Pinduoduo (PDD) Temu Partial Consignment Model Going To Show Result In Earnings

$PDD Holdings (PDD.US)$ is scheduled to announce its second-quarter earnings results on Monday, 26 August 2024 before market open.

Market have been putting the consensus EPS estimate at $2.86 and the consensus revenue estimate to be $13.97B.

The consensus EPS Estimate is $2.79 (+93.8% Y/Y) and the consensus Revenue Estimate is $13.97B (+93.8% Y/Y).

What would be interesting in this earnings would be the partial consignment model that PDD’s Temu has implemented. The partial consignment model requires merchants to handle their own fulfillment, freeing Temu from the constraints of managing logistics for small items. This move promises greater scalability and reduced costs.

So I would be looking forward to see how this model would help to push PDD revenue higher despite the challenges faced with regulatory challenges, intense competition, and the complexities of its ambitious expansion plan.

Will Temu Partial Consignment Model Give Significant Result In This Quarterly Result

Temu, the online marketplace operated by Chinese e-commerce giant PDD Holdings, continues to defy expectations, achieving in two years what takes most companies a decade. With sales skyrocketing to approximately USD 20 billion in the first half of this year—a significant leap from USD 18 billion in total sales for 2023—Temu is rewriting the playbook for global e-commerce expansion.

To grasp the magnitude of Temu’s recent milestone, consider this: Shein, another e-commerce juggernaut, took nine years to hit the USD 20 billion mark. TikTok’s e-commerce arm managed it in three. Temu? Just two years.

What is worth focusing would be Temu’s strategy to pivot from a full consignment model to a partial one. According to 36Kr, by early July, this new approach accounted for 20% of Temu’s US sales, barely four months after implementation.

The partial consignment model requires merchants to handle their own fulfillment, freeing Temu from the constraints of managing logistics for small items. This move promises greater scalability and reduced costs.

Temu’s recent growth has been propelled by US trade policies. The de minimis threshold exemption allows consumers to import goods valued at USD 800 or less without tariffs. In 2023, this policy facilitated the entry of up to 1 billion packages into the US, with Temu and Shein jointly accounting for a third of this volume. However, the potential return of Donald Trump to the White House could derail this policy, prompting Temu to double down on its partial consignment model, which is not reliant on the tax exemption.

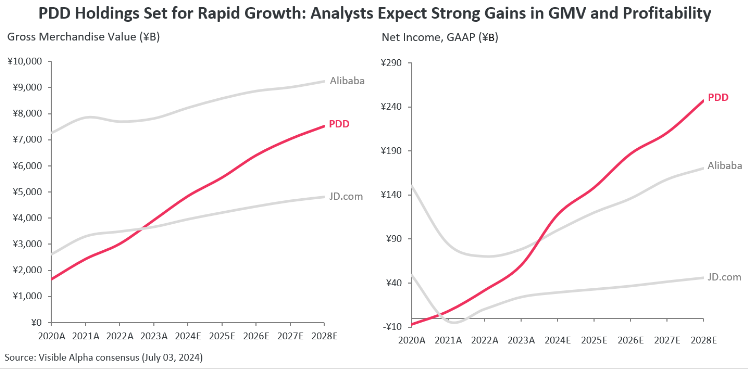

In 2024, analysts expect PDD’s GMV to rise by +23% year over year, reaching CN¥4.8 trillion. In contrast, Alibaba and JD.com are expected to achieve more modest GMV growth rates of +5% (reaching ¥8.1 trillion) and +8% (reaching ¥4 trillion), respectively. Although Alibaba is expected to lead in absolute revenue and GMV, PDD is forecasted to achieve stronger double-digit growth between 2024 and 2028. During this period, PDD’s GMV is expected to grow at a CAGR of 12%, and revenue at a CAGR of 17%. In comparison, Alibaba’s GMV is anticipated to grow at a CAGR of 3%, and revenue at 8%. Analysts also project rapid growth in PDD’s net income, with estimates suggesting that PDD will surpass Alibaba in terms of net income (GAAP) in 2024, generating net income of ¥117.5 billion compared to Alibaba’s estimated ¥99.6 billion. Additionally, PDD’s take rate has been steadily increasing, with analysts expecting it to rise to 8.6% in 2024, up from 6.3% in 2023.

PDD generates revenue primarily from two sources: online marketing services and transaction services, with the latter expanding significantly faster. Revenue from transaction services is expected to surge by +124% in 2024, totaling ¥211 billion, with Temu contributing an estimated ¥147 billion or as much as 70% to this figure.

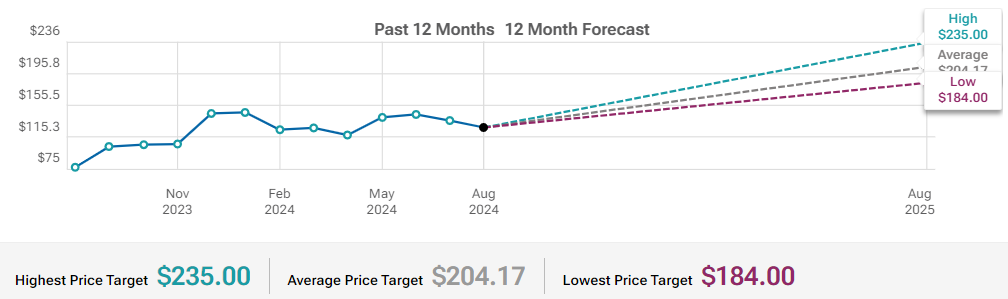

Pinduoduo (PDD) Price Target Forecast

Based on 6 Wall Street analysts offering 12 month price targets for PDD Holdings in the last 3 months. The average price target is $204.17 with a high forecast of $235.00 and a low forecast of $184.00. The average price target represents a 45.97% change from the last price of $139.87.

If we were to compare how PDD GMV have grown compared to $Alibaba (BABA.US)$ , we could see that PDD is catching up with this partial consignment, and hence I would say PDD might lead in terms of GMV.

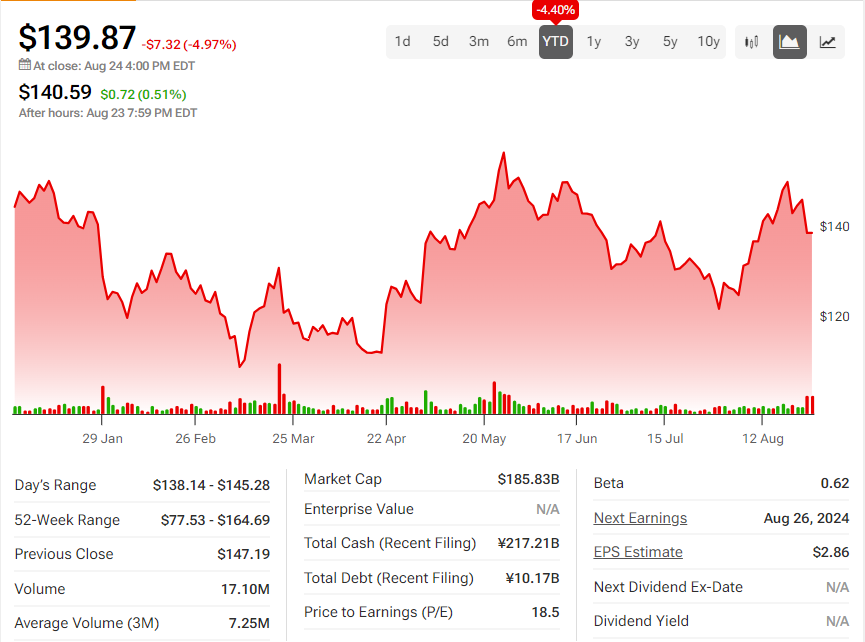

Pinduoduo (PDD) Year-To-Date Returns

Investors have been pretty disappointed with a 4% loss in stock price from PDD year to date, but I would think that things is going to change as the strategy deployed by PDD with Temu is fluid enough to help them tide over the challenges faced with regulatory challenges, intense competition, and the complexities of its ambitious expansion plan.

Do remember that the future of online retail is fast changing, so what is important for a strategy is fluid, it need to be able to adjust to changing market condition with less time and efforts.

I am looking forward to this Temu’s model in the upcoming earnings result.

Technical (MACD and KDJ)

With the market expecting China ecommerce to face a slowdown as seen in Alibaba earnings, it is no surprise that we are seeing downside signal from MACD and KDJ, and MACD is now at a crossroad of whether to continue with a bearish crossover, or it will be changing to a bullish crossover.

I would think that investors interest should come back if they have taken note of the sales figure that Temu has gotten since their partial consignment strategy, this strategy should not be seen as a short term solution to its expansion plan, I looked at it towards PDD strategy for market dominance.

If we were to look at things from the buying strength, we could see that PDD is gathering buying strength for its stock, this is important as we might see some positive guidance on its Temu’s model, this should help PDD’s stock price.

Summary

I would be focusing on looking at PDD revenue stream as Temu is a pretty significant contributor, and the results from Temu’s model should be substantial for Q2, and I am expecting positive guidance from PDD.

Appreciate if you could share your thoughts in the comment section whether you think PDD would be giving positive guidance as the Temu’s model is working well and producing results.

Disclaimer: The analysis and result presented does not recommend or suggest any investing in the said stock. This is purely for Analysis.

Disclaimer: Community is offered by Moomoo Technologies Inc. and is for educational purposes only.

Read more

Comment

Sign in to post a comment

ivanese : pdd always hide alot figure didn't declare on their annual report and they never do share buy .

Tonyco ivanese : What did they hide?