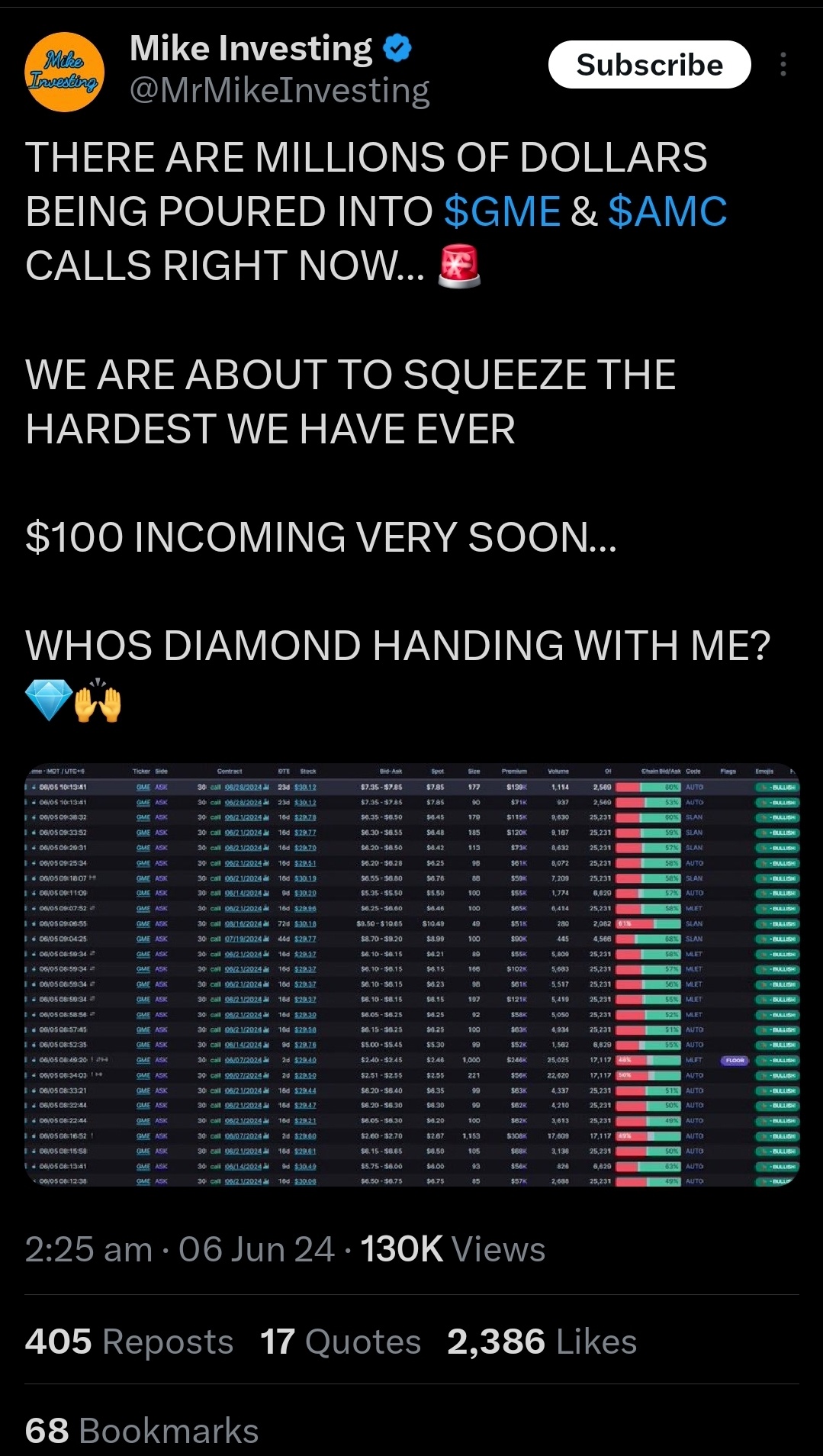

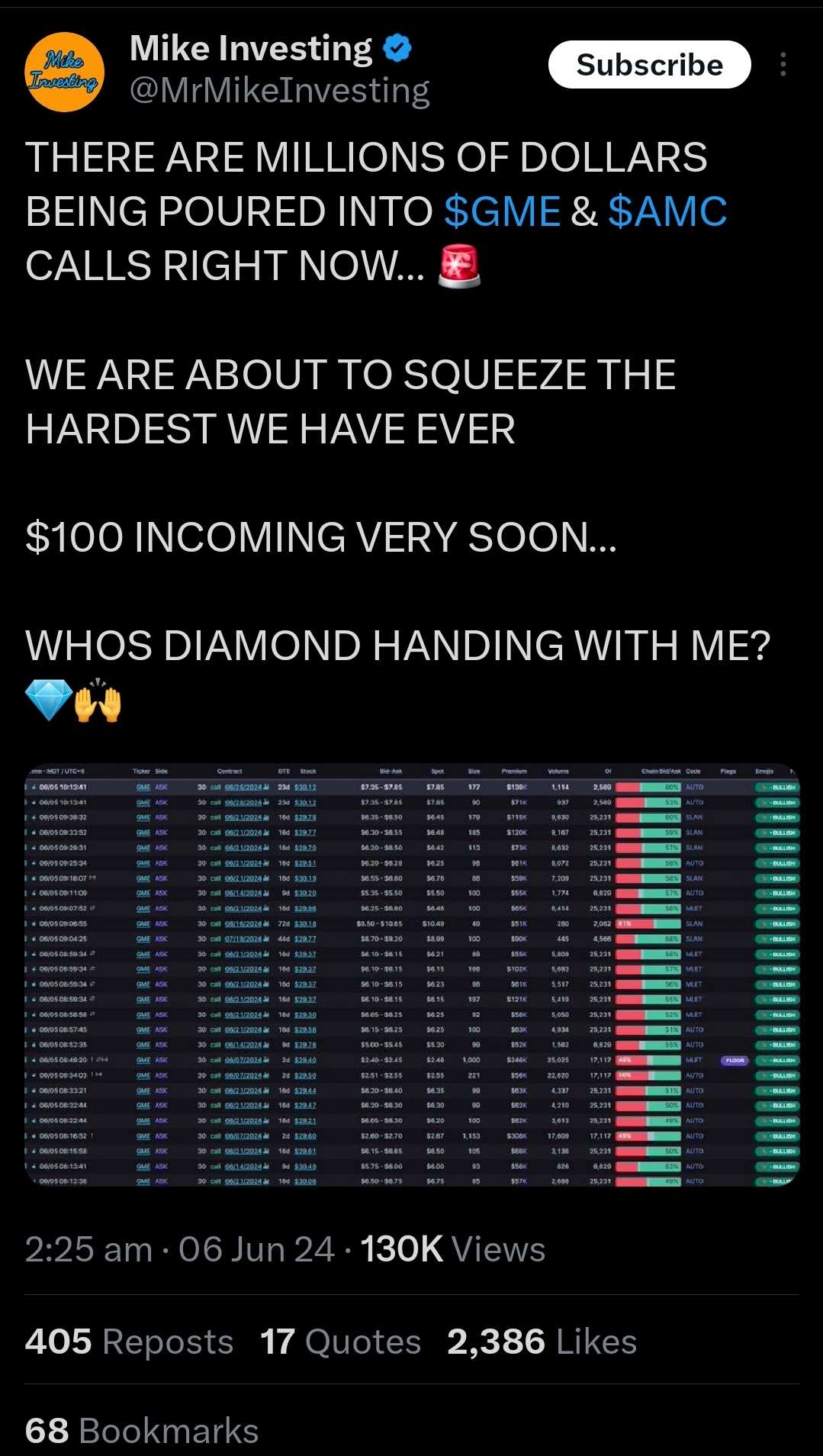

People are copying Kitty's tactic

$GameStop (GME.US)$ placing call options that force hedges to buy up the shares to back the contract. the more people doing this the more the price will spike. need to copy his trade.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

UNO Wild Card : I am wondering whose buying all these calls? Isnt that putting themselves into further deep sxxx

Ken Griffin Charity : “Placing call options that force hedges to buy up the shares to back the contract”

Can you explain how buying calls forces any of that?

cmawer OP Ken Griffin Charity : If they don't have the shares to back the contract then it's a naked contract... If he exercises the option and they don't own the shares. They gotta buy them from the market at the market rate. Supply and demand dictates that will be a massive premium.

The due diligence should have been they should hold at least a majority of the shares to "hedge" their risk.

As the contract is $20 share... as you can see the current price is >$30 a share. so Etrade (aka Morgan Stanley) who sold him the options contract needs to buy at a loss if they can't get the shares.

It appears they chose not to hedge these options to avoid the corresponding price spike by buying large volumes.

So now it's a gamble for them... What happens if he does exercise the contract.

Ken Griffin Charity cmawer OP : So let’s break that down:

1) Yes, naked calls are written all the time. But counterparties buying said calls does not mean that the option writers need to hedge their calls.

2) He can’t exercise those calls because he doesn’t have enough capital. His entire position right now inclusive of both shares and options does not cover the $240m required to exercise those calls.

3) There is no “premium” involved with covering a naked call. The option writer simply buys shares at the market rate to hedge.

4) There is zero evidence that the option writers have not hedged their calls. Even that 13f nonsense from Kevin Malone is dated to March. And even then, it doesn’t mean that all the counterparties of DFV’s options are “top call option writers”.

5) E*trade did not sell DFV his calls. That’s not how options work. The broker simply facilitates transactions between counterparties. That’s why they’re called “brokers”.