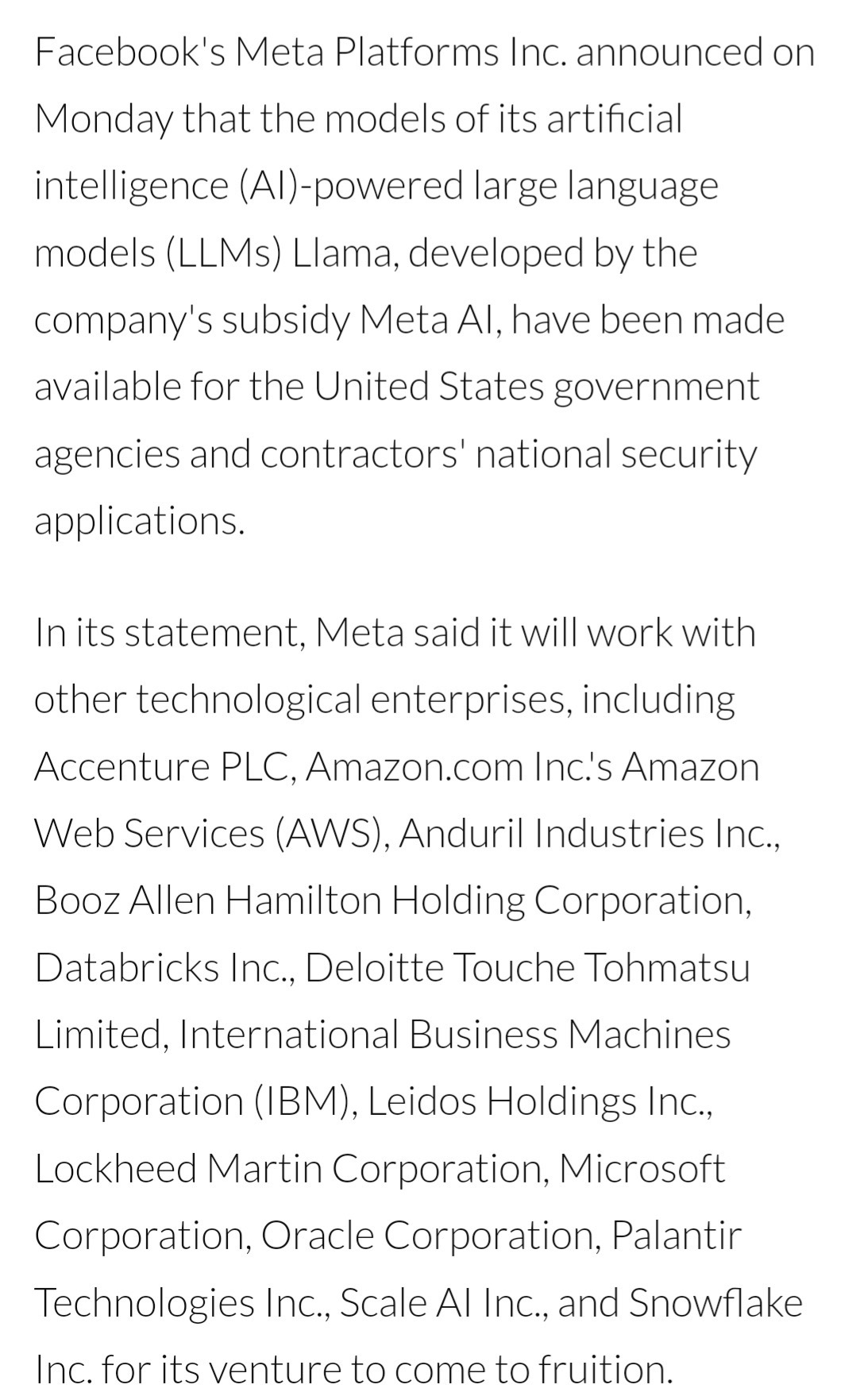

Strategic Partnerships: Collaborations with major companies and organizations can enhance their product offerings and expand their market reach.

Diverse Client Base: The company serves a range of sectors, including government, healthcare, and finance, which can help mitigate risks associated with reliance on a single industry.

Long-Term Contracts: Palantir often secures long-term contracts with government agencies and large enterprises, providing stable and recurring revenue.

Innovative Technology: Their advanced analytics platforms, like Foundry and Gotham, are continually evolving, allowing them to stay competitive and attract new clients.

Expansion into Commercial Markets: Palantir has been making strides to expand its commercial business, which could lead to significant revenue growth outside of government contracts.

These factors ☝🏽 contribute to a generally optimistic outlook for Palantir’s earnings potential in the coming years.

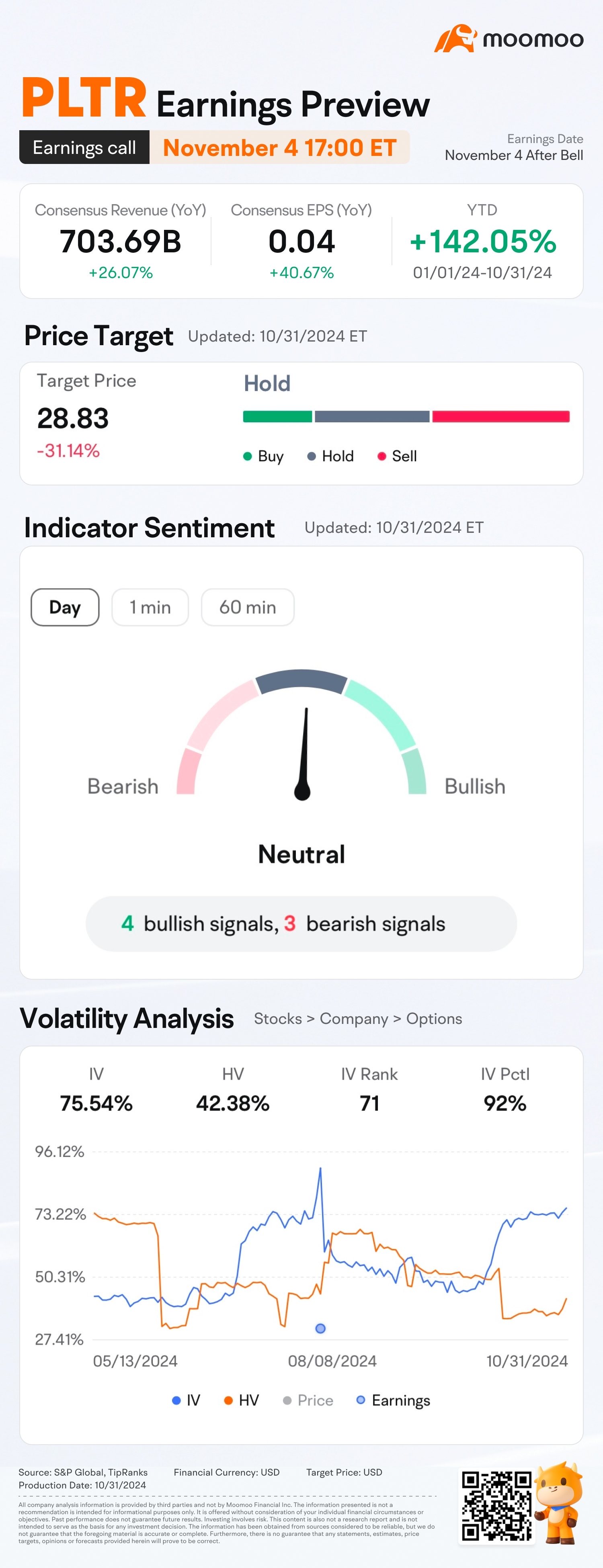

• PLTR shares rose Monday after the artificial-intelligence software company posted strong sales for the last quarter, buoying investor confidence in the company's growth amid voracious appetite for AI products. Analysts say growth in Palantir's commercial business and government contracts are critical to justify its lofty -- and rising -- stock price.

Palantir's share price has more than doubled since the start of the year, and has risen dramatically since the spring. Its addition to the S&P 500 in late September helped catapult the stock about 13%.

Diverse Client Base: The company serves a range of sectors, including government, healthcare, and finance, which can help mitigate risks associated with reliance on a single industry.

Long-Term Contracts: Palantir often secures long-term contracts with government agencies and large enterprises, providing stable and recurring revenue.

Innovative Technology: Their advanced analytics platforms, like Foundry and Gotham, are continually evolving, allowing them to stay competitive and attract new clients.

Expansion into Commercial Markets: Palantir has been making strides to expand its commercial business, which could lead to significant revenue growth outside of government contracts.

These factors ☝🏽 contribute to a generally optimistic outlook for Palantir’s earnings potential in the coming years.

• PLTR shares rose Monday after the artificial-intelligence software company posted strong sales for the last quarter, buoying investor confidence in the company's growth amid voracious appetite for AI products. Analysts say growth in Palantir's commercial business and government contracts are critical to justify its lofty -- and rising -- stock price.

Palantir's share price has more than doubled since the start of the year, and has risen dramatically since the spring. Its addition to the S&P 500 in late September helped catapult the stock about 13%.

• The significant jump in diluted earnings per share (EPS) by 100% to $0.06 is a notable highlight, indicating improved profitability for Palantir. This strong EPS growth reflects the company's efficient cost management and operational effectiveness, which could contribute to bolstering investor sentiment.

Palantir beats on revenue and EPS, raises FY Guidance, Shares +14%

Palantir beats on revenue and EPS, raises FY Guidance, Shares +14%

Palantir Technologies raised its annual revenue forecast for the third time, betting on strong spending from governments and rising demand for its software services from businesses looking to adopt generative AI technology.

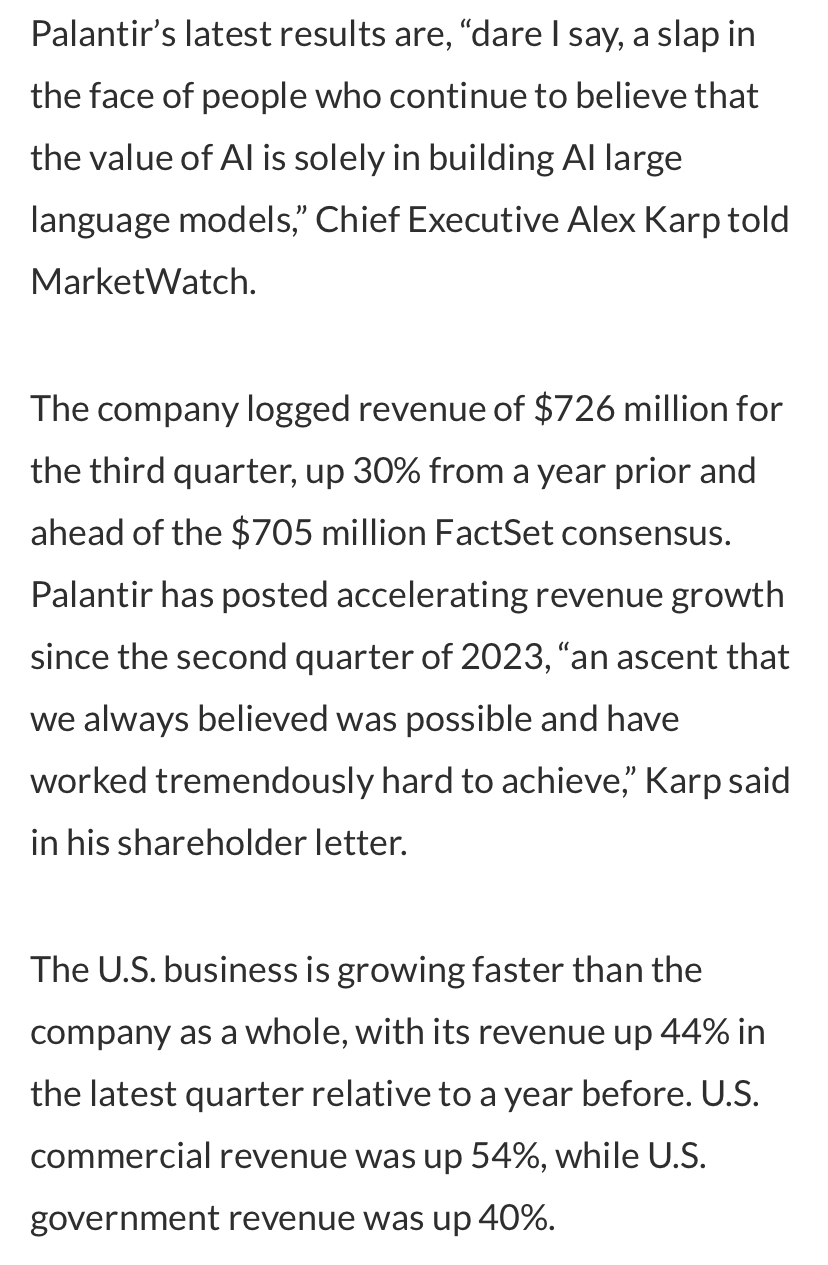

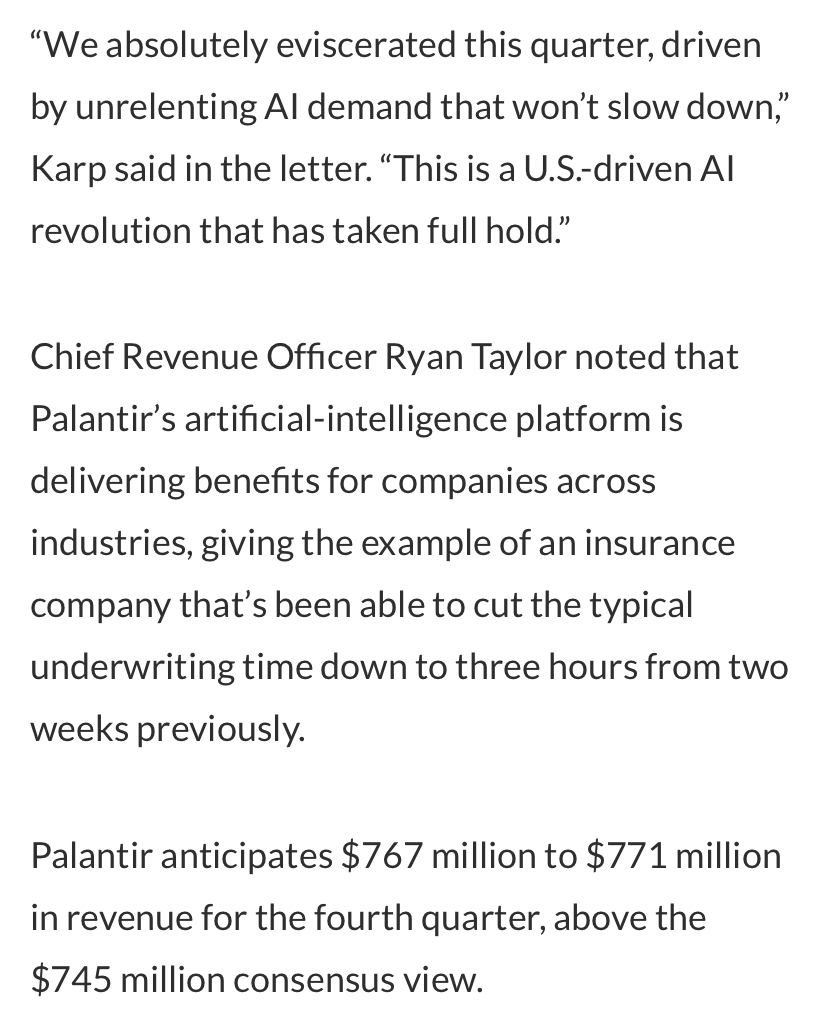

Palantir Technologies Inc. announced on Monday its revenue in the third quarter of the fiscal year 2024 saw an annual increase of 30% to reach $726 million, beating estimates. The company's net income grew by 20% compared to the same period in 2023 to hit $143.5 million. Meanwhile, its diluted earnings per share (EPS) soared 100% to land at $0.06.

The data analytics company has benefited from a boom in GenAI technology, as more companies turn to its AI platform, which is used to test, debug code and evaluate AI-related scenarios.

Palantir beats on revenue and EPS, raises FY Guidance, Shares +14%

Palantir beats on revenue and EPS, raises FY Guidance, Shares +14%

Palantir Technologies raised its annual revenue forecast for the third time, betting on strong spending from governments and rising demand for its software services from businesses looking to adopt generative AI technology.

Palantir Technologies Inc. announced on Monday its revenue in the third quarter of the fiscal year 2024 saw an annual increase of 30% to reach $726 million, beating estimates. The company's net income grew by 20% compared to the same period in 2023 to hit $143.5 million. Meanwhile, its diluted earnings per share (EPS) soared 100% to land at $0.06.

The data analytics company has benefited from a boom in GenAI technology, as more companies turn to its AI platform, which is used to test, debug code and evaluate AI-related scenarios.

The company now expects 2024 revenue in a range of $2.805 billion to $2.809 billion, up from its prior expectation of $2.742 billion to $2.750 billion.

The company is among the largest beneficiaries of a rally in AI-linked stocks, with its shares up more than 140% so far this year. It was added to the S&P 500 in September and has outperformed the index's 20% year-to-date gain.

It also raised its annual forecast range for adjusted income from operations to between about $1.05 billion and $1.06 billion. It earlier forecast $966 million to $974 million.

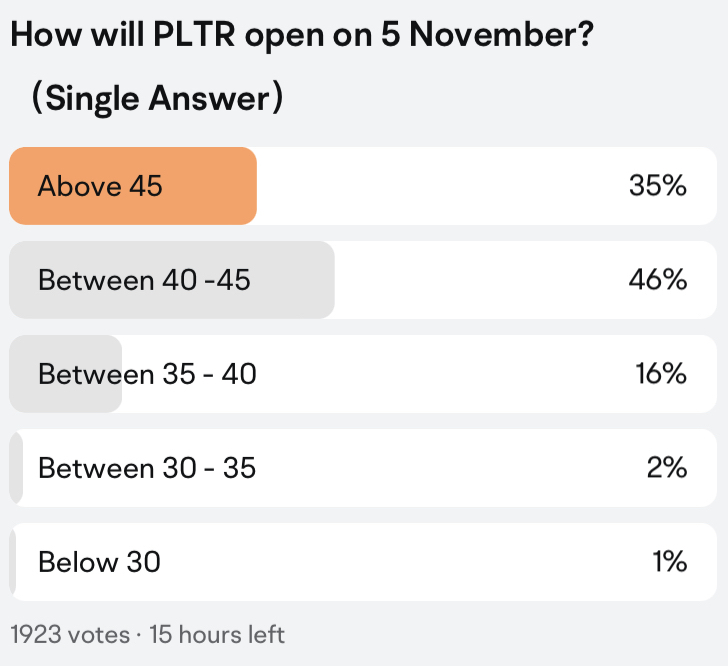

$Palantir (PLTR.US)$ experienced a 14.2% surge in stock price after announcing an upward revision to its full-year revenue forecast alongside strong third-quarter results.

• These 3 are CHANGING LIVES:

• Palantir raises 2024 revenue forecast again on robust AI adoption; shares surge

• NVDA stock was rising Monday, pushing its market capitalization past Apple's to make the chip maker the world's most valuable company. Continued high spending from big technology companies and the chip maker's inclusion in the Dow Jones Industrial Average index look to be boosting sentiment around Nvidia

$Palantir (PLTR.US)$ told y’all about PLTR whoever listened is WINNING 🏆

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

Ankur Tiwari : The significant jump in diluted earnings per share (EPS) by 100% to $0.06 is a notable highlight, indicating improved profitability for Palantir. This strong EPS growth reflects the company's efficient cost management and operational effectiveness, which could contribute to bolstering investor sentiment.

101823892_antony : good bye

Coach Donnie OP 101823892_antony : Cool

Coach Donnie OP : $Palantir (PLTR.US)$

Coach Donnie OP : $Palantir (PLTR.US)$

Coach Donnie OP :

Wendy's Uses Palantir AI Tech To Manage Burger, French Fry Inventories; Return On Investment Is 'Significant' - Wendy's (NASDAQ:WEN) - Benzinga

Wendy's Uses Palantir AI Tech To Manage Burger, French Fry Inventories; Return On Investment Is 'Significant' - Wendy's (NASDAQ:WEN) - Benzinga

Coach Donnie OP : PLTR was just awarded a Billion dollar deal with the navy effective January 2025. You may or may not find this on Google. I’m long on this stock. Do your Own Due Diligence

https://sam.gov/opp/462a1d9ed13244e2a7089b4308216aa7/view

Coach Donnie OP : Principal Financial Group Inc. Grows Position in Palantir Technologies Inc. (NYSE:PLTR)

Coach Donnie OP : Palantir Technologies Thrives With Robust Growth Predictions

Coach Donnie OP : Palantir Stock vs. Nvidia Stock: Billionaire Ken Griffin Buys One and Sells the Other | The Motley Fool

View more comments...