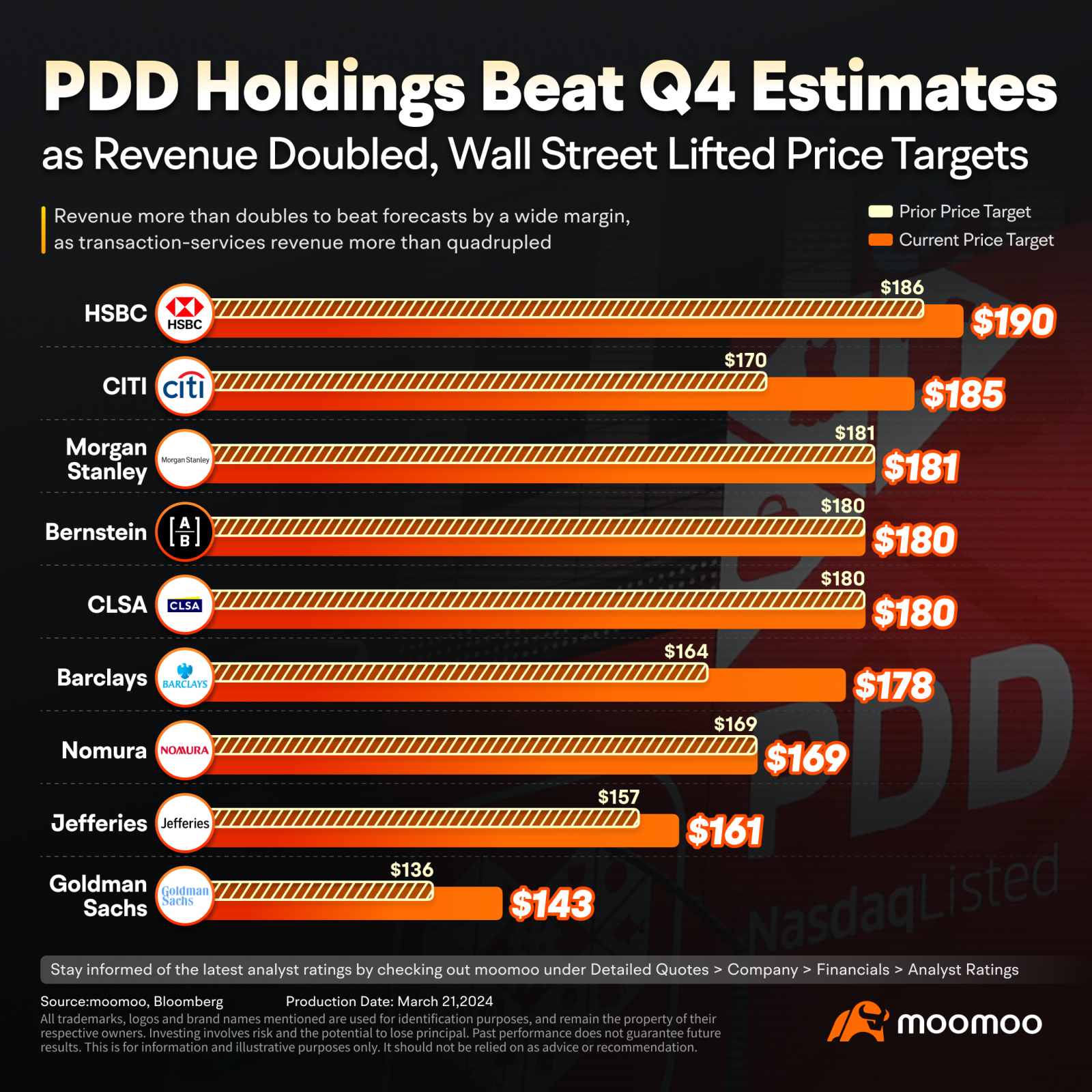

• PDD's earnings this year may remain supported by its Temu platform's strong momentum, Nomura analysts Jialong Shi and Rachel Guo say in a research note. Temu's revenue in 2024 could grow 96% to CNY62 billion, accounting for 19% of PDD's revenue, the analysts say. PDD's operating loss could also narrow to CNY29 per order in 2024 from Nomura's estimated loss of CNY55 per order in 2023, they say. The U.S., which is Temu's largest market, has high potential but is fraught with geopolitical risks, they say, adding that Temu will need to accelerate diversification of its overseas markets to mitigate the risk. Nomura maintains a buy call on PDD and keeps its ADR target unchanged at $169.00.

Yang6688 :