TSLA

Tesla

-- 431.660 RGTI

Rigetti Computing

-- 17.0800 NVDA

NVIDIA

-- 137.010 LAES

SEALSQ Corp

-- 9.080 PLTR

Palantir

-- 79.080

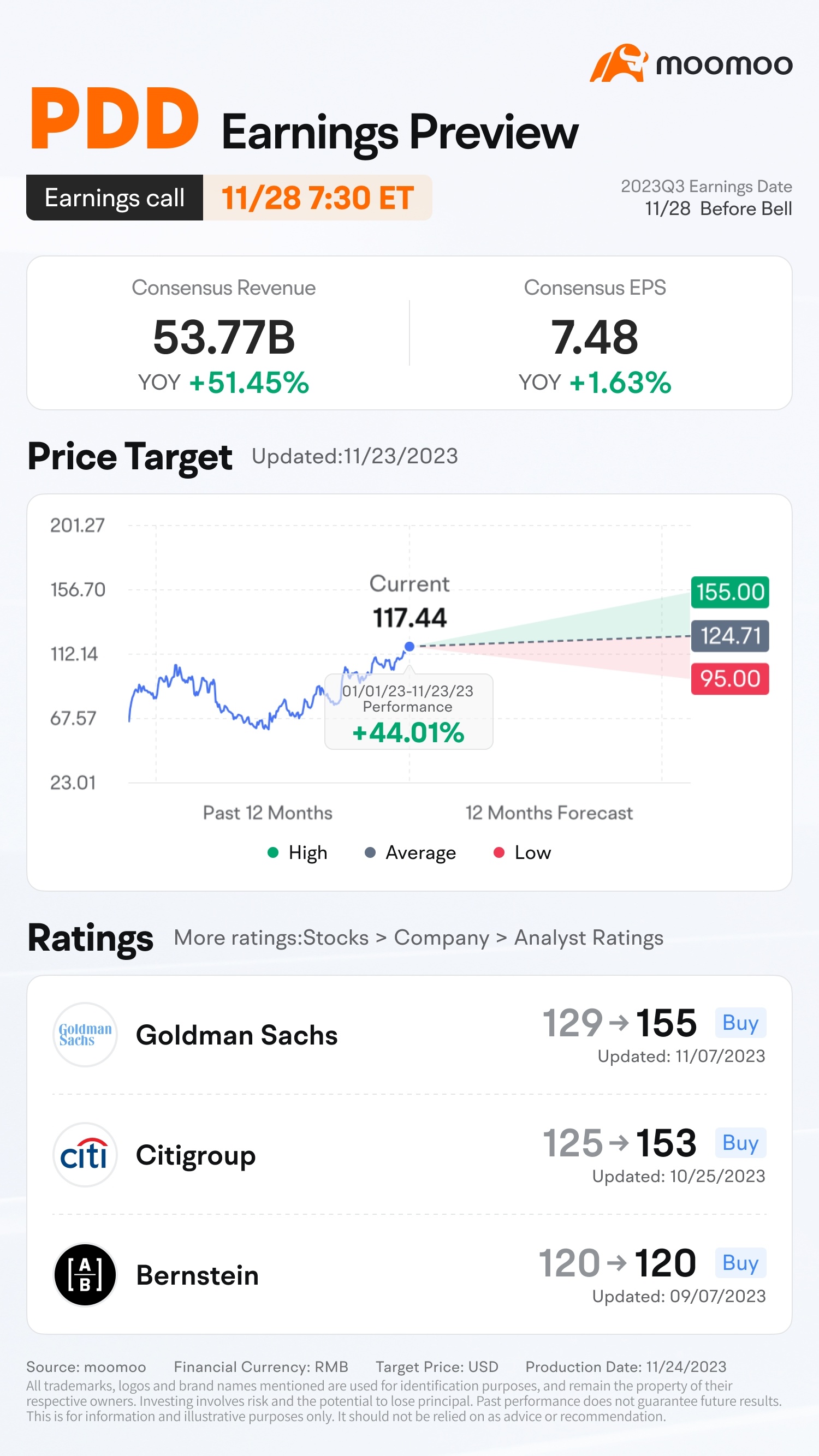

Goldman Sachs Group Inc. sees a "strong top-line beat" in the third quarter while warning that Temu could post a bigger-than-expected loss. But investors are "gradually willing to ascribe some valuation for the Temu business" on the back of faster-than-expected GMV expansion, analyst Ronald Keung wrote in a note.

If PDD is able to beat consensus estimates and deliver a narrower-than-expected margin drop while delivering strong 2H growth of more than 50%, the stock could re-rate further," said Bloomberg Intelligence analyst Catherine Lim.

While PDD usually deemphasizes its participation in Singles’ Day, we believe more buzz around its 'Billion Dollar Subsidy' and 'Annual Price Reduction Lists' and the consumption trade-down trend is likely to support higher growth," Citigroup Inc. analyst Alicia Yap wrote in a note.

We believe that Temu's rapid rise in popularity was supported by the company's elevated marketing investments, its low prices and focus on promotions, and the success of its referral campaigns," said Berstein's analysts.

Rehmatbugti : Hi Friends